What Does Pre Qualification For A Mortgage Mean

It s essential to understand what these terms mean they ll guide your home search and help you focus on homes you can afford when the time comes they can also help decide how much to offer and show the seller that you re a serious buyer.

What does pre qualification for a mortgage mean. Fha pre qualification often takes place online through the lender s website. Sometimes lenders use the terms pre qualification and pre approval interchangeably. These are some of the questions we will address in this mortgage tutorial. Letter of moral intent.

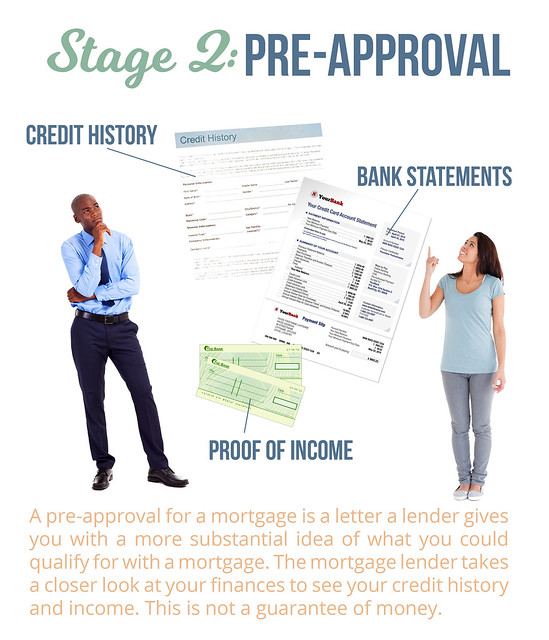

Consumers initiate this process when they submit a prequalification application for a loan or card. Pre qualifications are conditional and involve the lender reviewing a borrower s. What does it mean to be pre qualified for a home loan. Getting pre approved for a mortgage before you make an offer on a house is a smart idea.

Prequalification means the creditor has done at least a basic review of your creditworthiness to determine if you re likely to qualify for a loan or credit card. It doesn t mean much at all frankly. What does prequalified mean. Getting back to your question.

Pre qualification is often seen as the first step in the mortgage process and pre approval is the next step. At the request of borrowers mortgage lenders will pre qualify or pre approve potential buyers prior to applying for a mortgage on a. What does mortgage pre approval mean. Mortgage pre qualification doesn t always require a credit check which means you won t get a hard inquiry on your credit.

Does being pre qualified for an fha loan mean you ll be approved later on. It means a lender has guaranteed to give you a home loan. Mortgage prequalification is not a commitment to lend. As you prepare to apply for a mortgage you ll come across terms like prequalification and preapproval.

What it means to pre qualify for a home loan. But generally here s how the two may differ. A pre qualification is an estimate for credit given by a lender based on information provided by a borrower. When you pre qualify for a home loan the lender will review your income to give you a general idea how much you are able to borrow.

And different lenders might have different definitions for each. While not legally binding the letter indicates the parent company s. A letter to a bank from a parent company whose subsidiary is applying to borrow money from that bank.

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)