What Happens When Interest Rates Rise

Backed by higher us interest rates the dollar tends to depress the values of emerging market currencies at a time when many em economies are already weakening and their currencies have already slumped against the greenback.

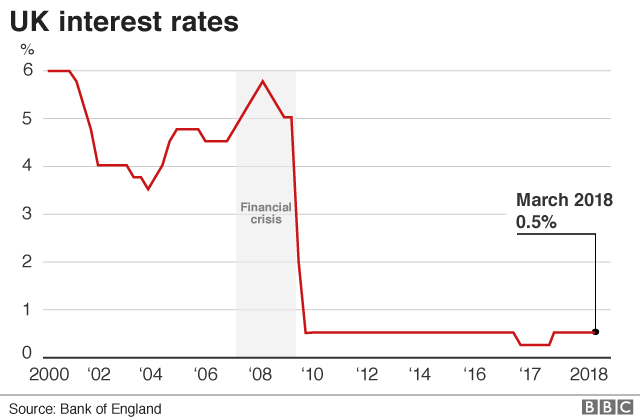

What happens when interest rates rise. What happens when interest rates rise. 4 footnote 4 canada s housing market which has been very hot for a few years now may also be cooling off as higher interest rates make mortgage payments go up. The uk has experienced two major recessions caused by a sharp rise in interest rates. The lower interest rates go the less people worry about rising rates.

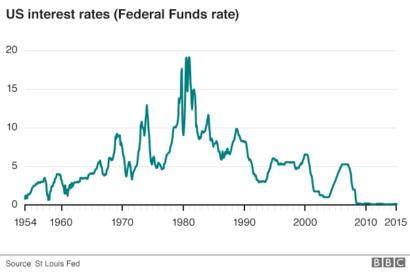

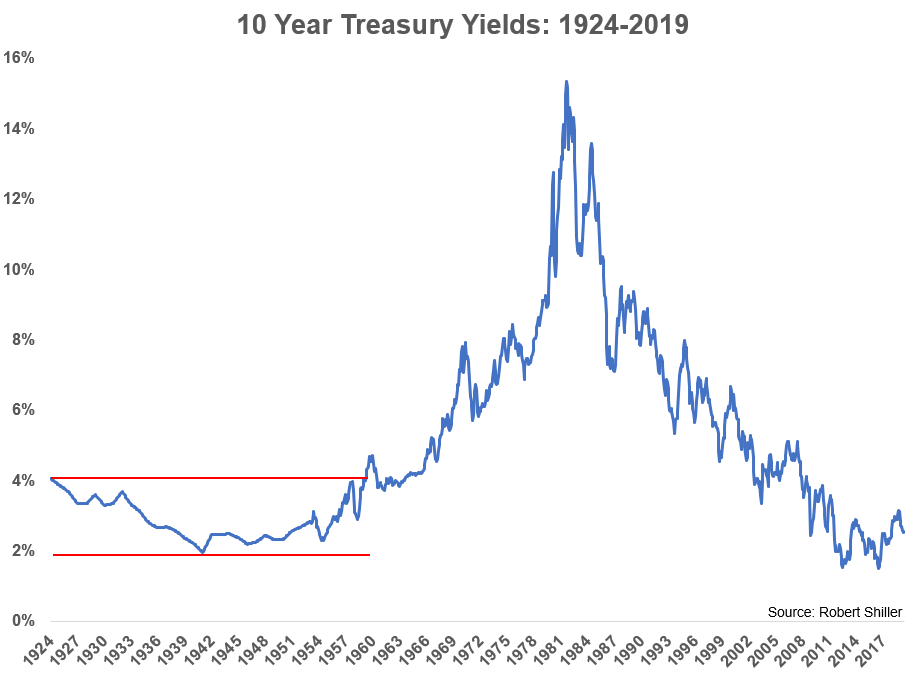

Rates were unfazed by that huge post wwii price spike because the government essentially put a cap on them. Interest rates and recession. The federal reserve s decision now lifts the official cash rate of. Unemployment is rising fast the number of people out of work continues to rise and in the three months to july the number rose by 80 000 meaning a total number of 2 51million unemployed in the uk this puts the uk unemployment rate at 3 9.

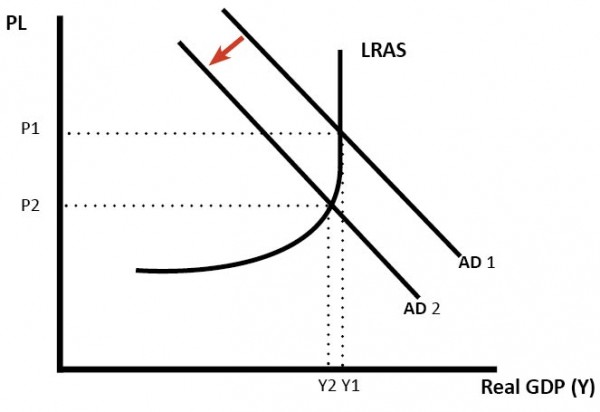

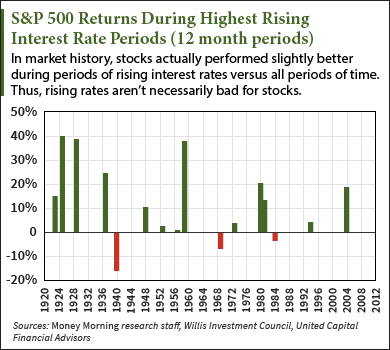

The only direct impact is that borrowing money from the. Weak economic growth reduces the chance of an interest rate rise so until economic growth improves an interest rate rise seems unlikely. Rising interest rates can cause a recession. When rates are at 4 for example it seems entirely possible that they can go to 7.

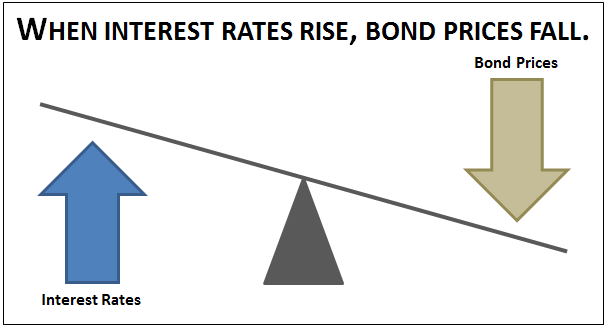

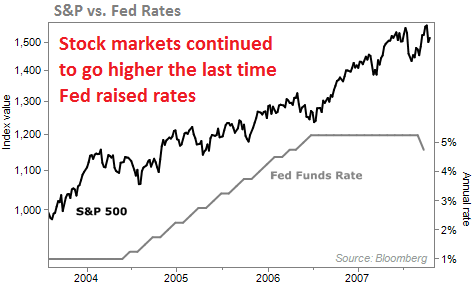

The fed s rate rise could exacerbate the em currency turmoil and even help precipitate a full blown crisis. When interest rates begin to creep up with a future outlook of a continued rise buyers will flock to the market before eventually cooling off. In 1979 80 interest rates were increased to 17 as the new conservative government tried to control inflation they pursued a form of monetarism. When interest rates rise bond prices fall and vice versa.

Rising rates might put pressure on buyers to find a home sooner rather than later to ensure they get a home that fits their needs at a manageable interest rate. Rates didn t start rising until the late 1950s long after this spending had worked its way through the system. Overnight the governing banking system of the united states decided to hike interest rates from 1 50 percent to 1 75 percent. Here is the trailing 12 month inflation rate along with the 10 year treasury yield from 1939 1959.

At first glance the inverse relationship between interest rates and bond prices seems somewhat illogical but upon closer examination. 3 footnote 3 a poll from nanos research suggests that canadians are spending less due to rising rates. What happens if interest rates rise.