What Information Is Needed For Mortgage Pre Approval

When to get a preapproval mortgage preapproval letters are typically valid for 60 to 90 days.

What information is needed for mortgage pre approval. Pre approval means that a lender has stated in writing that you qualify for a mortgage loan based on your current income and credit history. Documents needed for mortgage pre approval canada. You provide a mortgage lender personal financial information including your income debt and assets. A mortgage pre approval shows home sellers that you have your finances in check that you re serious about buying a house and that you won t be denied a mortgage if they decide to sell you their home.

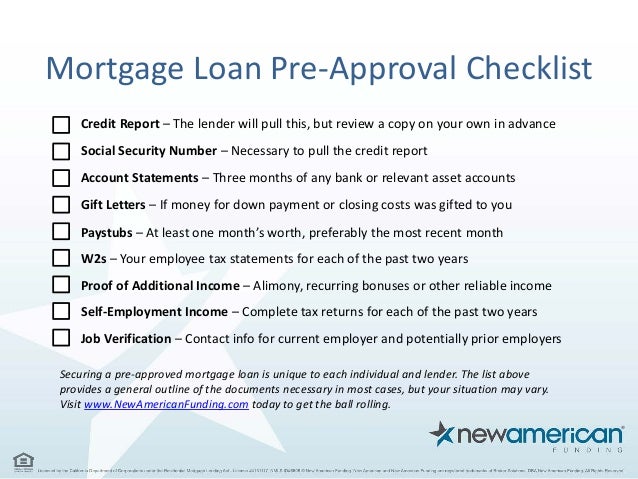

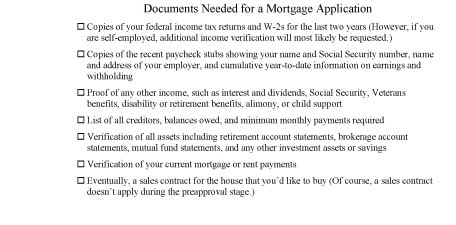

Mortgage pre qualification is generally a quick simple process. Asset statements on bank retirement and brokerage accounts. In most cases you ll conveniently upload them online. There are four 4 main types of documents needed for a mortgage pre approval.

To get pre approved for a mortgage you ll need to meet with a mortgage broker or a lender. You may be asked for a few more depending on your circumstances covered below. Based on your information the lender will give you a tentative assessment as to how much they d be willing to lend you toward a home purchase. A pre approval is when a potential mortgage lender looks at your finances to find out the maximum amount they will lend you and what interest rate they will charge you.

A pre approval usually specifies a term interest rate and mortgage amount. Lenders put an expiration date on these letters because your finances and credit profile could change. As mentioned very few loans these days require you to take mortgage pre approval documents to a physical office space. Know the maximum amount of a mortgage you could qualify for estimate your mortgage payments.

A pre approval is typically valid for a brief period of time and usually has a number of conditions that must be met. Documents needed for a mortgage preapproval letter income and employment documents such as tax returns w 2s and 1099s. Because most of your information is in the lender s system a mortgage pre approval accelerates the loan process once you make an offer. When you are pre approved for a mortgage it means a lender has determined how much you can borrow the loan programs that you may qualify for as well as the interest rate you qualify for.

It establishes your credibility as a homebuyer. With a pre approval you can.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)