What Do Payroll Taxes Fund

Though payroll taxes ostensibly go to trust funds that build up assets from which the benefits are paid the demographic challenge posed by the large rapidly retiring baby boomer generation.

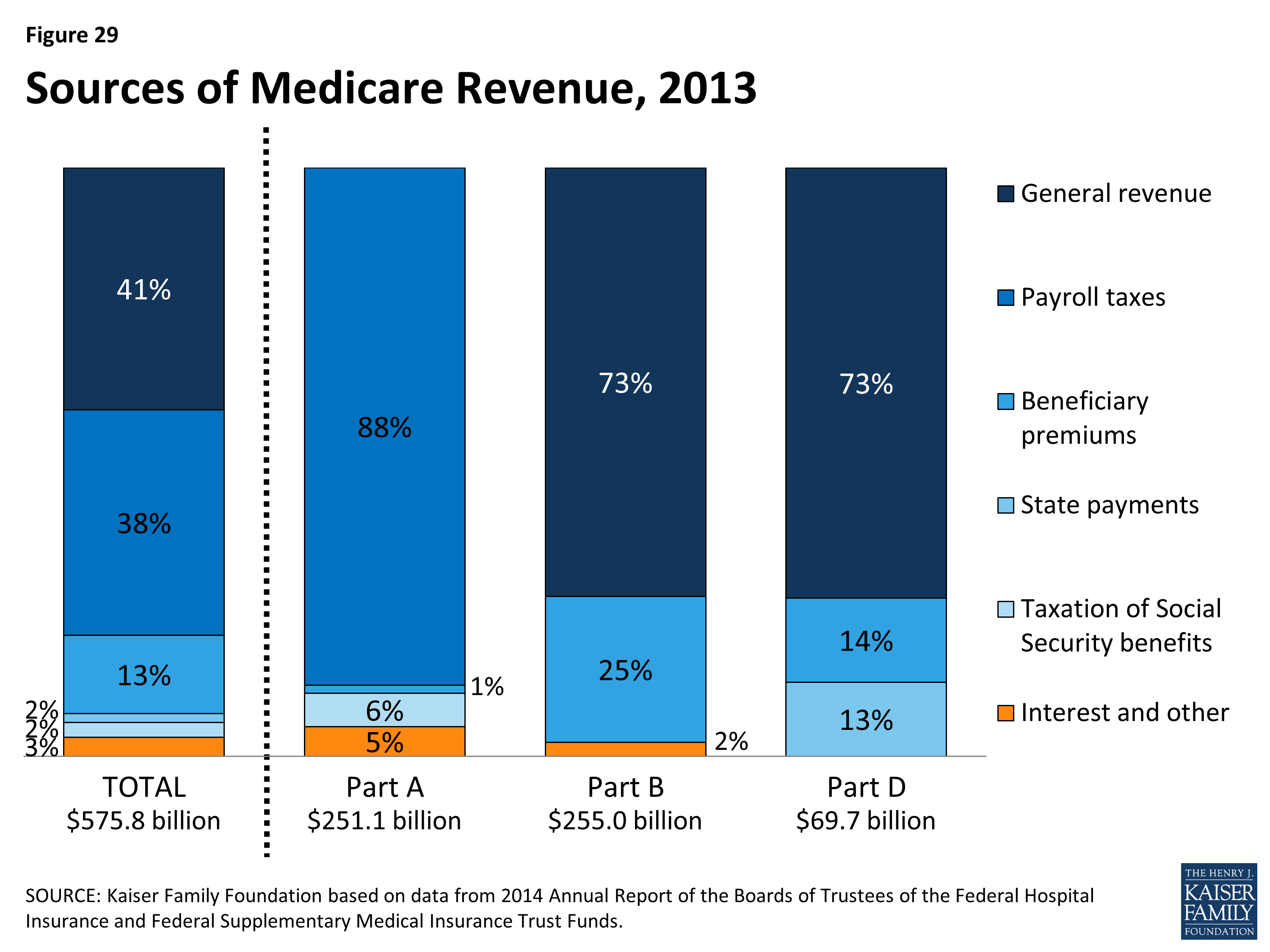

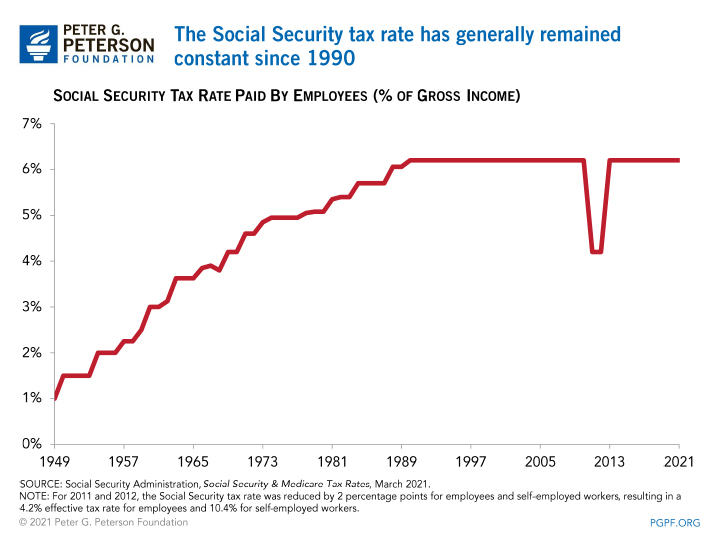

What do payroll taxes fund. Payroll taxes which are used to fund specific programs are distinct from income taxes. In the rebound from the great recession the obama administration trimmed workers social security tax to 4 2 in 2011 and 2012. These taxes raised 1 24 trillion last year according to the. The revenues from payroll taxes help fund medicare s hi program which is used to pay for hospital stays and a few forms of home healthcare such as hospice care.

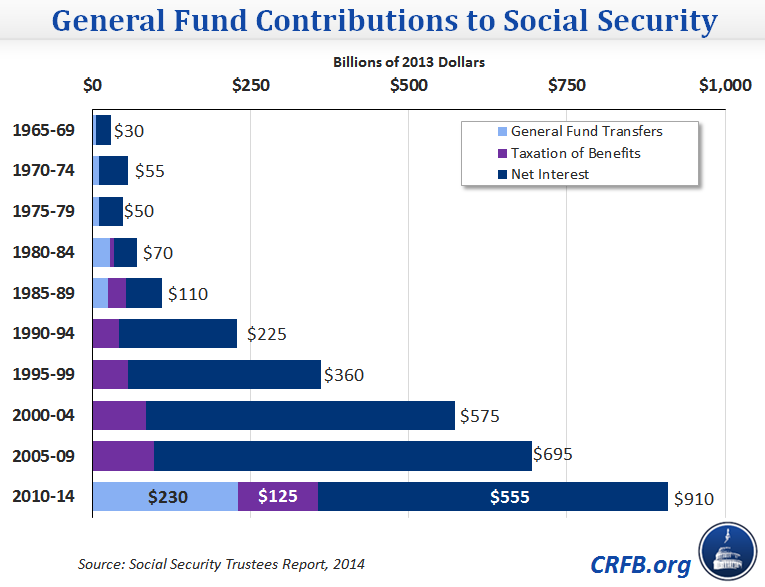

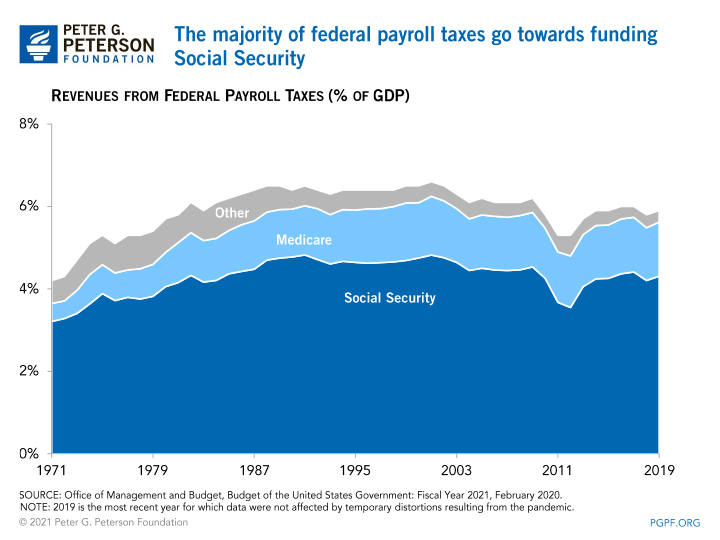

That could be accomplished as it was the last time there was a payroll tax cut in 2011 when money was moved from the general fund to the trust funds. Individuals are taxed at both the federal and state levels. In some cases municipalities may also impose. A 12 4 payroll tax split between employers and workers funds social security while a 2 9 payroll tax finances medicare.

Payroll taxes are shared by the employer and employee. Each is responsible for a 6 2 levy that goes toward social security as well as a 1 45 tax that funds medicare. For 2019 hi tax revenues were 1 3 percent of gdp an amount that has been relatively constant for the past 25 years. There is precedent for altering payroll tax rules.

/payroll-tax-concept--papers--calculator-and-money--1128492914-ea403a57dd164b3f830ab222c2d24ee7.jpg)