What Does 0 Apr On Balance Transfers Mean

:max_bytes(150000):strip_icc()/GettyImages-1049192158-8c9d6892323e48c09146c90a96cbd6b0.jpg)

Credit cards targeted at consumers with poor credit scores that carry numerous fees making the cost of credit extraordinarily expensive.

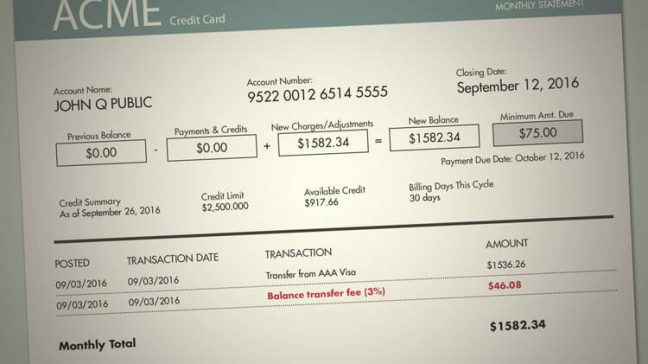

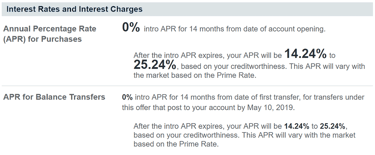

What does 0 apr on balance transfers mean. The best 0 apr credit cards give 15 18 months without interest. Many credit cards offer an introductory apr on balance transfers a low interest or 0 rate that stays in effect for a set time period which ranges from six months to 21 months or more depending on the card issuer. Fee harvesting cards charge fees for. But the average 0 apr intro period is about 10 5 months for cards offering 0 purchases.

Credit card type. These 0 apr offers can help you save money on interest but you may still pay other fees to borrow. A balance transfer apr is the interest rate you ll pay on balances that you transfer to your credit card. After that the variable apr will be 14 74 24 74 based on your creditworthiness.

If it is something you can pay off in a few months the balance transfer fee may be more than interest where it is on a declining balance. 0 intro apr for 18 months on purchases from date of account opening and 0 intro apr for 18 months on balance transfers from date of first transfer. For example your credit card might charge a balance transfer fee for you to pay off balances on other credit cards. So how much can you.

So 0 interest does not necessarily mean totally free. To qualify for the best offers you generally have to have good or excellent. For example if your 0 intro apr offer was for balance transfers only then any new purchases on your card may be charged interest unless you pay off your balance in full each month by the due date. The card you pursue should not just be good for the introductory rate deal it should match your long term needs and lifestyle.

After the introductory period ends your balance and any new purchases will be subjected to the regular apr the national average as of june 24 2017 is 15 96. Balance transfers must be completed within 4 months of account opening. A 0 apr means that you pay no interest on new purchases and or balance transfers for a certain period of time. Qualifying for a promotional balance transfer offer usually requires you to have good to excellent credit.

And the way they word how it expires usually means that you need to totally pay it off by the due date or statement closing data a week later the month before that to avoid getting charged interest.

/what-does-apr-mean-315004-v3-jl-442b370734d44759ac43d09edcc3fb26.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/man-sitting-on-couch-in-living-room-with-laptop-and-credit-card-735892519-5ab6f0c1875db9003732331f.jpg)