Va Home Mortgage Loans

/va-home-loans-1798389_FINALv2-d42807494ecd4966aed01de64838b89c.png)

You ll still need to have the required credit and income for the loan amount you want to borrow.

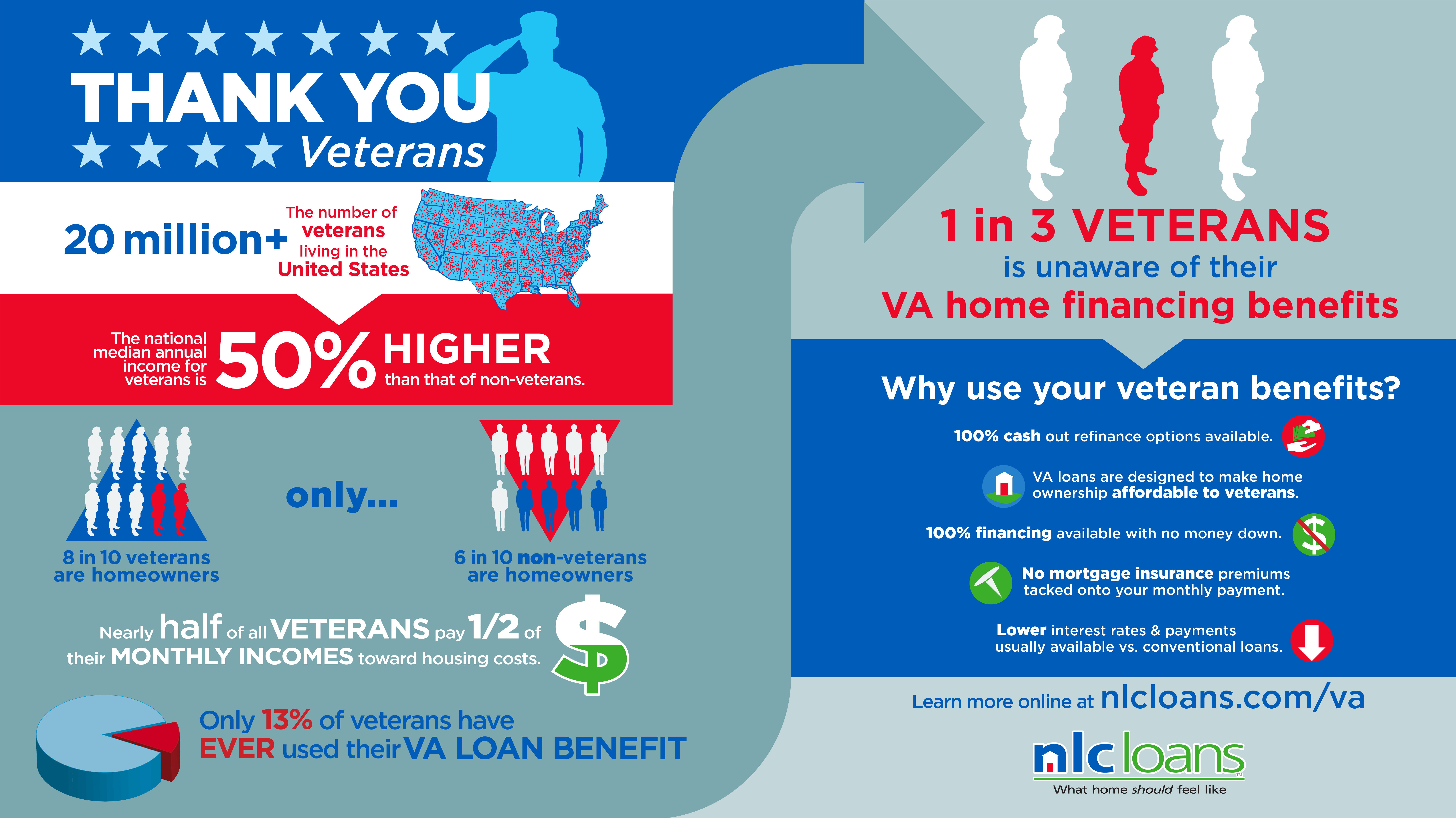

Va home mortgage loans. You ve sold the home you bought with the prior loan and have paid that loan in full or. As part of our mission to serve you we provide a home loan guaranty benefit and other housing related programs to help you buy build repair retain or adapt a home for your own personal occupancy. Purchase loans interest rate reduction refinance loans or irrrl also referred to as a va streamline refinance loan and cash out refinance loans. The va home loan was created in 1944 by the united states government to help returning service members purchase homes without needing a down payment or excellent credit.

Department of veterans affairs va. Find out if you qualify for a nadl. The native american direct loan nadl program often has better terms than a home loan from a private lender a private bank mortgage company or credit union. Speak with a home loan specialist about current va loan rates.

For example nearly 90 of va backed loans are made with no down payment. This means you ll work directly with us to apply for and manage your loan. Your lender determines the rate on your va loan based on your unique financial situation. You may be able to restore an entitlement you used in the past to buy another home with a va direct or va backed loan if you meet at least one of the requirements listed below.

Va loans typically have lower average interest rates than other loan types. There are many benefits to a va loan but one of biggest benefits is that no down payment is needed to purchase a home. There are three types of va loans. No monthly mortgage insurance premium mip or private mortgage insurance pmi is required.

Va loans are issued by private lenders such as a mortgage company or bank and guaranteed by the u s. With a va direct home loan we serve as your mortgage lender. The va limits the amount you can be charged for closing costs and sellers are allowed to pay all of your loan related closing costs as well as up to 4 percent in concessions. Eligible veterans and service members find that rates are generally lower with a va home loan than a conventional mortgage.

Va home loans are provided by private lenders such as banks and mortgage companies.