Types Of Stock Trades

Investors do not have that much time to invest in the market nitty gritty.

Types of stock trades. In this beginner s stock trading step by step tutorial part of our guide to trading stocks online you will learn about the different kinds of trading orders you can place with your online broker. It totally depends on your independent expectation from the stock market. History has proven that a number of specific trading patterns. It s easy to buy otc stocks but the tougher question to answer is whether you should buy otc stocks.

Day trading refers to short term trades where you enter and exit a trade within the same trading day. Each has a one or two letter code this is a complete list of the codes. As we ve seen some types of stocks trade on the otc markets. When a company sells shares of stock to the public those shares are issued as one of two main types of stocks.

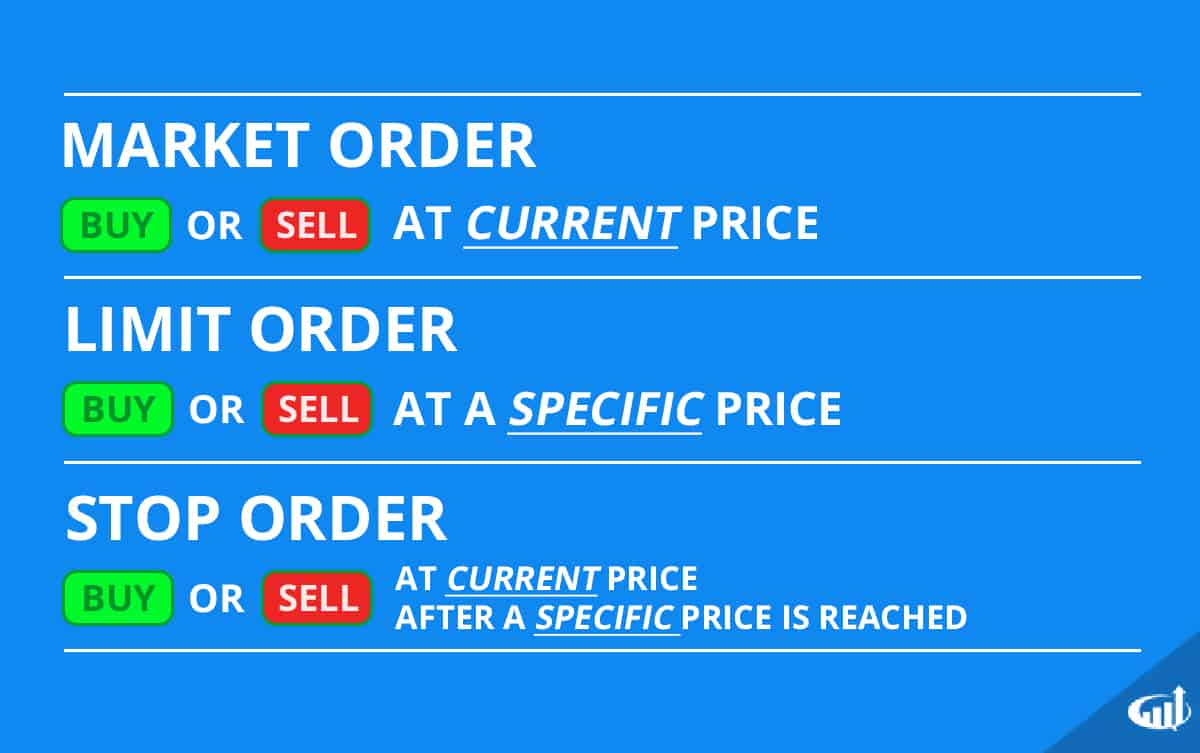

To trade stock splits successfully a trader must above all correctly identify the phase at which the stock is currently trading. A market order simply buys or sells shares at the prevailing market prices until the. All trades consist of at least two orders to make a complete trade. A stock is an investment into a public company.

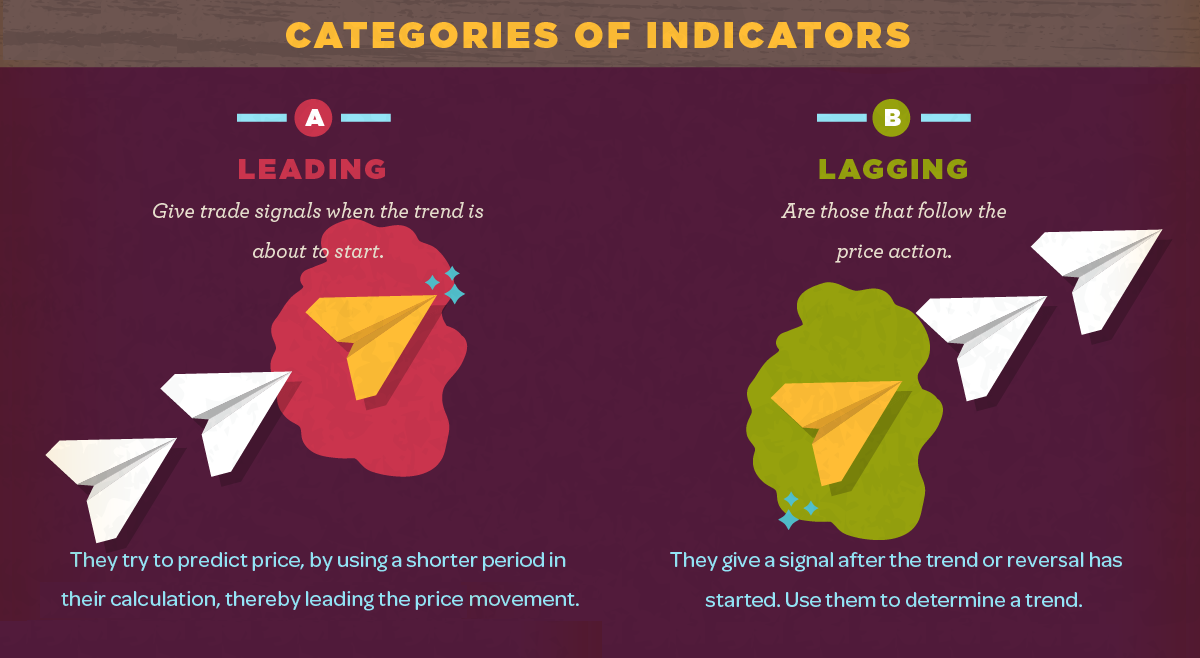

Order types are the same whether trading stocks currencies or futures. The 13 primary types of stock order. The bottom line on otc stocks. Day traders use technical analysis to find and exploit intraday price fluctuations.

One person places an order to buy a security while another places an order to sell that same security. Depending on your investing style different types of orders can be used to trade stocks more effectively. In contrast recall the turnover snake analysis that found stock turnover percent of market cap that trades. Common stock or preferred stock.

To try to maximize profits and minimize losses you ll typically use a profit target and set a stop loss. The different types of stock trades explore the latent opportunity therein. Trade types the london stock exchange has several types of trade. O ordinary trade system will delay if over 6 x nms a standard trade made through the market makers and dealt at normal settlement date.

:max_bytes(150000):strip_icc()/shutterstock_97670996-5bfc47c3c9e77c0051862960.jpg)

/stock-trading-101-358115_V3-37f97e70c6df4b748ba5cb19942ef6a9.gif)