Tax Filing Software For Small Business

For some small businesses tax filing is a relative breeze but not every business is so lucky.

Tax filing software for small business. Supports s corp partnership c corp and multi member llc or trust tax forms. Take a look at our list of the best tax software for small business below. Based on aggregated sales data for all tax year 2018 turbotax products. The download version for federal and state is 79 95 for unlimited business returns.

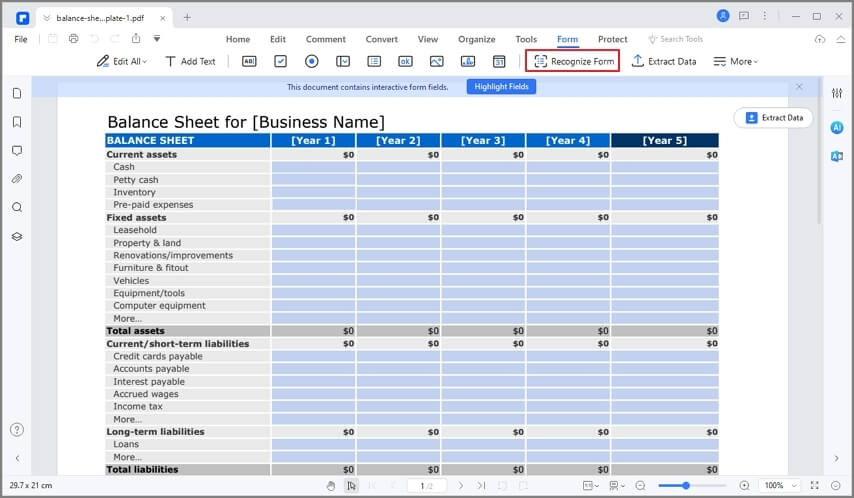

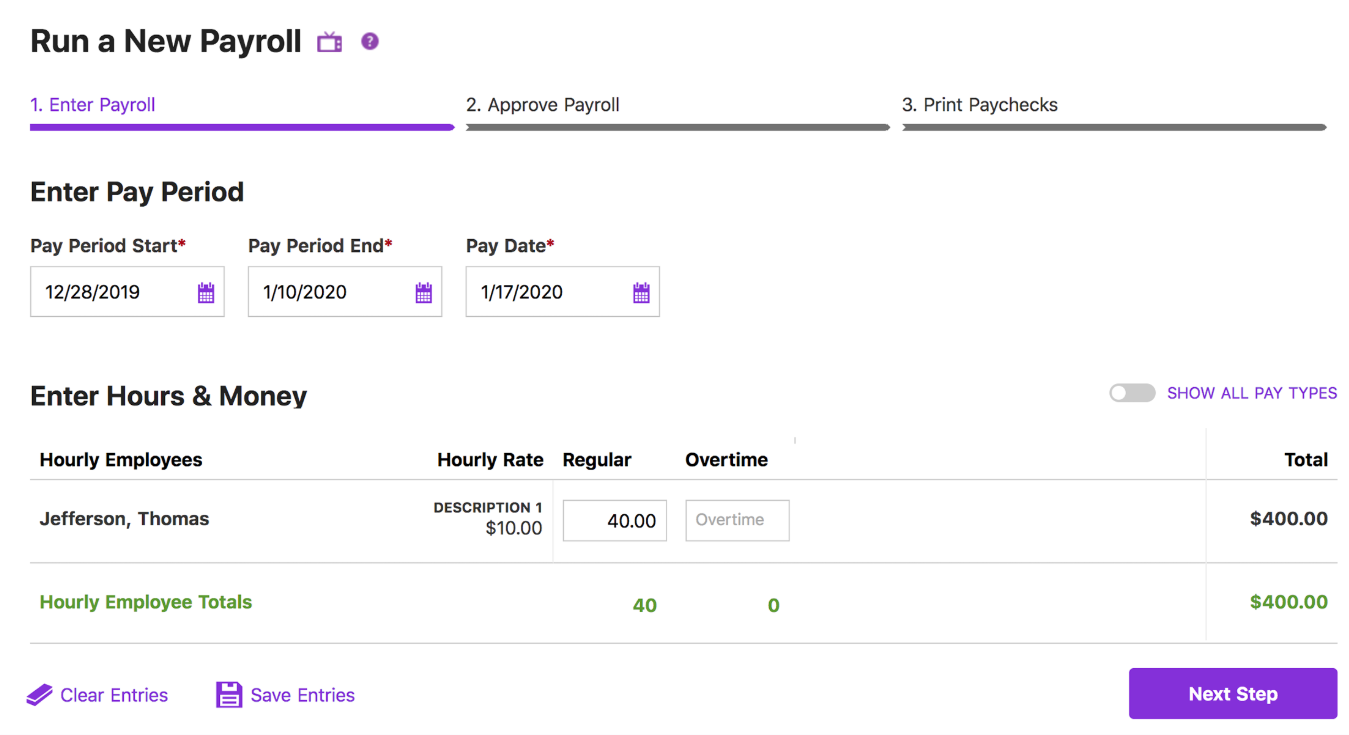

We identify the best small business tax software based on pricing features and ease of use. Most business owners require more than one return. We compare the cost across tax programs based on the price of preparing. Maybe you have a lot of tough deduction decisions to make or perhaps your company needs additional software for accounting or hr.

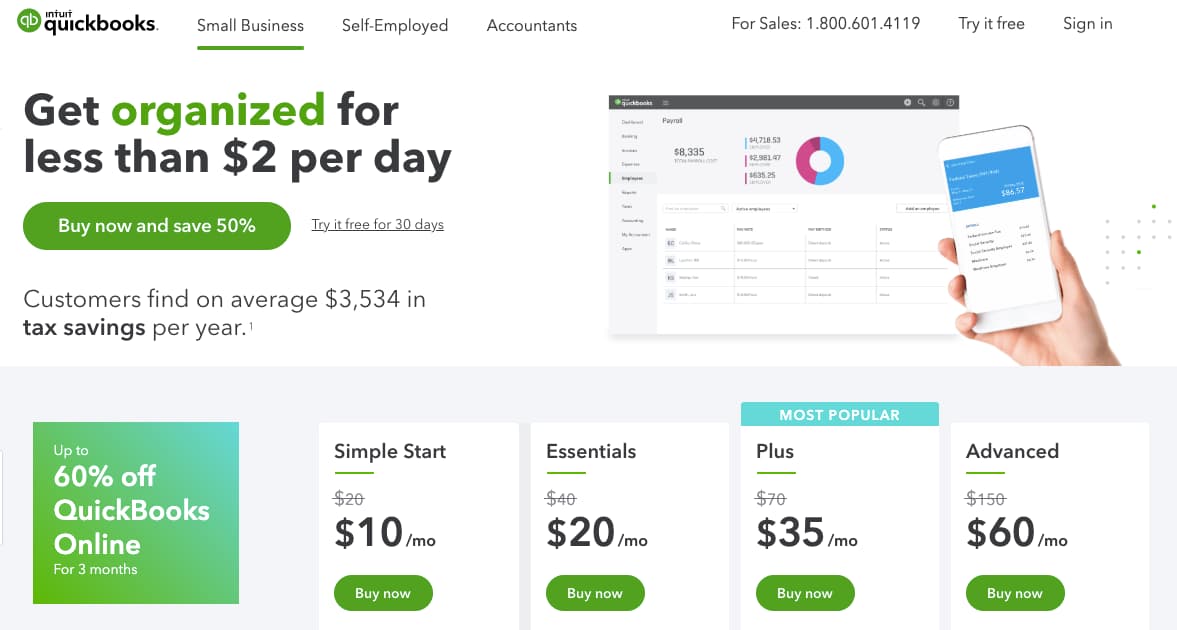

This software includes s corporation c corporation partnership and llc returns. When it s time to file a federal income tax return for your small business. 1 best selling tax software. Automatically import your quickbooks desktop income and expense accounts.

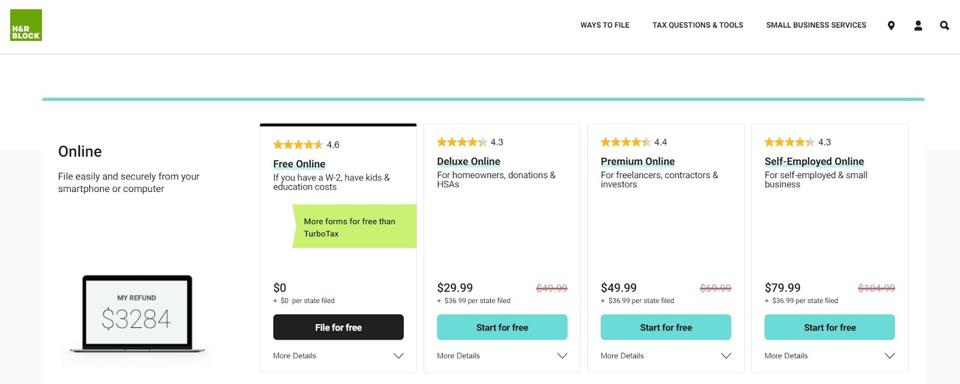

Maximize industry specific business tax deductions. With h r block you can file taxes online from any device users have the option of having their return checked for free by a tax professional before they file to ensure accuracy and help them get the maximum refund. A newcomer to the tax software scene halon tax is a service that specializes in small business returns specifically s corp and partnership tax prep and planning for forms 1120s and 1065. Schedule c is a simple way for filing business taxes since it is only two pages long and lists all the expenses you can claim.

Turbotax business cd download is business tax software that makes preparing business taxes easy. Small business owners can prepare their own tax returns for a fraction of the cost of tax professionals.