What Is Fha Streamline Loan

Avoiding a lot of paperwork and often without an appraisal the streamline option saves borrowers time and money.

What is fha streamline loan. Fha streamline refinance loans can help homeowners lower monthly mortgage payments and interest rates. It s called an fha streamline 203 k loan and it will make anywhere from 5 000 to 35 000 available to repair upgrade or weatherproof your home. By reusing the original loan s paperwork the process to refinance a home was reduced from a few months to. What you need to know.

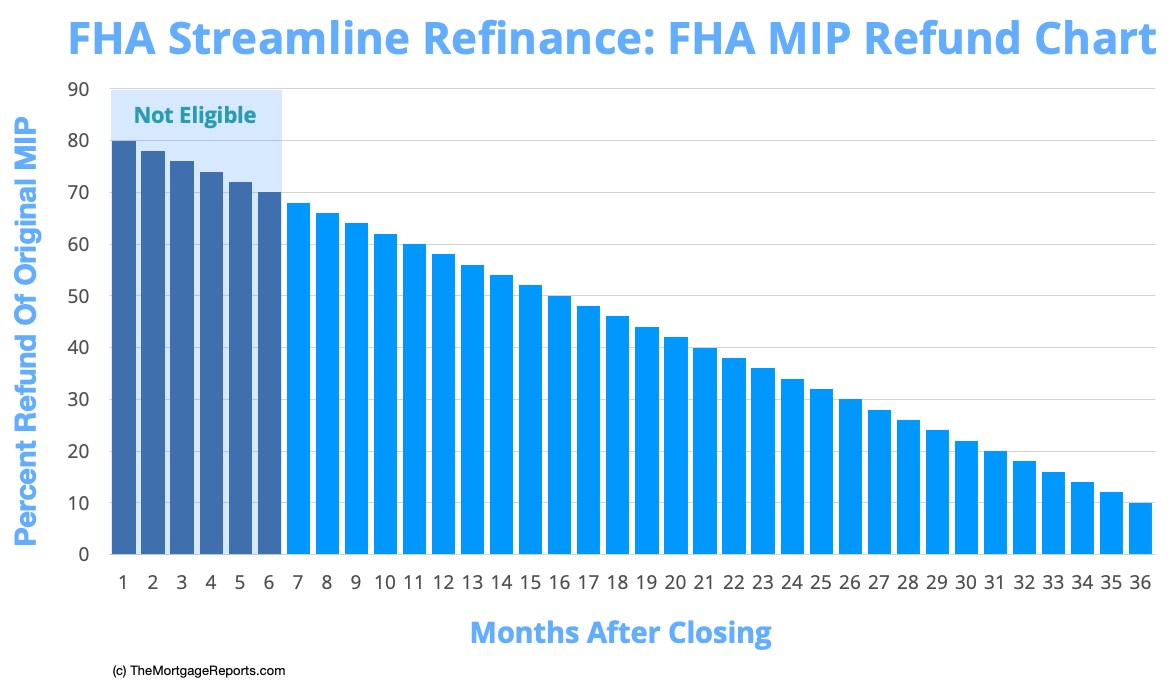

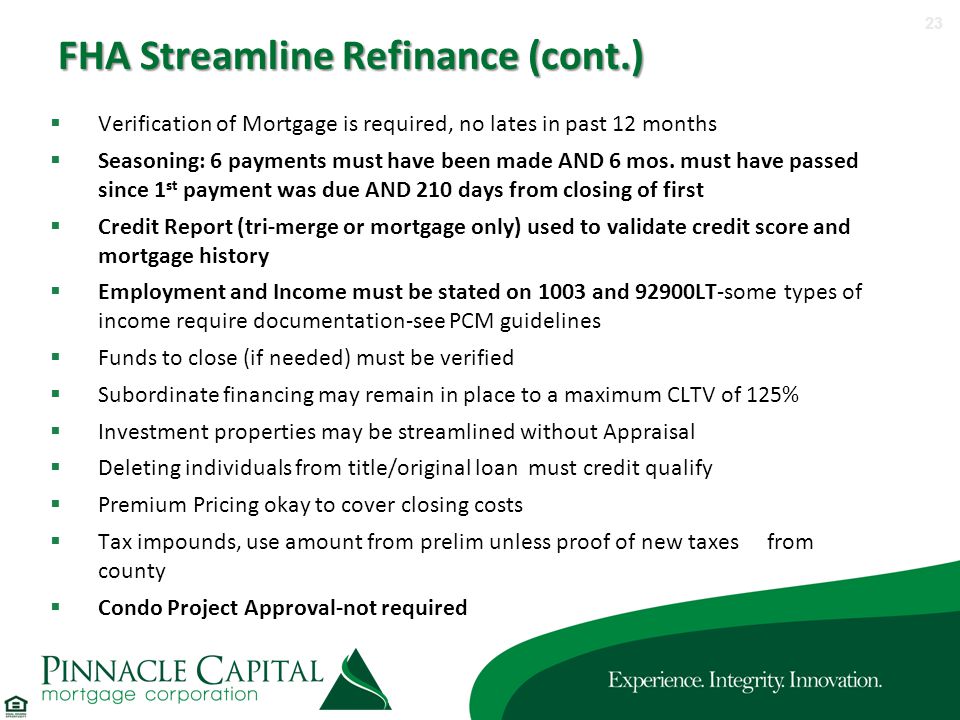

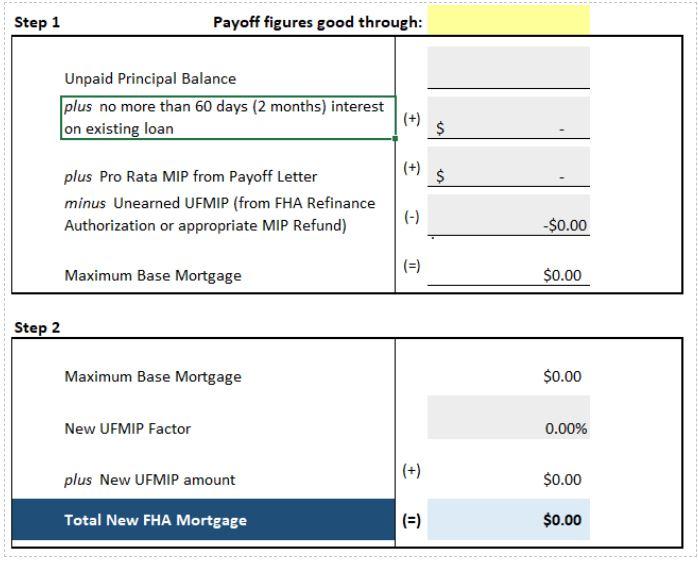

The homeowner must be current on payments for the existing fha loan and show proof of employment. The program was introduced by the fha as a way to speed up the home refinancing process. Pros cons of a streamline refinance. For an fha streamline refinance replacing a loan endorsed on or after june 1 2009 the fha upfront mortgage insurance premium is equal to 1 75 percent of your loan size or 175 basis points.

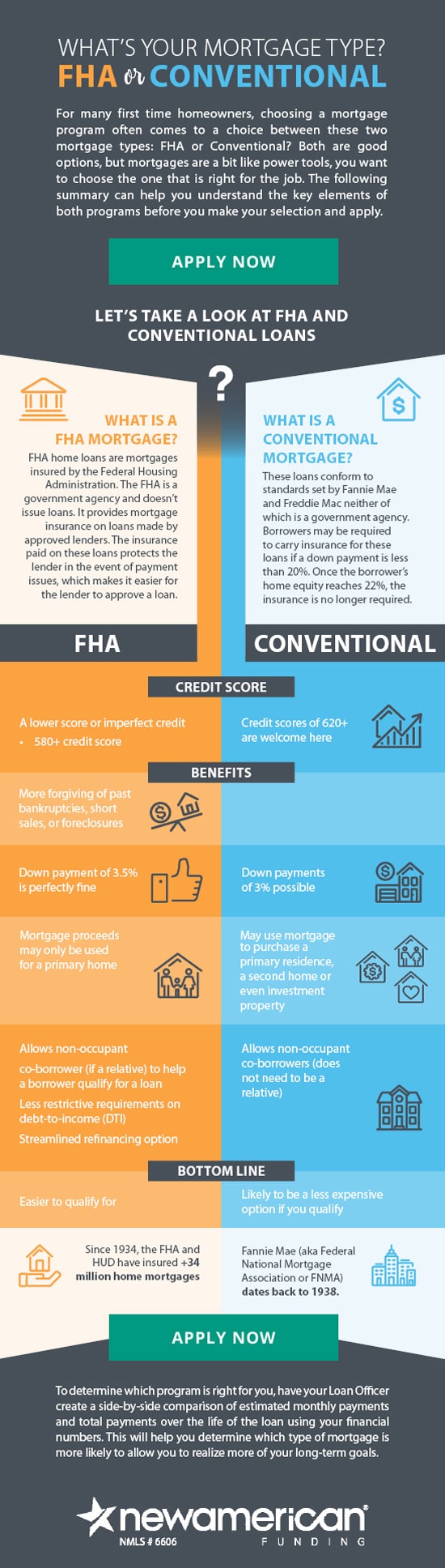

Requirements for a streamline mortgage. Streamline refinancing is a mortgage refinancing process in the united states for federal housing administration fha mortgages that reuses the original loan s paperwork allowing quicker refinancing. To begin you need an existing fha mortgage if you don t have an fha loan but want to refinance your options include conventional refinancing or applying for an fha refinancing loan. Fha streamline refinance is a specific mortgage product reserved for homeowners with an existing fha insured mortgage.

It is the simplest and easiest way to refinance an fha loan. The fha streamline refinance program gets its name because it allows borrowers to refinance an existing fha loan to a lower rate more quickly. But what do you need to qualify for an fha streamline loan. The fha streamline program is the best known and has been in existence since the 1980s.

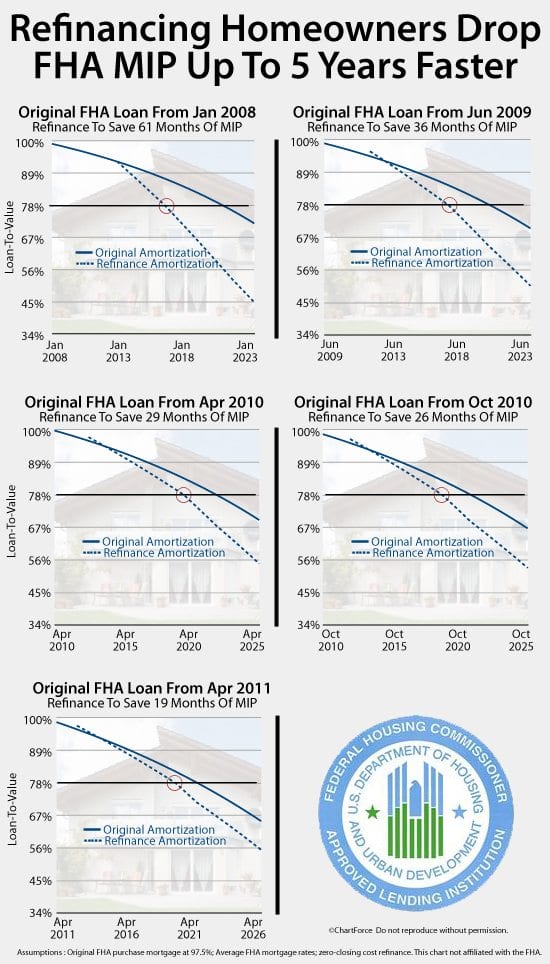

Clearly homeowners with an fha loan taken out before june 1 2009 benefit the most from the fha streamline refinance program but even those with more recent loans should compare their current monthly payments with their payments under a refinance. The fha streamline program allows an fha to fha refinance to lower the interest rate and payment from the current loan without proof of income or a home appraisal. Unlike a traditional refinance an fha streamline refinance allows a borrower to refinance without having to verify their income and assets. Fha streamline refinance sometimes it pays to refinance.