Va Home Loan Cash Out Refinance

When you take out a home equity loan you still have your original mortgage.

Va home loan cash out refinance. Qualified military service members and veterans have a refinancing option that allows them to lower their interest rate and get money out of the value of their home with the va s cash out refinancing loan. While it might sound odd homeowners aren t required to take out cash with these refinance loans. Learn more interest rate reduction refinance loan irrrl. We offer va home loan programs to help you buy build or improve a home or refinance your current home loan including a va direct loan and 3 va backed loans.

With regard to a cash out refinance the maximum loan amount can represent no more than 100 percent of the property s value. A cash out refinance is an option for those with a va or conventional loan looking to take advantage of their home s equity to access cash for home improvements emergencies pay off debt or any other purpose. This value is determined by reviewing a new appraisal on the property. You can use your va home loan benefit to purchase or build a home to be owned and occupied by you or an eligible dependent using your va home loan benefit can help you purchase a home at a competitive interest rate.

Cash out refinance loans allow you to take cash out of your home equity to take care of concerns like paying off debt funding school or making home improvements. You can use the cash out option to refinance an existing first mortgage loan of record on the home you currently own and occupy. The va cash out refinance is the only loan that allows you to refinance up to 100 of the value of your home. Learn more about the different programs and find out if you can get a certificate of eligibility for a loan that meets your needs.

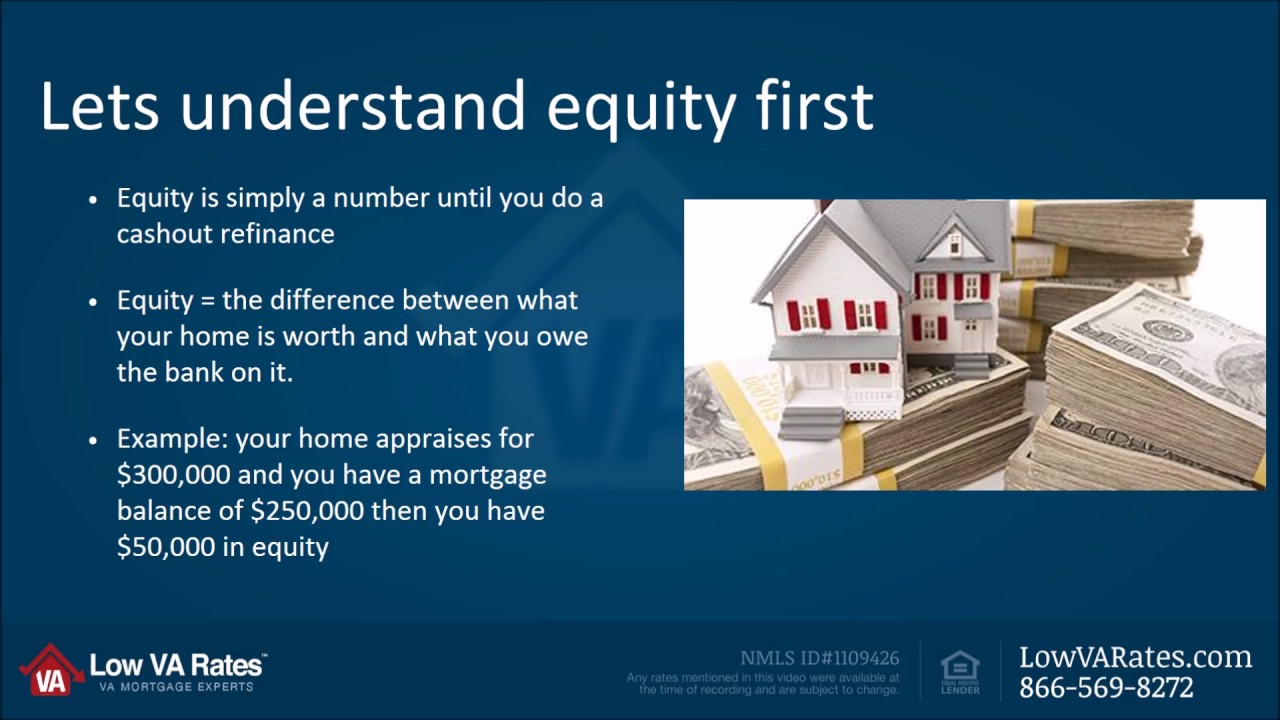

That means qualified veterans with non va loans can use this benefit to simply take advantage of lower rates or to get out of an adjustable rate loan or. If you think this sounds like a home equity loan it s different. The va cash out refinance loan replaces your existing mortgage instead of complementing it. If you want to take cash out of your home equity or refinance a non va loan into a va backed loan a va backed cash out refinance loan may be right for you.

Also called the streamline refinance loan can help you obtain a lower interest rate by refinancing your existing va loan.