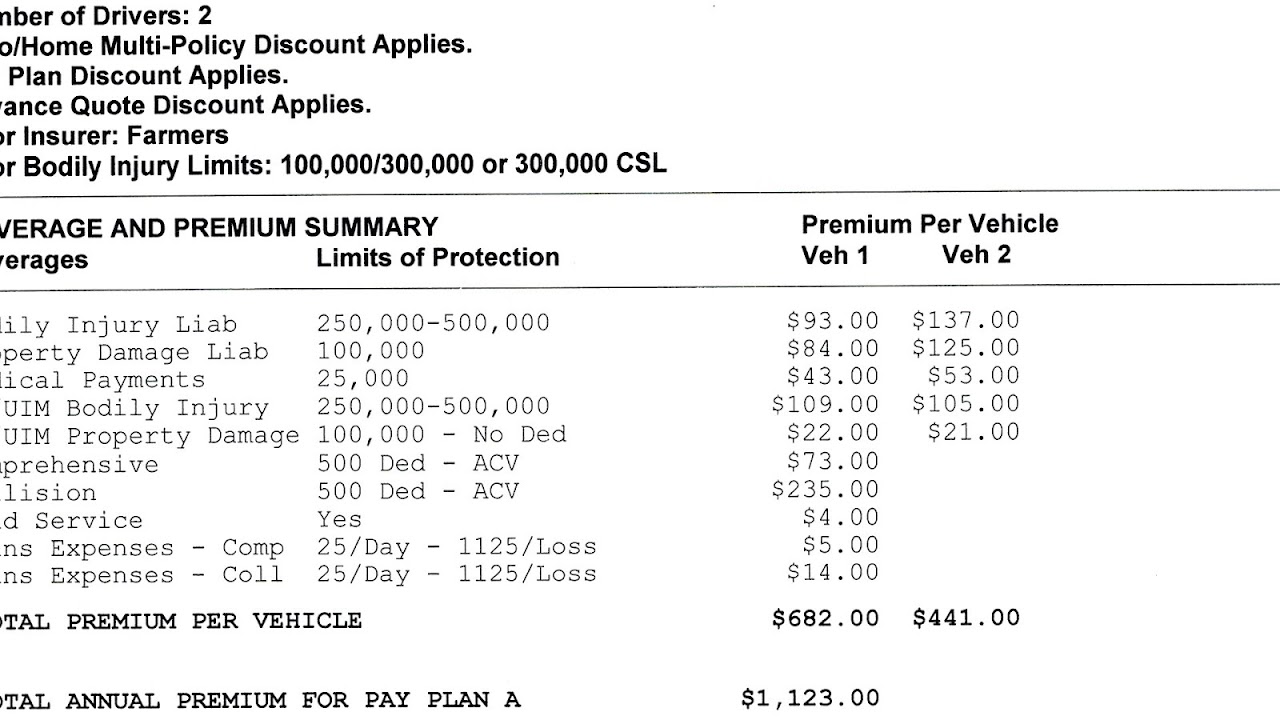

What Is Csl In Auto Insurance

Combined single limit liability coverage csl this type of auto insurance coverage is a combination of all the liability limits bodily injury and property damage.

What is csl in auto insurance. An umbrella policy for 1 million dollars will cover you if you have claims against you or are sued and have to pay more than the coverage limits under your auto and or homeowner s policies. Combined single limit csl coverage for 1 million dollars would strictly be under your car insurance policy and pays out only for covered losses under that policy. There is not a split differential between the three main components. In that instance the coverage will be listed as a single amount 500 000 for example and all claims for damage to property and injuries will be made against the csl coverage.

Learn more about bodily injury liability insurance. Combined single limits csl is usually used for commercial auto insurance but some companies offer it for private car insurance as well. Before learning more about combined single limit liability car insurance you can compare combined single limit liability car insurance rates by using our free tool. A combined single limit policy would state that the insurer.

Combined single limit csl csl is a single number that describes the predetermined limit for the combined total of the bodily injury liability coverage and property damage liability coverage per occurrence or accident. A provision of an insurance policy that limits the coverage for all components of a claim to one dollar amount. Understanding combined single limit csl and split limit liability insurance june 26 2017 in many states vehicle owners who purchase car insurance may have the option of purchasing a split limit auto policy or a combined single limit auto policy. In this way this becomes an umbrella policy that will cover automobile and homeowner insurance in one place.

Commercial auto insurance terms and definitions. Liability is combined into one single limit. While most liability auto insurance is purchased as split liability it is also possible to purchase combined single limits on a car insurance policy. There are many options for combined single limit liability coverage or csl insurance including 500k csl 100k csl and many more.

Csl policies offer broader coverage and for that reason they tend to have a higher premium range. A combined single limit is exactly what the name implies.