What Is Error And Omission Insurance

We will help you find the cheapest rates from the best insurance companies.

What is error and omission insurance. How much does errors and omissions insurance cost. Errors and omissions insurance policies vary from company to company and are written to reflect inherent risks and common exposures particular to different types of businesses. E o insurance generally protects service businesses from errors and or omissions made by a business owner employee or contractor working on behalf of the company. Errors and omissions insurance e o is a type of professional liability insurance that protects companies and their workers or individuals against claims.

Protect your business from lawsuit costs and apply online for a free e o insurance cost quote from the hartford to help protect your small business today. The errors and omissions insurance cost can vary for different types of businesses. Errors and omissions insurance also known as e o insurance and professional liability insurance helps protect you from lawsuits claiming you made a mistake in your professional services this insurance can help cover your court costs or settlements which can be very costly for your business to pay on its own. Errors and omissions insurance definition.

It used to be that. Our commercial insurance brokers will help you get the right coverage. We help you protect your business from all types of mistakes errors omissions and more. Such is the case with professional liability insurance also known as errors and omissions e o insurance.

Liability protection for advice and services. Once upon a time there was a distinction between errors and omissions insurance and professional liability insurance. Errors and omissions insurance. Insurance lingo isn t always easy to understand especially when a policy goes by multiple names.

Save on errors and omissions insurance in ontario. Even if claims are found to be unwarranted legal fees and other related expenses can quickly eat up a company s cash reserves in no time causing a financial hardship. Errors and omissions insurance e o. Protect your business from costly mistakes.

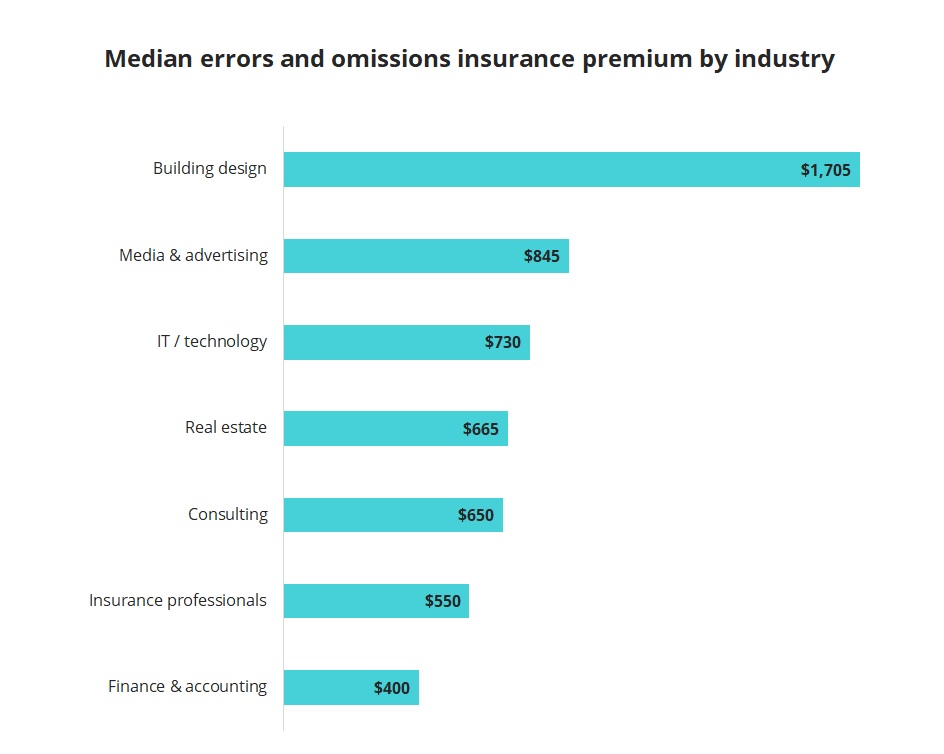

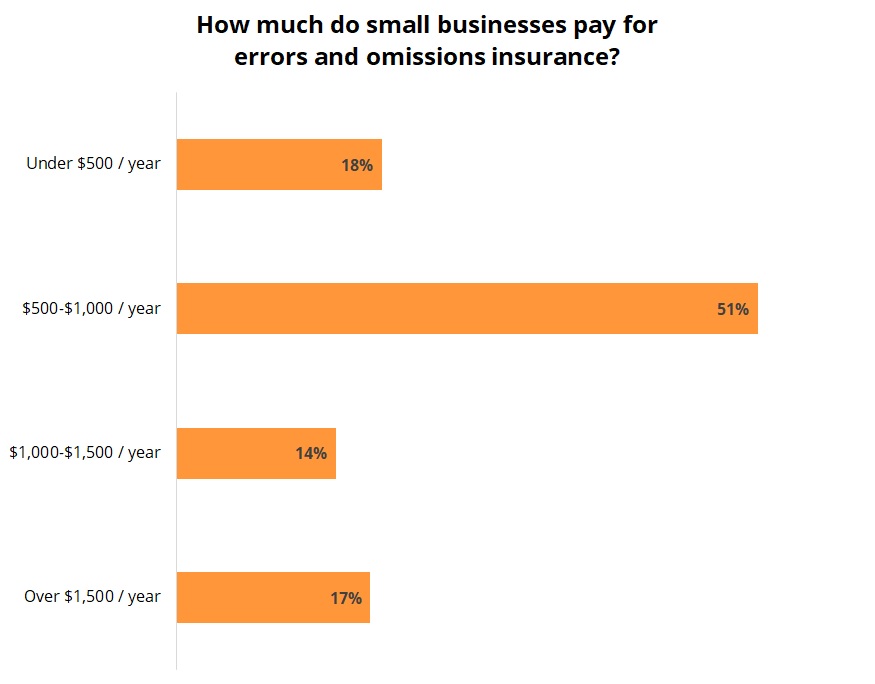

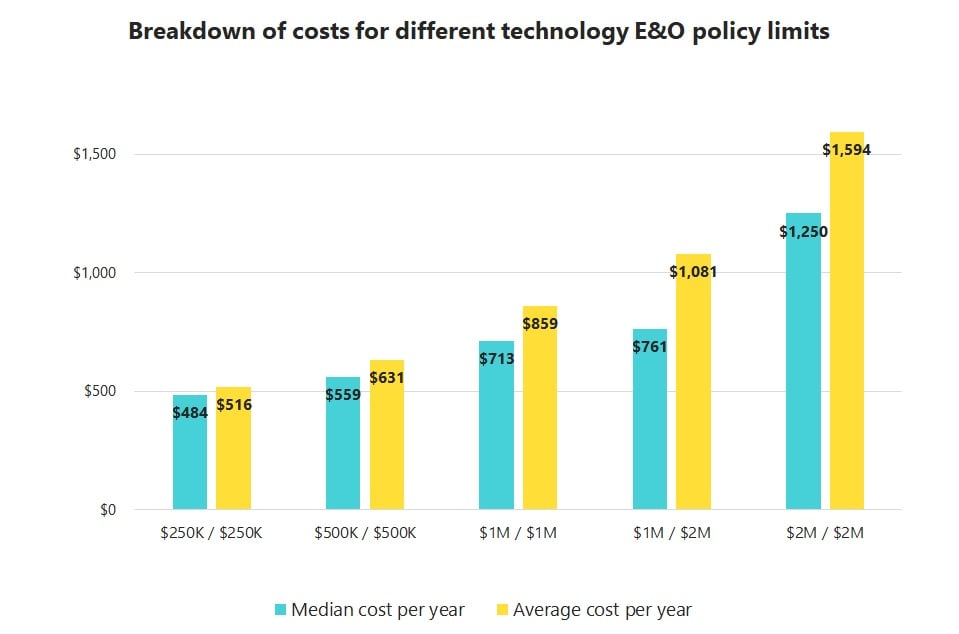

Professional liability insurance pli also called professional indemnity insurance pii but more commonly known as errors omissions e o in the us is a form of liability insurance which helps protect professional advice and service providing individuals and companies from bearing the full cost of defending against a negligence claim made by a client and damages awarded in such a civil. Regardless of policy limits the median monthly cost of errors and omissions insurance is 59 713 annually.

/GettyImages-1134608647-d06eff10dc3746119683550068860dae.jpg)