When To Refinance My Home

Estimate your new monthly mortgage payment savings and breakeven point.

When to refinance my home. Using bankrate s mortgage refinance calculator you can figure out. For most people the goal of refinancing is to lower monthly bills. Refinancing for an amount. Refinancing your home a housing specialist s home ownership fact sheets with information on the best time to refinance.

Today you are approved for a 3 rate. For a 30 year fixed rate mortgage on a 100 000 home refinancing from 9 to 5 5 can cut the term in half to 15 years with only a slight change in the monthly payment from 805 to 817. For instance if your home is currently worth 300 000 but you have 175 000 left to pay on your mortgage your equity in your home is 125 000. If the value of your home has gone up you might also get some benefit from refinancing especially if you have other high interest debt to pay off.

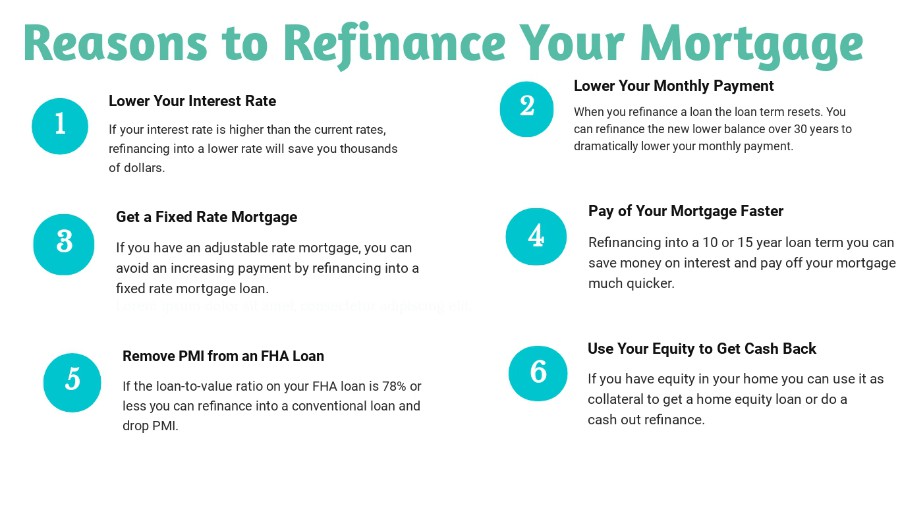

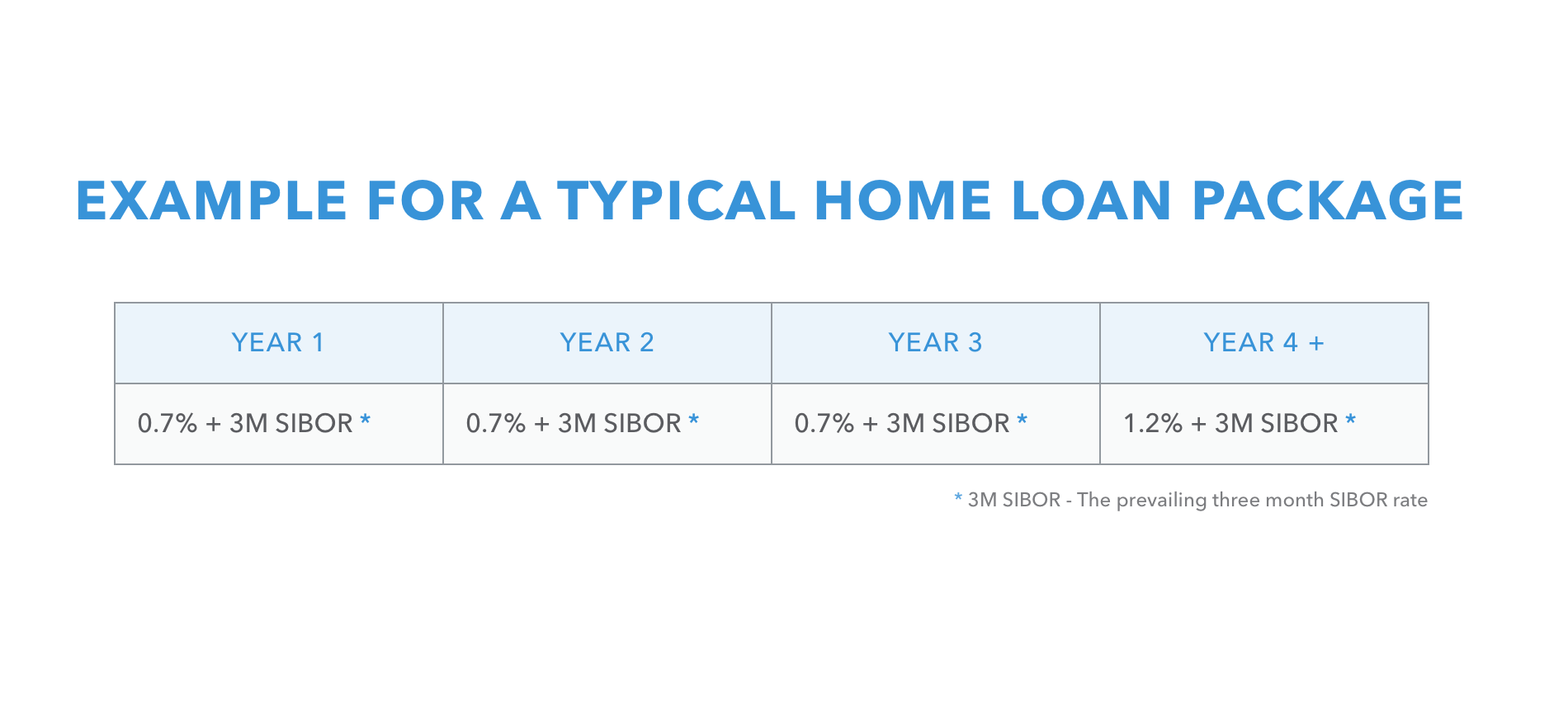

Your home has increased in value. Current interest rates are at least 1 percent lower than your existing rate. Try our easy to use refinance calculator and see if you could save by refinancing. Now you want to refinance the remaining 139 581 of your principal balance with a new 30 year fixed rate loan of 4 5 percent.

Say you have a 30 year mortgage for 250 000 that you took out a year ago at 4 46. Although every situation is different i would recommend refinancing your mortgage if. When you get a cash out refi you take out a new mortgage that s larger than what you previously owed and you receive the difference in cash. 4 so if your loan amount was 100 000 you could end up paying 3 000 in fees at a minimum.

Refinancing and the us economy the issues regarding the costs and benefits of mass refinancing by the american people.

:max_bytes(150000):strip_icc()/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)