Taxation Problems And Solutions

They provide free and independent advice assistance and advocacy to people who need help with tax or tax debt.

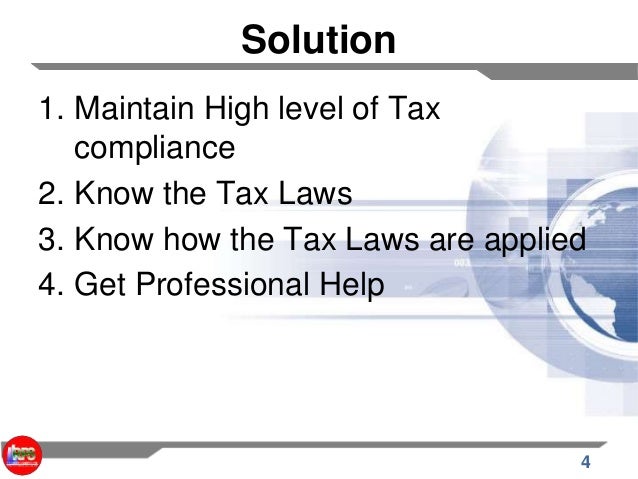

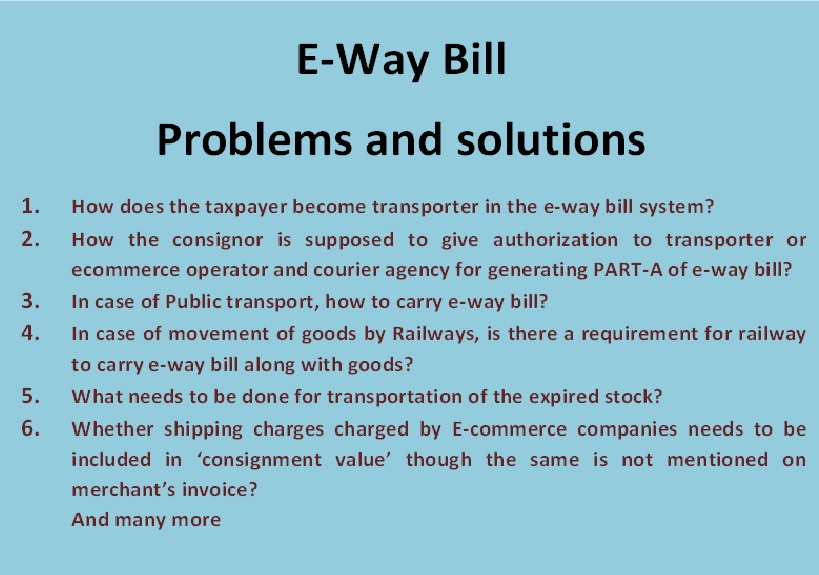

Taxation problems and solutions. Find a solution for your tax problem. Do very little good because they ignore the nature of taxation itself. Information on irs problems solutions. The irs is not an easy government agency to navigate especially when trying to resolve a tax problem.

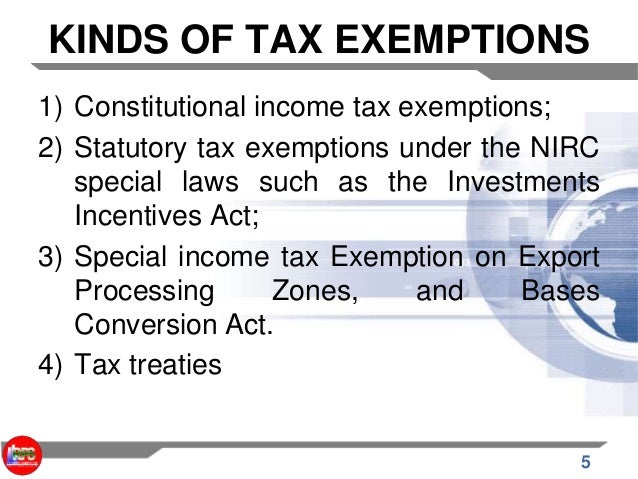

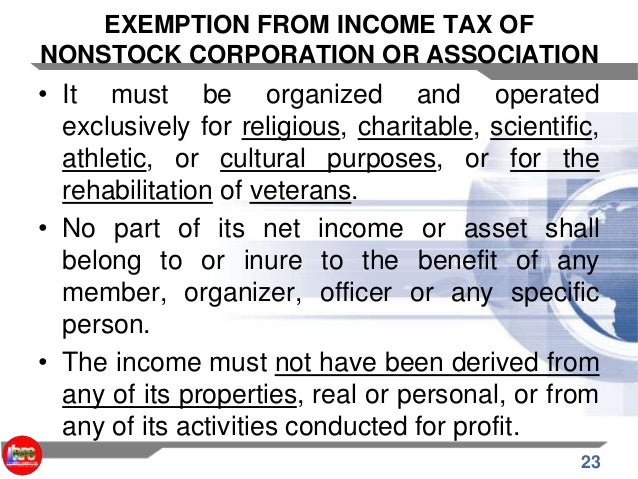

There is no separate income tax slab for a woman tax payer. Unfortunately the recently enacted tax cuts and jobs act tcja fails to solve fundamental problems facing the corporate tax and in some ways makes these problems even worse. Because the irs resists directing you to solutions to most tax problems especially the problem of excessive tax debt this irs common problems solver is designed to fill that void. From this experience one truth is clear.

Interest on public provident fund account is not taxable. In above example her net taxable income is rs 5 50 000. Regardless of your tax problem there is a resolution. You can overcome the four most common tax problems people face by discovering the best solutions for them.

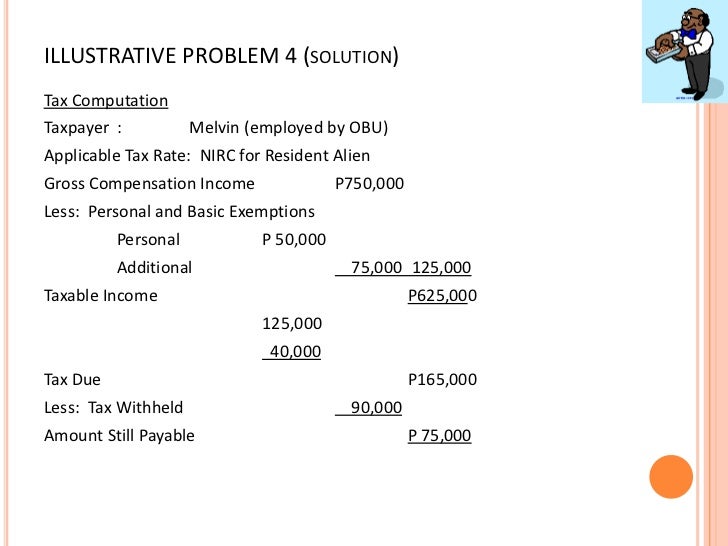

You may have unpaid taxes or unfiled returns you may be facing an audit or a garnishment or you may have received notices from the irs. They define low income as around 20 000 per year or less. No matter what your problem is with your taxes there is a solution. X is 42 years old and her basic income tax exemption limit for financial year 2014 15 is rs 250000.

Therefore she is liable to pay income tax. The 8 essential problems with taxation reforms to make the tax system flatter fairer or simpler etc. They can help with problems about tax allowances paye codes tax arrears self employment tax returns and hm revenue and customs administration and complaints. The irs and states have put in place many different mechanisms to allow any taxpayer in any situation to resolve a problem no matter how bad you think your problem is.

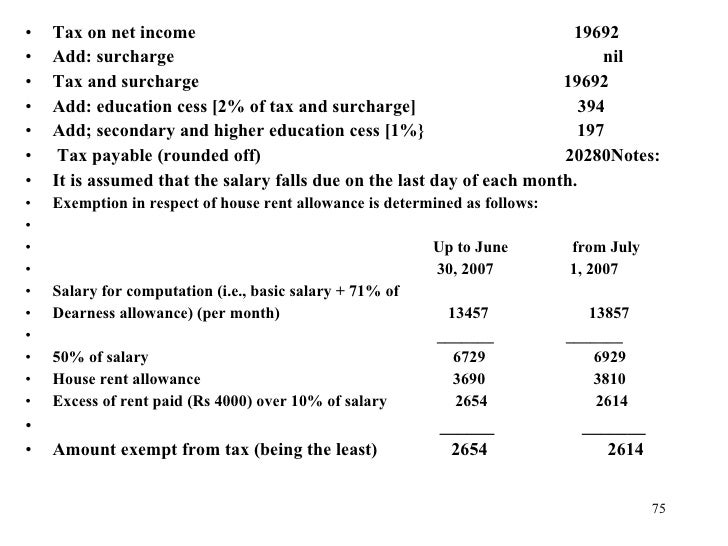

All the problems and solutions have been thoroughly revised in the light of up to date amendments in income tax law and rules for assessment year 2019 20. The salient features of the present edition are. When it comes to meeting the needs of society it s not that we are using a great tool badly. It describes numerous taxpayer rights and remedies and shows you the steps to take to determine which solution best suits your situation.

The nation s corporate tax system has been dysfunctional for decades.