What Is A Cash Out Refinance Home Loan

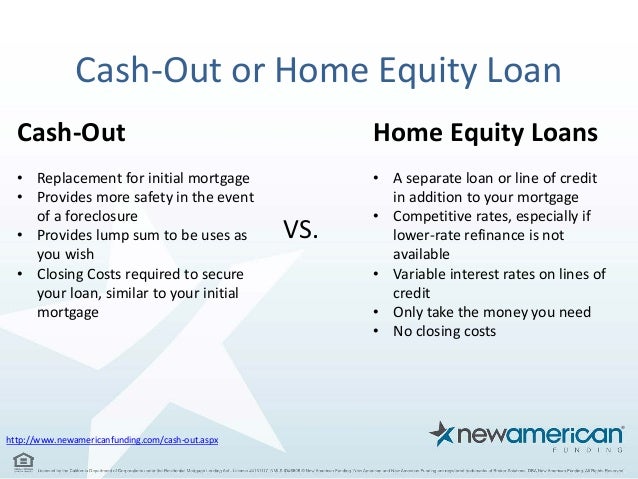

Cash out refinances and home equity loans are both ways you can get cash from your home to do just that.

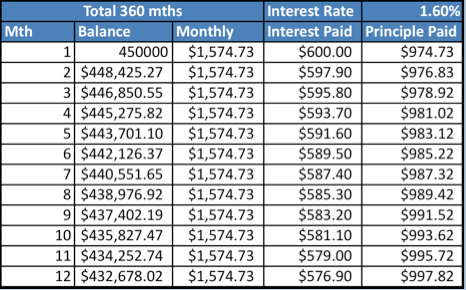

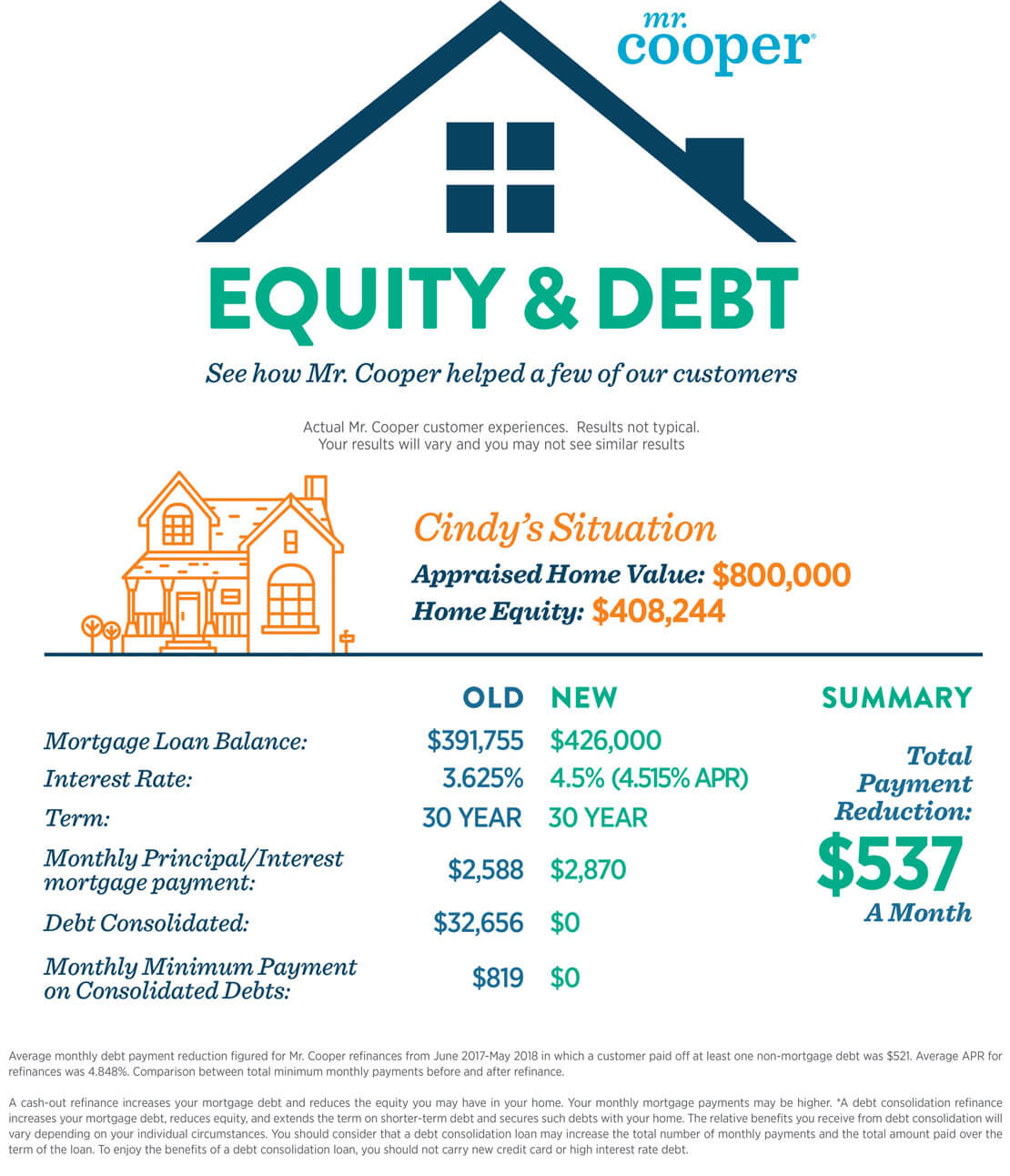

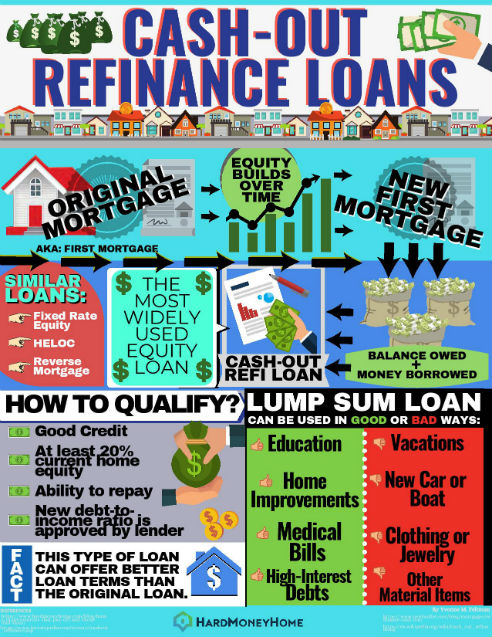

What is a cash out refinance home loan. Because your withdrawing cash from your home s value the new mortgage will be higher. This results in a new mortgage loan which may have different terms than your original loan meaning you may have a different type of loan and or a different interest rate as well as a longer or shorter time period for paying off your loan. Cash out refinance pays off your existing first mortgage. Used properly cash out refi can be a powerful tool for debt consolidation or low interest funds.

In addition cash out refi loans. You can release up to 90 of the property value with evidence of the use of the funds. Cash out refinancing also called a reverse mortgage or second mortgage or cash out refi for short is a way for property owners in singapore to unlock the monetary value of their home. A cash out refinance can come in handy for home improvements paying off debt or other needs.

You can borrow up to 80 of the value of your property if you can provide a stated purpose no evidence required. A cash out refinance is a refinancing of an existing mortgage loan where the new mortgage loan is for a larger amount than the existing mortgage loan and you the borrower get the difference between the two loans in cash. A cash out refi often has a low rate but make sure the rate is lower than your current mortgage rate. Home equity loans and cash out refinancing both involve taking out a new installment loan.

In either case lenders may review your credit reports with a hard inquiry. Sometimes offer a cash out refi option for fha loans that allow you to borrow as much as 85 percent of the value of the home. Also when your loan is added to your credit reports the average age of accounts on your reports will decrease and your loans will have a high balance relative to their original loan amount. A cash out refinance allows you to tap your equity by refinancing your mortgage.

A cash out refinance is a mortgage refinancing option where the new mortgage is for a larger amount than the existing loan to convert home equity into cash.

/GettyImages-814625196-6c04aa0eb7ea45feba8041094f655a5e.jpg)

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)