What Is Child Life Insurance

Child life insurance is an insurance policy that would pay the child s beneficiary usually the child s parents a specific amount of money in the event of the child s death.

What is child life insurance. Even life insurance for teenagers doesn t require their consent. They re made exclusively for higher education costs and have some nifty tax benefits. If a child education plan is what you re concerned about consider a 529 plan. Quite often a child insurance plan is designed to offer safety to the children in the case of financial crunch during taking any vital decisions of life.

As for college savings and future nest eggs these alternatives to children s life insurance give you more bang for your buck. Quite expectedly a child education policy is a must for every parent. Life insurance for children would pay out and could help cover the cost of running your home while you re not working. The money can pay for any funeral or medical expenses or it can be donated to a charity in your child s name.

As long as you re a parent grandparent great grandparent stepparent or legal guardian you can buy coverage on them without their knowledge. If tragedy strikes and your child dies prematurely the death benefit may help your properly grieve by providing needed support and eliminating distractions. Life insurance for children is not for the death benefit. However it is a sad replacement in exchange for your child s life.

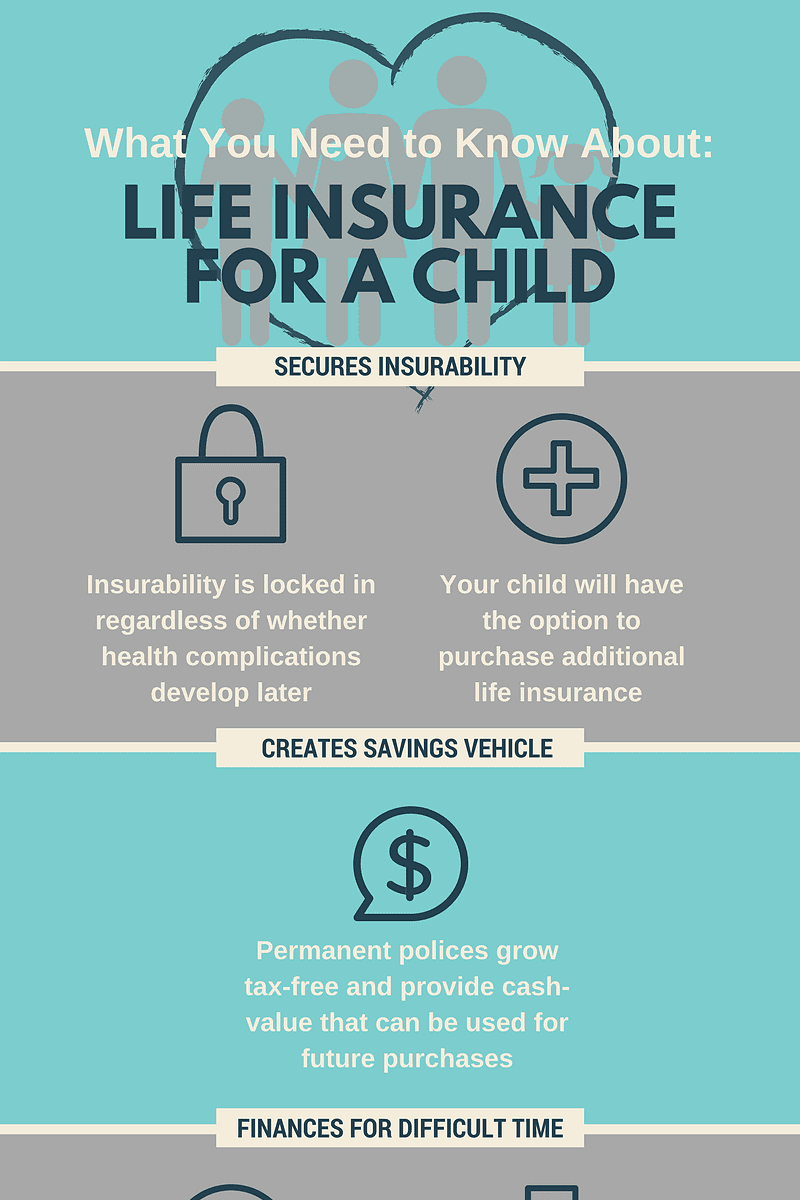

It is usually purchased to protect a family against the sudden and unexpected costs of a child s funeral or burial and to secure inexpensive and guaranteed insurance for the lifetime of the child. It offers guaranteed growth of cash value which some carriers allow to be withdrawn collapsing the. What life insurance for children is not. Most life insurance policies for children are sold as whole life policies.

It s a bit like a health insurance for children. Because child life insurance is whole life insurance and has a cash value that can be borrowed from whole life insurance for adults can cost six to 10 times more per month than an adult term life. Alternatives to child life insurance. No life insurance company requires children to consent to a life insurance policy on them.

A child insurance plan comes loaded with an array of useful features to ensure a rewarding return and protection. As the name suggests a whole life policy protects your child from the day you sign onto a policy until the day they die. The truth is most people in their 20s and 30s have no problem getting a good term life insurance policy so there s really no need to buy life insurance for your kids.