What Is An Insurance Policy

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/iStock_54597974_MEDIUM-57fe8bda5f9b5805c2664bc2.jpg)

Riders provide insured parties with options such as additional coverage or they may.

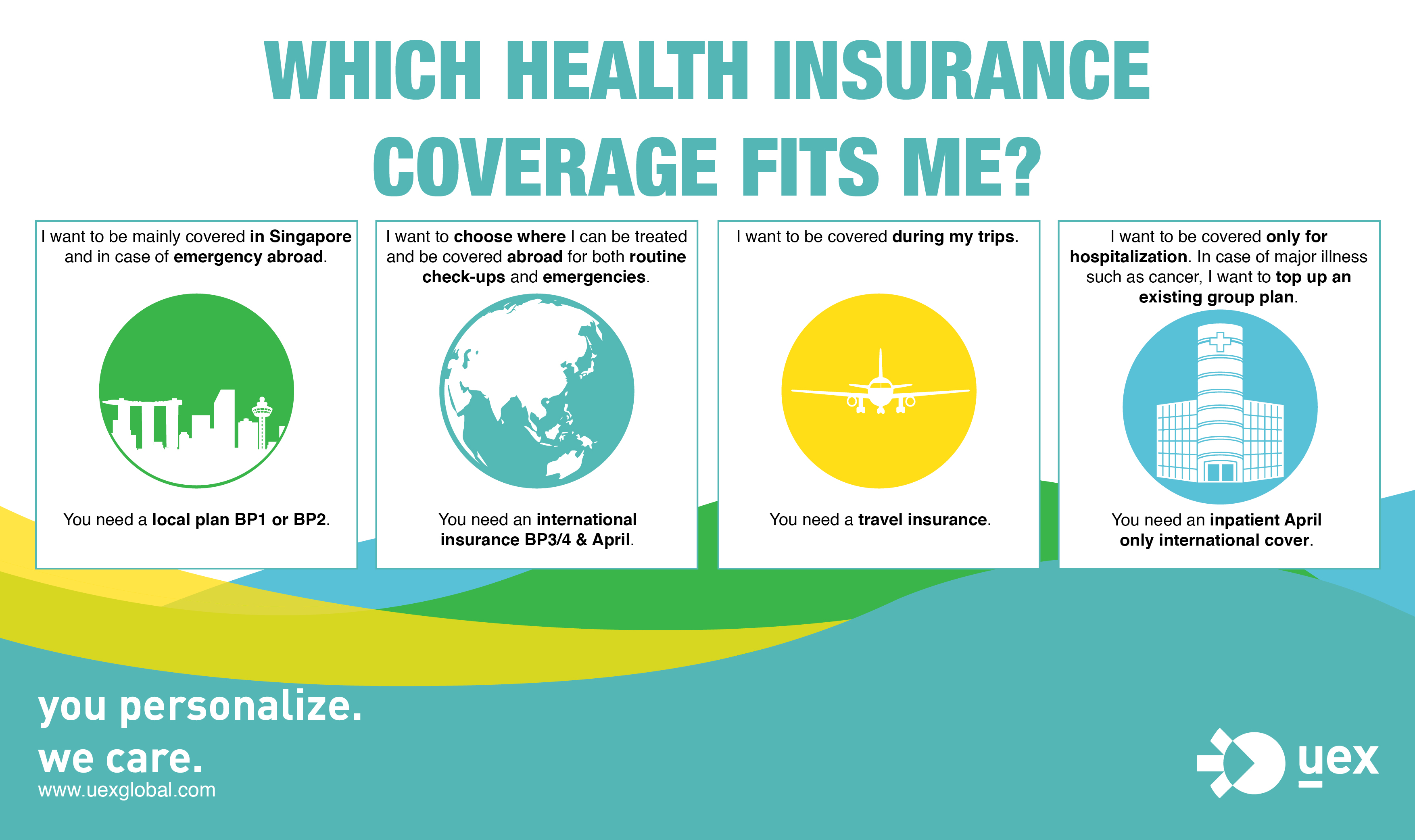

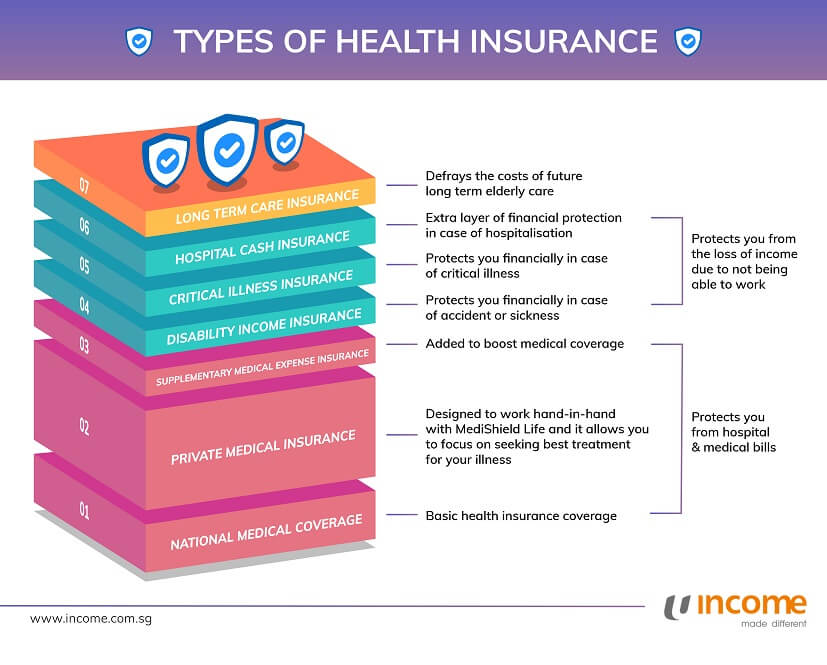

What is an insurance policy. Date issued it is important to know the date the insurance was issued especially when it comes to life insurance as term insurance has an expiration date and permanent insurance will have a surrender charge that may apply if you cancel the policy in the first five to twenty years. Least expensive alternative treatment leat. It 1 puts an indemnity cover into effect 2 serves as a legal evidence of the insurance agreement 3 sets out the exact terms on which the indemnity cover has been provided and 4 states associated information such as the a specific risks and. In insurance the insurance policy is a contract generally a standard form contract between the insurer and the insured known as the policyholder which determines the claims which the insurer is legally required to pay.

Policy number you will always need your policy number when you call and ask questions about an insurance policy. In exchange for an initial payment known as the premium the insurer promises to pay for loss caused by perils covered under the policy language. Employers insurers main contractor developers. Insurance can offer peace of mind if you know you re protected against the unexpected.

Depending on the contract other events such as terminal illness. Employers must get wic insurance for your employees. Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder. A clause in an insurance policy that indicates that the insurer will only cover the least expensive option for treatment repair or remediation.

A rider is an insurance policy provision that adds benefits to or amends the terms of a basic insurance policy. Formal contract document issued by an insurance company to an insured. A contract of insurance describing the term coverage premiums and deductibles. A project wic policy is a wic insurance policy that limits coverage to work injury sustained at a project site or while doing work for a specific project.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

/GettyImages-166044577-57684c005f9b58346ae59b2c.jpg)

/GettyImages-1053743626-3b1327252ce94a998c9508c06fed8eea.jpg)