Reduce Tax Debt

/LafferCurve2-3509f81755554440855b5e48c182593e.png)

This tax related encouragement of debt financing has not gone uncriticized.

Reduce tax debt. Put an end to your tax problems today save 1 000s i am self employed and owed the irs 56 641 from back taxes. Here are five tips to lessen that burden. Tax debt can snowball quickly keep in mind that tax debt can get out of hand quickly if you procrastinate about dealing with it. We can only release you from payment of particular tax debts where paying those debts would leave you not able to provide for yourself your family or others for whom you are responsible.

Call now for free 30 min consultation. We call this release. Chapter 7 provides for a full discharge of allowable debts. To be a rich entrepreneur learn how to use debt and reduce taxes.

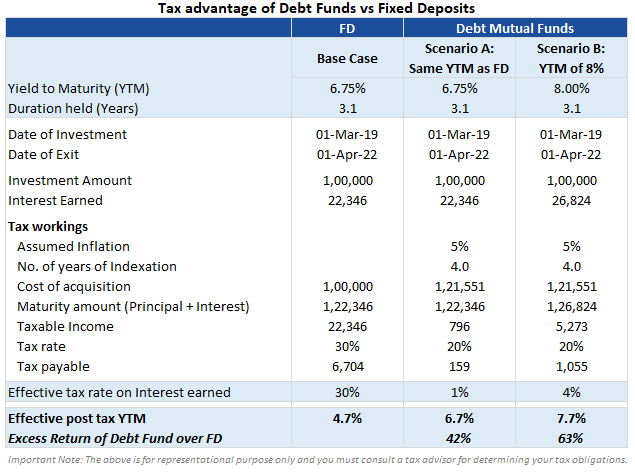

Spending cuts and tax increases played roles in both efforts. Eisenhower managed to reduce government debt in 1956 and 1957. There are moves you can make to reduce the impact of unpaid taxes on your life credit and financial well being. Which could reduce the internal revenue code s influence on capital structure decisions potentially reducing the economic instability attributable to excessive debt financing.

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. Notification effective april 27 2020. All markets have risk. Accept the fact of risk.

Filing for bankruptcy is one of five ways to tax debt relief but you should consider bankruptcy only if you meet the requirements for discharging your taxes. Did you know that the irs initiative the fresh start program making it easier for taxpayers to reduce irs tax debts pay back taxes and avoid tax liens. I ll leave you with some valuable free advice. For example some critics have argued that the cost of equity should also be deductible.

Eventually it will run out of patience and take more serious measures imposing levies and liens. With your help i was able to reduce my tax debt to 2 800. Release from your tax debt. A pro business pro trade approach is another way.

The application fee for offer in compromise is 205 unless you qualify for the low income certification or submit a doubt as to liability offer. In certain circumstances we can permanently remove some or all of an individual s tax debt.

/will-the-u-s-debt-ever-be-paid-off-3970473-finalv2-acb523b4dacf43529f4915254c600777.png)