Tax On Bonus Pay

This applies to bonuses and supplemental wages paid in the 2019 tax year as well as in the 2020 tax year.

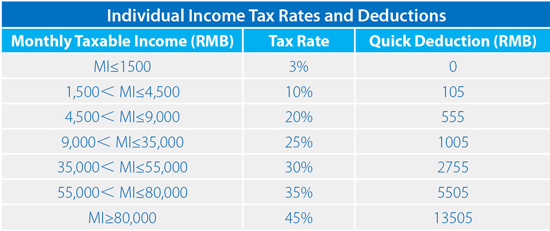

Tax on bonus pay. Schedule 5 tax table for back payments commissions bonuses and similar payments. Just as your employer holds back a portion of your regular paycheck to prepay your taxes it must take money out of your bonus check too. This rate was put in place after 2017 and is expected to be in effect until the end of 2025. To determine how much income tax to deduct from bonuses or retroactive pay increases take the total remuneration for the year including the bonus or increase and subtract the following amounts.

This bonus is not subject to conditions and cannot be rescinded without legal consequences. The coronavirus pandemic has seen many of us move to our home office but some of us may be in for a bonus come tax time. Just like that your bonus shrinks to 1 280 000 because 220 000 goes to the irs right off the top. The 1080 offset is still on the table.

There is a withholding limit of 47 on tax withheld from any additional payments calculated using an annualised method. The employees must pay federal and state income taxes and fica taxes social security and medicare on bonus pay. In this example the bonus is considered to be the employees income for 2019 because the employer s liability to pay the bonus arises in 2019 and employees become entitled to it in 2019. Certain qualifying retroactive lump sum payments are eligible for a special tax calculation when an individual files their income tax and benefit return.

These funds are sent to the irs on your behalf. The problem with this approach is that instead of taxes being withheld at a flat 25 and having that 25 rate applies only to the bonus amount taxes are withheld at what is almost certainly a higher rate on the combined amount of your normal pay and the bonus. There could be a big tax difference between your employer including your bonus with your regular wages in a single payment or giving you a separate check. Therefore the bonus will be taxed in ya 2020.

This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. For payments made on or after 1 july 2018.