Small Business Liability Insurance

Business insurance can fill in the gaps to make sure both your personal assets and your business assets are fully protected from unexpected catastrophes.

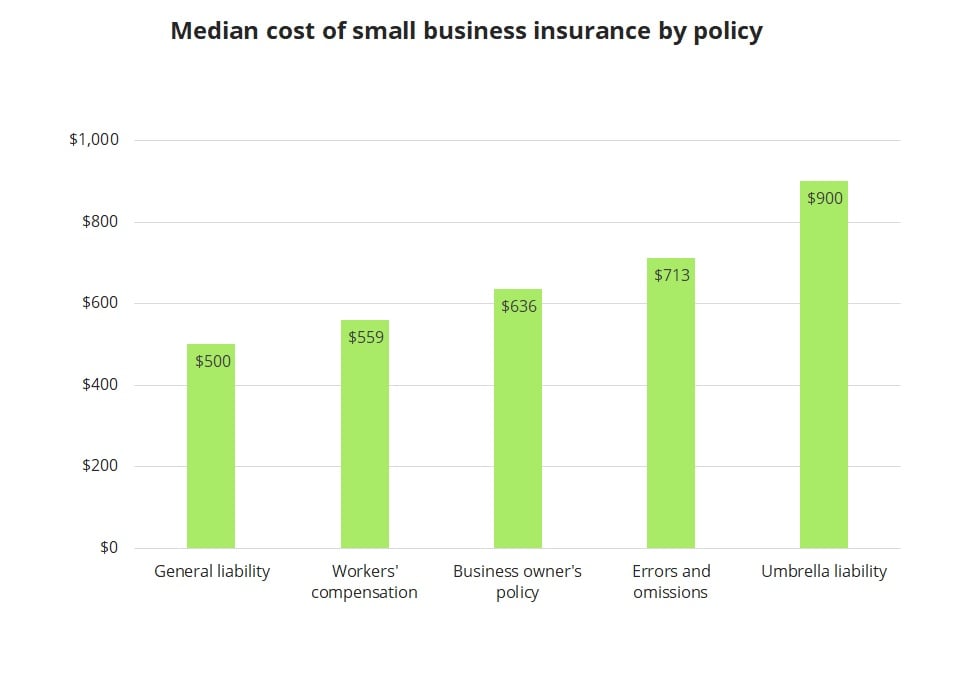

Small business liability insurance. Small business owners also can quote commercial auto workers comp and professional liability with the hanover. Costs vary depending on your risk but most small businesses pay between 400 and 1 300 per year for coverage. General liability gl insurance typically provides insurance coverage to small businesses for among other things third party bodily injuries medical payments and advertising injuries. This product bundles errors and omissions cyber liability and first party data breach coverage into a single convenient package.

Business liability insurance endorsement options enhance a basic policy with additional commercial liability insurance options that meet the specific needs of your business. Hired and non owned auto liability provides auto liability coverage for short term auto rental or for employees using their personal car for business. As a contractor or small business owner you need some form of business liability insurance to safeguard your livelihood. Business or general liability insurance helps protect businesses from claims that happen as a result of normal business operations.

Commercial motor insurance is only available to purchase under the small business advantage pack if you also purchase public and products liability insurance under the same policy. Extend your small business liability insurance coverage umbrella insurance or excess liability insurance is a great way to extend your insurance coverage. The protections you get from choosing a business structure like an llc or a corporation typically only protect your personal property from lawsuits and even that protection is limited. General liability insurance is a fundamental business policy because it covers events that may happen to any business owner like injuries and property damage you cause people who aren t your employees.

We believe that the best coverage are provided by insurance companies that understand the trade your company specializes in. Small business liability insurance also known as commercial general liability insurance can help protect your business from liability claims like these. If you do not require public and products liability insurance allianz offers a standalone commercial motor insurance policy that you can consider instead. Small business liability is a liability insurance agency committed to providing the best coverage to contractors freelancers and small businesses throughout the united states.

It gives your business a safety net if a claim costs more than the limits on your policies. For example let s say a customer slips and falls in your store. A great way to protect against this is to make sure you have liability coverage that matches your level of exposure.