Retro Insurance

Your policy s retroactive date is the date on which your professional liability coverage.

Retro insurance. Retroactive insurance is a type of insurance that provides coverage for losses that have already occurred but have not yet been reported. Many third party capital investors will have to pay out major losses for the first time after re insurers in recent years have increasingly boosted capacity with. Retroactive insurance insurance purchased to cover a loss after it has occurred. Losses may go unreported because they were forgotten not recognized or the paperwork simply wasn t filed when it should have been.

In general most claims made insurance contracts include a retroactive date. We offer insightful advice on risk solutions in order to help our clients gain a strategic advantage. Like many other types of insurance this is done for a fee. This is done by accepting business that the other.

A dedicated ilw team and specialist in house analytics team. A center of excellence in london that supports major business hubs throughout the world including london u s emea apac. Reinsurance companies commonly participate in retrocession in order to prevent the chances of being unable to meet their financial obligations in the event that a disaster occurs and causes many claims to be filed at once. Retroactive date a provision found in many although not all claims made policies that eliminates coverage for claims produced by wrongful acts that took place prior to a specified date even if the claim is first made during the policy period.

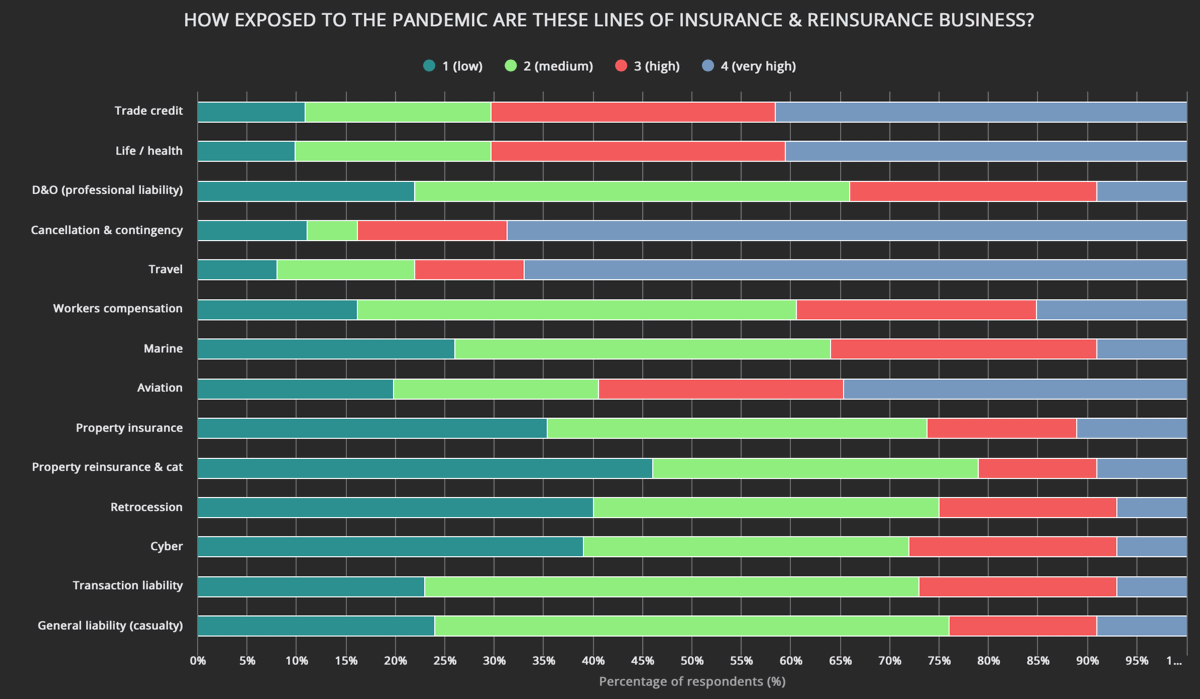

With reinsurance the company passes on cedes some part of its own insurance liabilities to the other insurance company. Primary insurers traditional reinsurance collateralized reinsurance and insurance linked securities ils will all share the losses of these events the retro market is expected to pick up a large portion of the q3 loss tab. Retrocession is the practice of one reinsurance company providing services to another by insuring the activities of another reinsurance company. Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself at least in part from the risk of a major claims event.

For example such insurance may cover incurred but not reported ibnr claims for companies that were once self insured.