What Does Car Liability Insurance Cover

Let s say you make a left turn without checking your blind spot and you don t see an oncoming car which causes you to run into their vehicle.

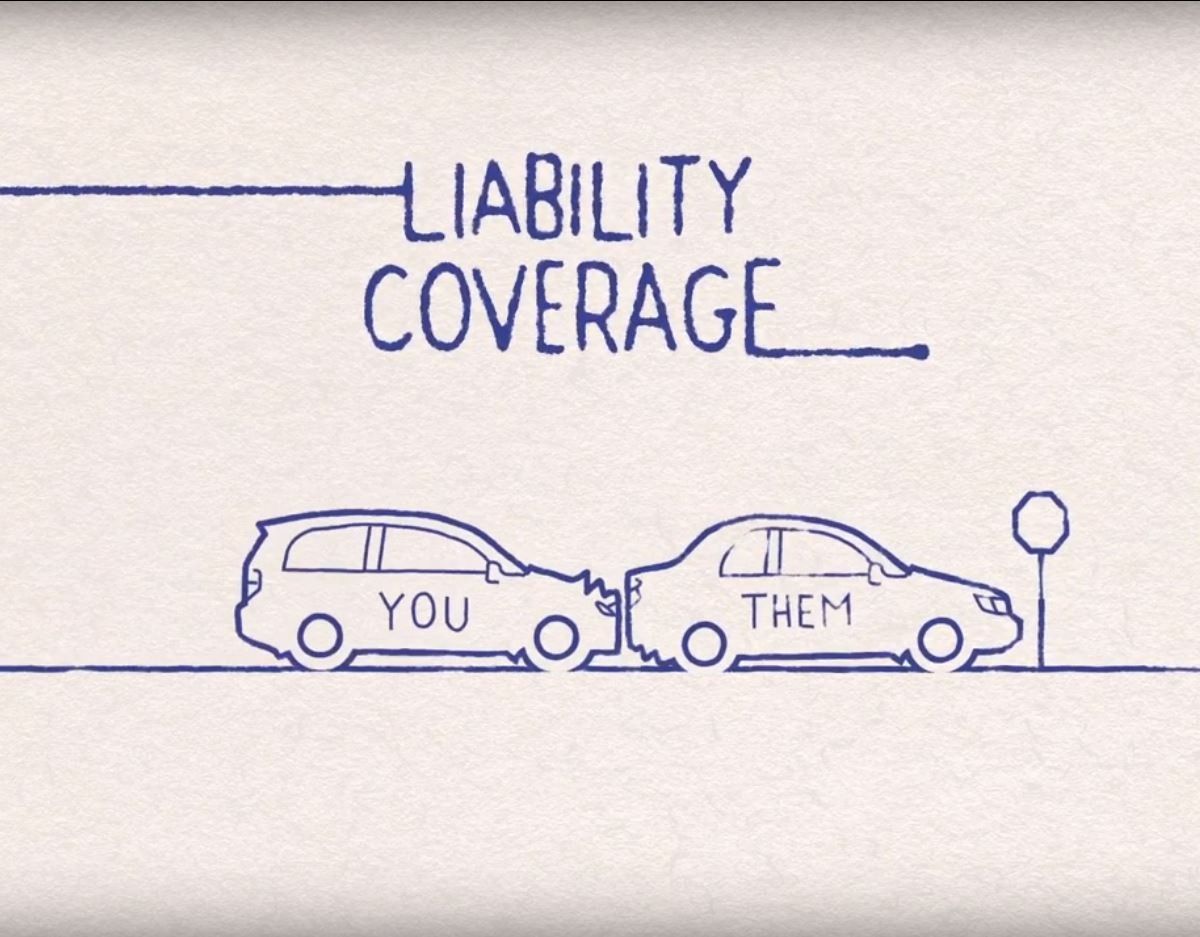

What does car liability insurance cover. Put simply it is insurance coverage that protects you against financial loss as a result of bodily injury and property damage you cause to others while driving your own vehicle. Liability insurance is basic coverage that protects you against having to pay for damages and injuries to others when you cause an accident. Auto liability insurance coverage helps cover the costs of the other driver s property and bodily injuries if you re found at fault in an accident. Similarly your liability insurance won t cover injuries you sustain in an accident you caused.

For example when it comes to liability insurance if you cause an accident while driving the rental car your liability insurance would pay up to your policy limits for the damages done to other cars or property. The auto liability coverage definition may sound simple enough but here s a real life example. In general the coverage you have from your primary auto insurance will cover a rental vehicle. Upgrading to full coverage can be beneficial but you.

Liability car insurance or liability coverage as it s also known helps pay for the costs of the other driver s property and medical injuries if you are at fault in an accident. Your liability car insurance coverage does absolutely nothing to pay your own medical bills or fix your own vehicle if you are the person who causes the accident. Not only is the other car damaged the driver says they have neck pain. All states except new hampshire and.

You re at a four way stop a few blocks from your house. You can opt to include medical payments coverage in your car insurance often known as medpay or you can rely on your health insurance policy to cover medical costs after an accident. Liability insurance covers you if you are found at fault for an auto accident. Auto liability insurance is a type of car insurance coverage that s required by law in most states.

Contractors all risks car insurance is a non standard insurance policy that provides coverage for property damage and third party injury or damage claims the two primary types of risks on. If you cause a car accident in other words if you are liable for the accident liability coverage helps pay for the other person s expenses. Your insurer will pay for the property damage and injuries up to the covered limit.