Va Mortgage Pre Approval

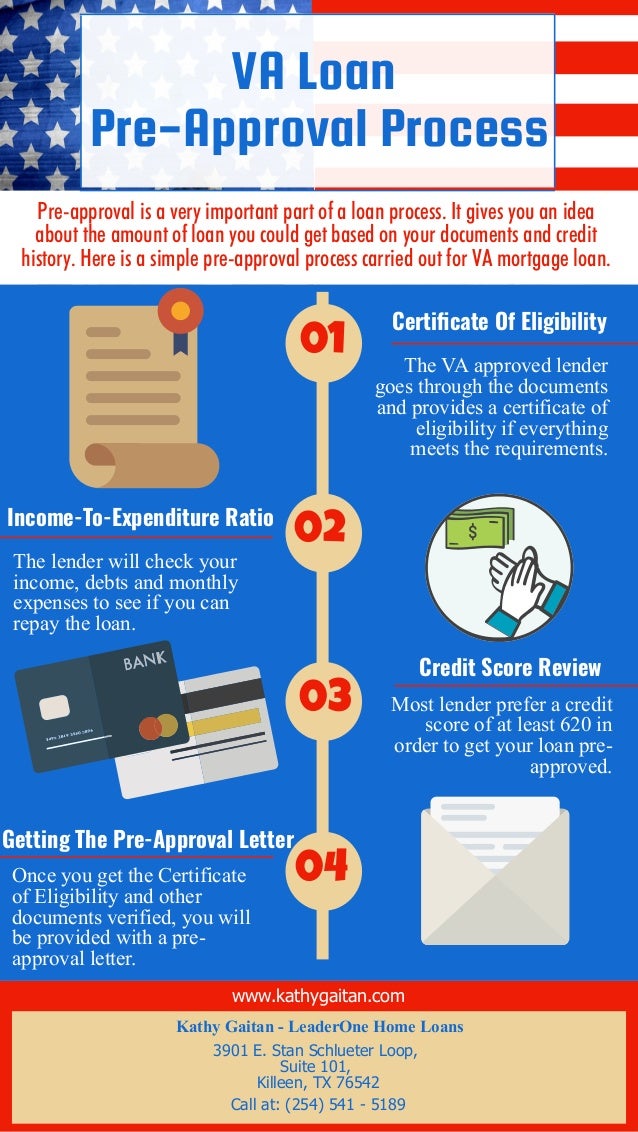

To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification and other types of documentation.

Va mortgage pre approval. Va and partners proudly serving veterans. Requirements for pre approval. Customers with questions regarding our loan officers and their licensing may visit the nationwide mortgage licensing system directory for more information. 1 participation in the verified approval program is based on an underwriter s comprehensive analysis of your credit income employment status debt property insurance appraisal and a satisfactory title report search.

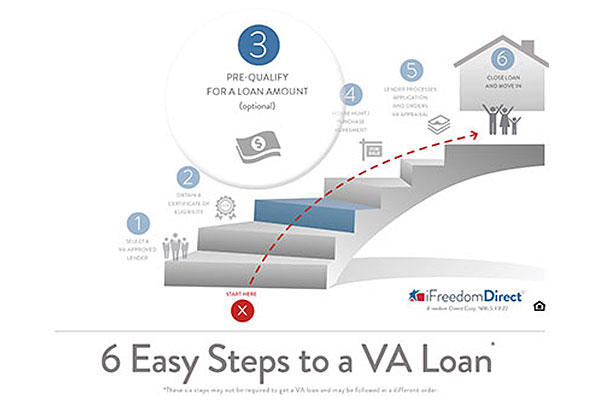

This letter is good for at least 30 days and as long as 90 days if you stay in touch with your home loan advisor. Let s take a deeper dive into the va loan process starting with the first and arguably most critical step getting preapproved. Current the va loan pre approval process up next the va home loan closing process. Va loan guaranty service employees and representatives of the private industry describe the benefits of the va home loan and why they serve veterans.

Further along in the mortgage process we ll ask you for documentation to verify this information. Not endorsed or sponsored by the dept. Income credit score and debt are just some of the factors that go into the pre approval process. Va mortgage calculator how much can i borrow.

Getting preapproved for a va loan is a foundational first step. Although the preapproval letter lets you know how much you can borrow it is not a commitment to lend. Since 1944 va and private industry partners have helped deliver the dream of homeownership to generations of veterans and servicemembers. 1400 veterans united dr columbia mo 65203.

Va loans for current and veteran military members don t require a down payment or mortgage insurance. Everything you need to know veterans united home loans is a va approved lender. Enter all income and expenses as monthly figures not annual. Of veterans affairs or any government agency.

Loan preapproval is important on a couple major fronts. A mortgage pre approval is a written statement from a lender that signifies a home buyers qualification for a specific home loan. If new information materially changes the underwriting decision resulting in a denial of your credit request if the loan fails to close for a reason outside of quicken.

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)

/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)