What Is Factoring Company

The factoring company pays you the remaining invoice amount minus their.

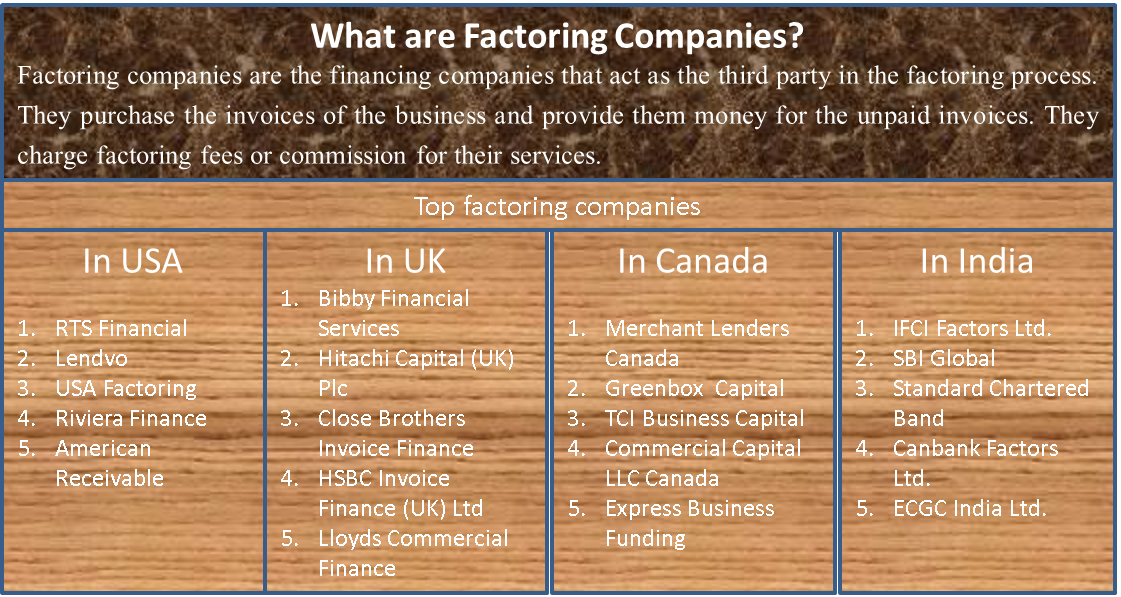

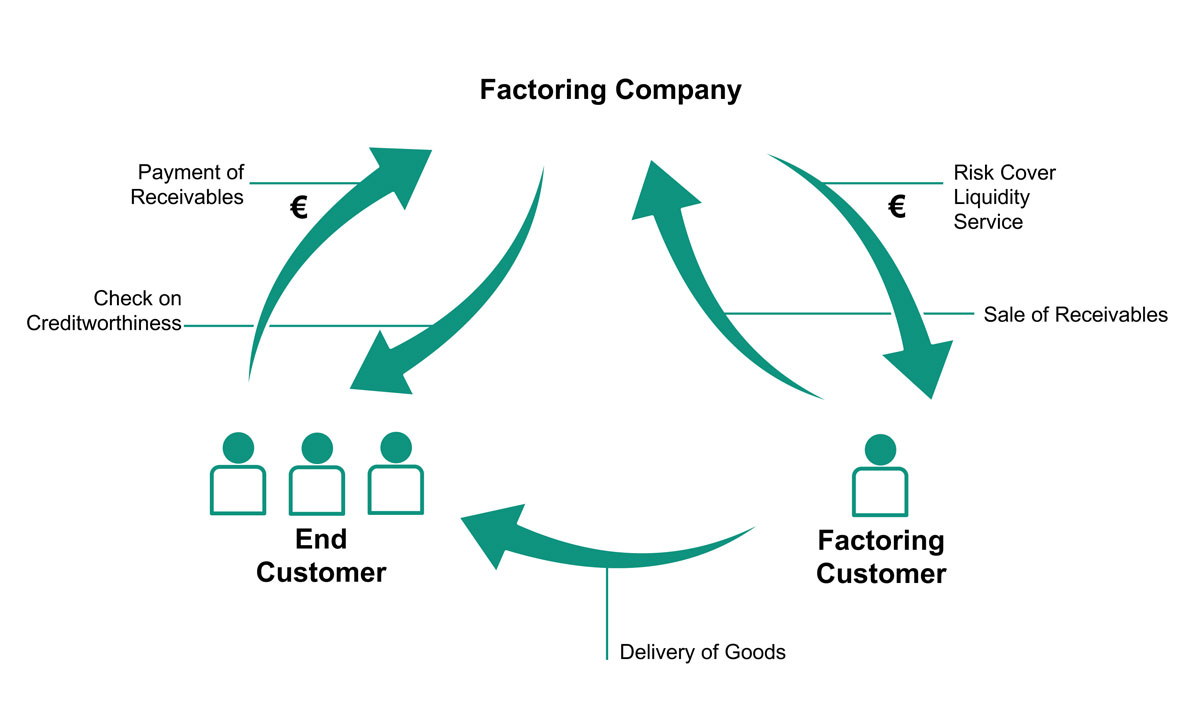

What is factoring company. Factoring is a short term solution. Your customers pay the factoring company directly. Instead they purchase the accounts receivable from their clients at a small discount. Factoring is a form of financing that helps companies with cash flow problems due to slow paying clients.

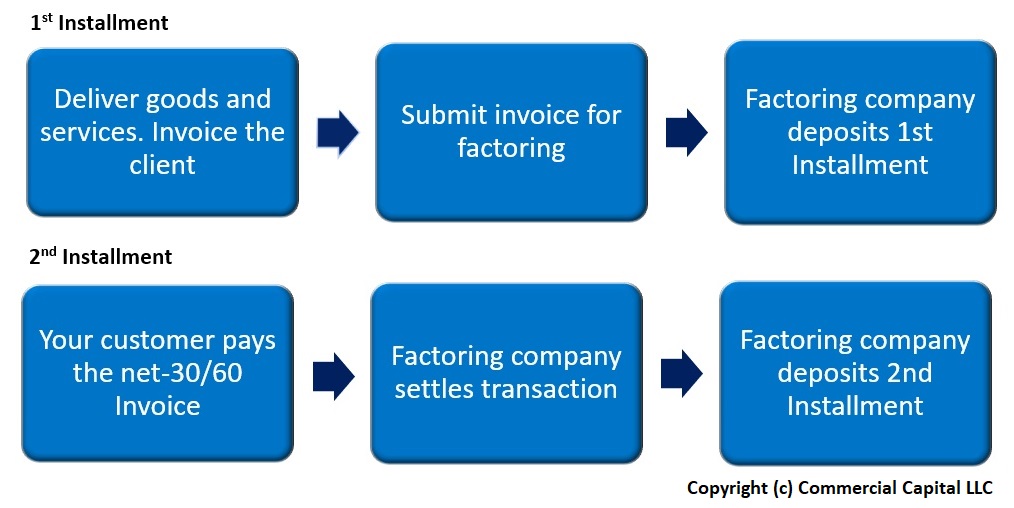

A factoring company specializes in financing invoices from businesses that have cash flow problems due to slow paying customers. The main reason that companies factor is to get paid on their invoices quickly rather than waiting the 30 60 or sometimes 90 days it often takes a customer to pay. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. Working with factoring companies is a popular financing solution for businesses that have cash flow issues due to slow paying.

It allows your business to finance invoices which improves your company s working capital. Factoring receivables factoring or debtor financing is when a company buys a debt or invoice from another company factoring is also seen as a form of invoice discounting in many markets and is very similar but just within a different context. Factoring companies typically advance 70 90 percent of the invoice value up front. Factoring is sometimes referred to as accounts receivable financing.

The remaining balance is remitted when the invoice is paid minus a fee. A factoring company is a business that purchases another company s invoices. Factoring is a type of finance specifically designed to increase working capital or liquidity by selling the company s outstanding and future sales invoices to a factoring company as and when they are raised in return for an immediate payment of a pre agreed percentage of the invoice value. The factoring company then collects payment on those invoices from your customers.

Factors don t lend money. In this purchase accounts receivable are discounted in order to allow the buyer to make a profit upon the settlement of the debt. Invoice factoring is a financial transaction in which a business sells its accounts receivables invoices at a discount to an external financing company known as a factor or factoring company. Most companies factor for two years or less.

Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. The factoring company chases invoice payment if necessary. Basically a factoring company offers invoice factoring or accounts receivable factoring services to companies of a variety of sizes. The client gets immediate funds for the receivable.