What Is Included In Full Coverage Auto Insurance

But a full coverage policy covers you in most of them.

What is included in full coverage auto insurance. In the broadest sense full coverage auto insurance refers to a policy that includes vehicle specific protections such as comprehensive and collision coverage in addition to the usually mandatory liability component by that definition full coverage car insurance is essentially the antithesis of a liability only policy. The average full coverage car insurance rates are 119 mo. What is included in a full coverage car insurance policy. Insurance is meant to protect you from being sued or left financially stranded by a totaled car or ruined by an uninsured driver.

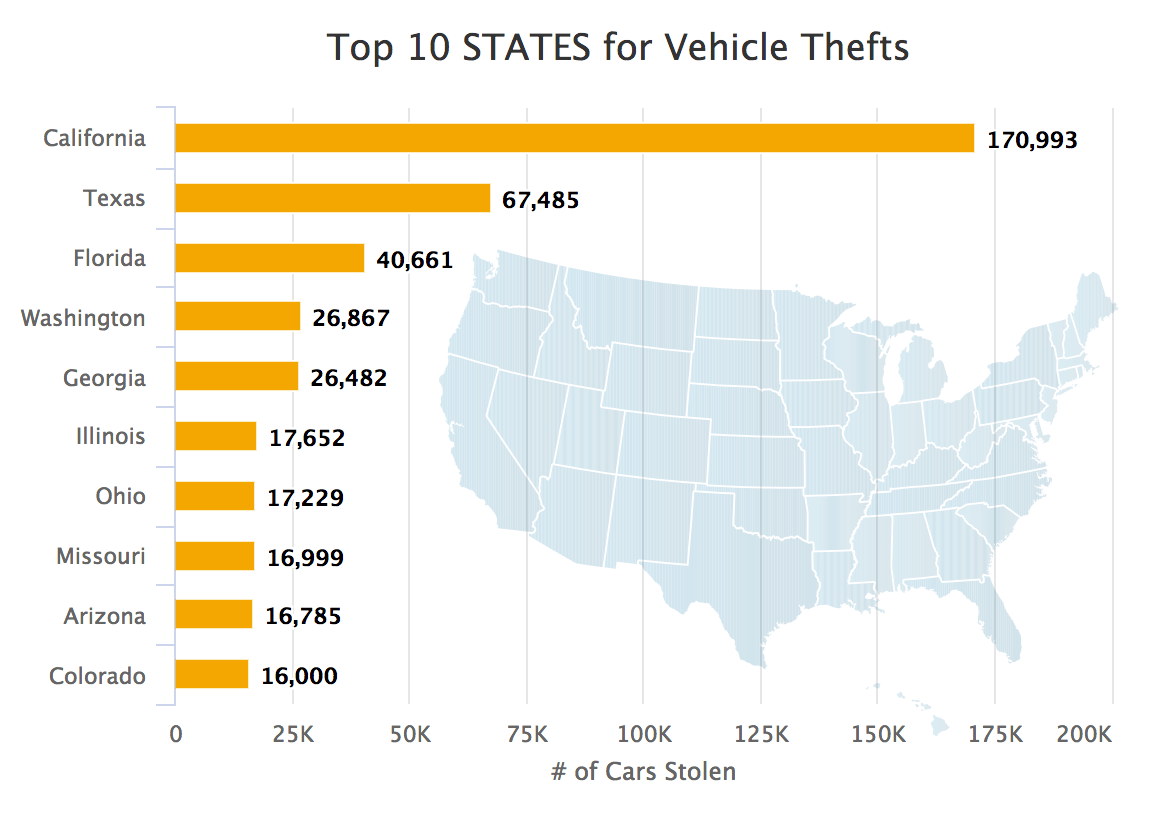

No insurance policy can cover you and your car in every circumstance. Car insurance quotes for full coverage are available right here as soon as you place your zip code in the free quote tool above. Bodily injury liability coverage helps pay for another person s medical expenses if you cause an accident. Full coverage auto insurance typically means a combination of coverage that includes liability insurance this coverage made up of bodily injury liability insurance and property damage liability insurance can help pay for the other driver s injuries or vehicle damage if you cause an accident.

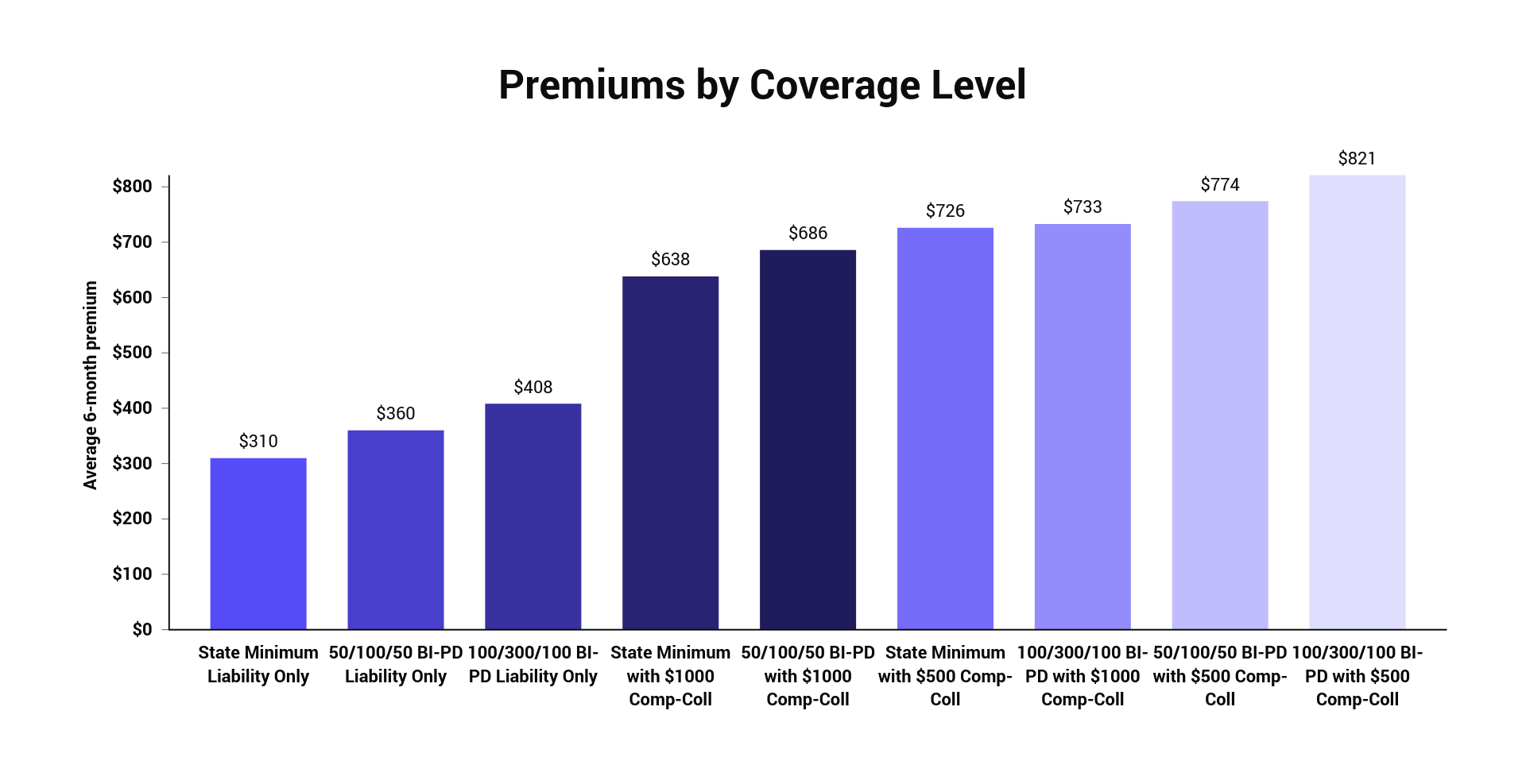

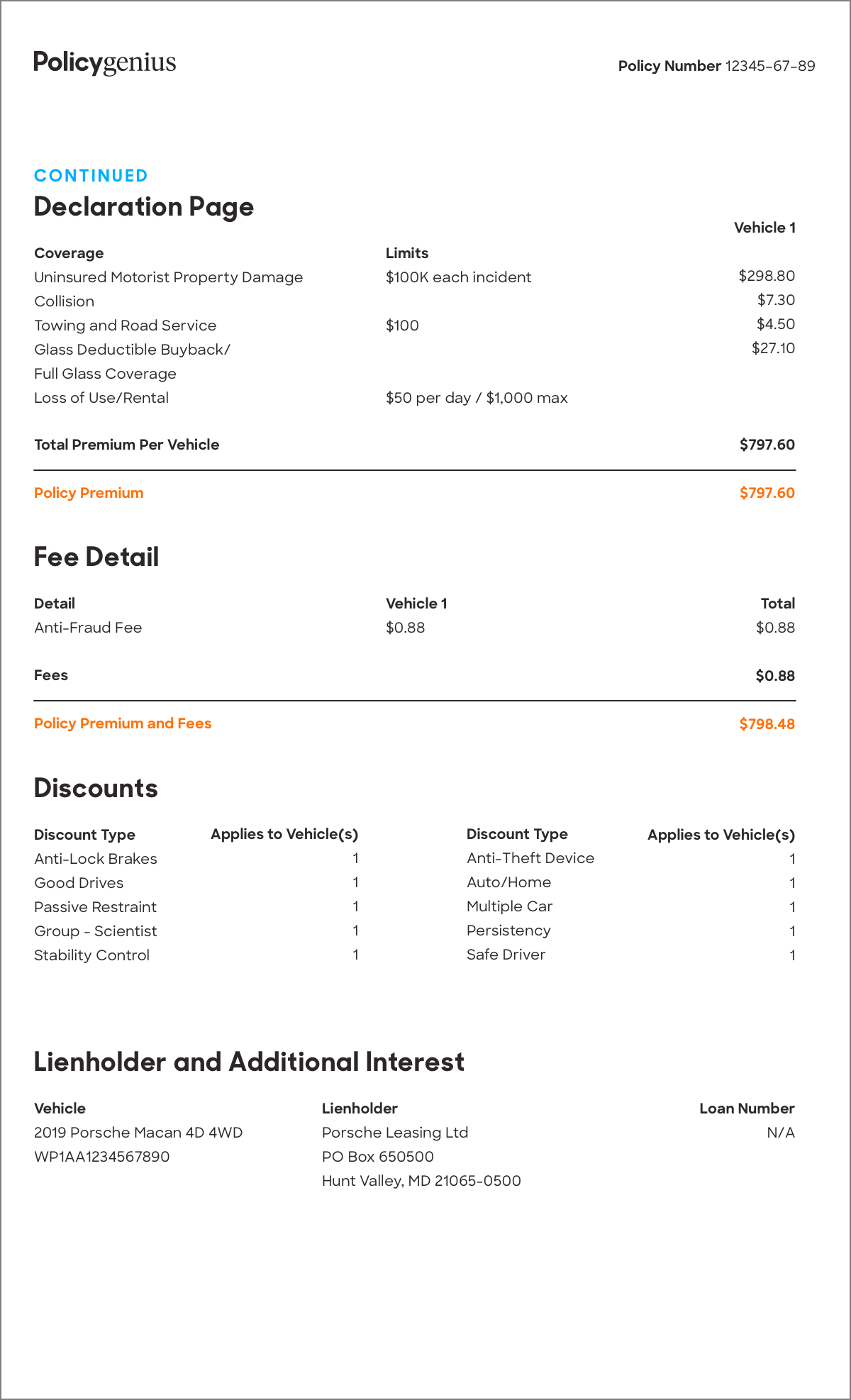

Insurance policies are limited in the extent of coverage they provide. For example insurance policies do not automatically cover a tow from the scene of an accident or rental car while a vehicle is being repaired. Full coverage auto insurance rates average 79 58 mo. Lenders require full coverage insurance to finance a car for the duration of the loan.

In the u s and a full coverage policy is required for all new and used vehicles that are financed. Property damage liability coverage helps pay for damage you cause to another person s property in a car accident. Other times full coverage refers to all possible coverage types that are bundled together into a car insurance policy. Full car insurance offers so much more coverage than just basic insurance so it does a much better job of protecting you your car your assets and your family.

Full coverage car insurance includes liability collision and comprehensive coverage to protect your personal property. Full coverage car insurance. Generally full coverage is a combination of different kinds of auto insurance coverage as required by your state or circumstances. Read on for more.

This covers your liability to the other driver or their passengers for bodily injury and property damage. Liability coverage is typically included in all auto insurance policies as it s required by law in most states. Often lenders and leasing companies refer to full coverage auto insurance as coverage that combines liability and physical damage together. Full coverage is generally the best way to go when it comes to car insurance.

This usually includes at a minimum.