What Is Liability In Car Insurance

The reason why it s so important to carry it is because it helps protect you in the event you caused an accident.

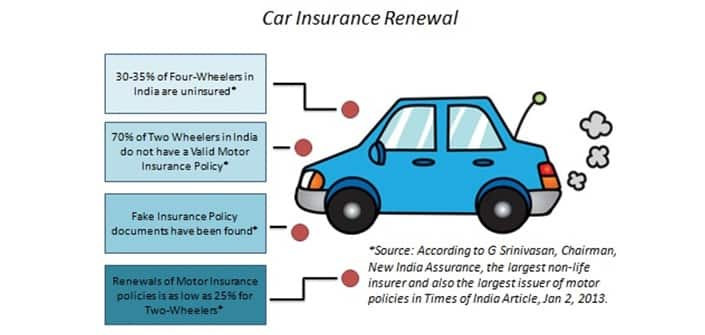

What is liability in car insurance. Damages to structures like homes and storefronts. Nearly everyone in the united states needs liability insurance. It helps protect you against the claims that are made by other drivers for injuries or damages that they claim they sustained up to the limits of liability in your policy. Liability just means responsibility so liability insurance protects you.

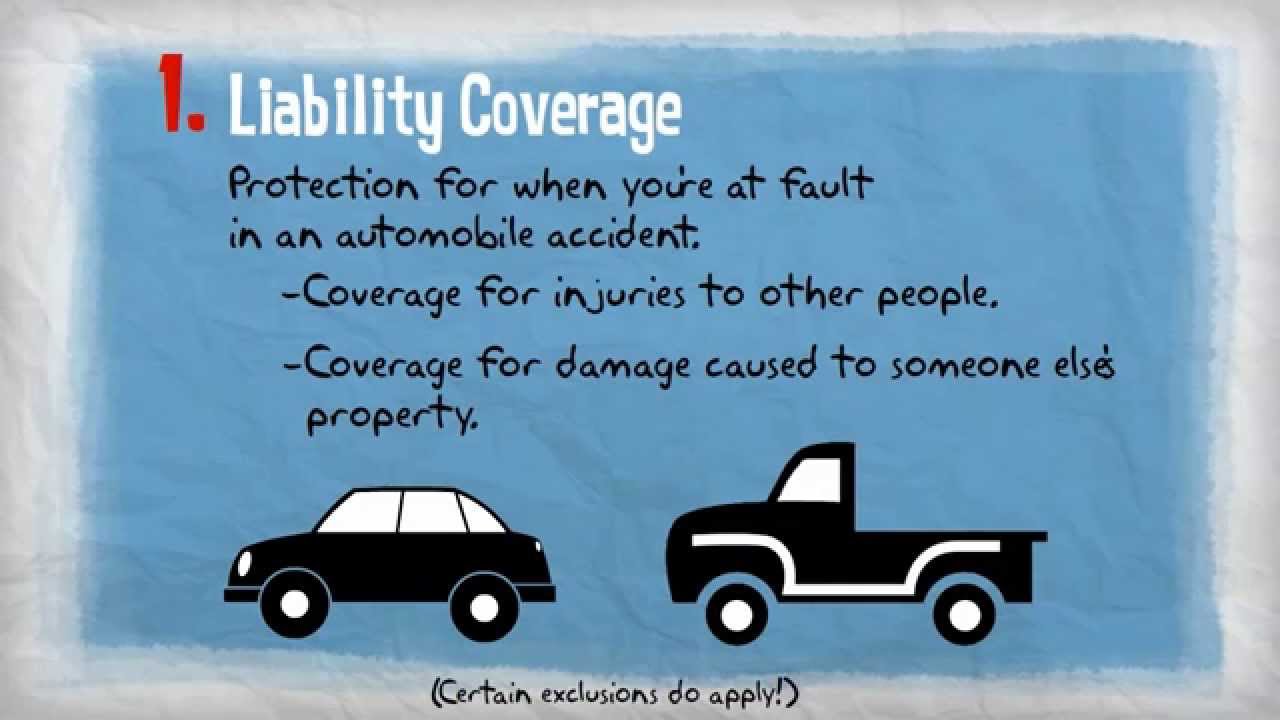

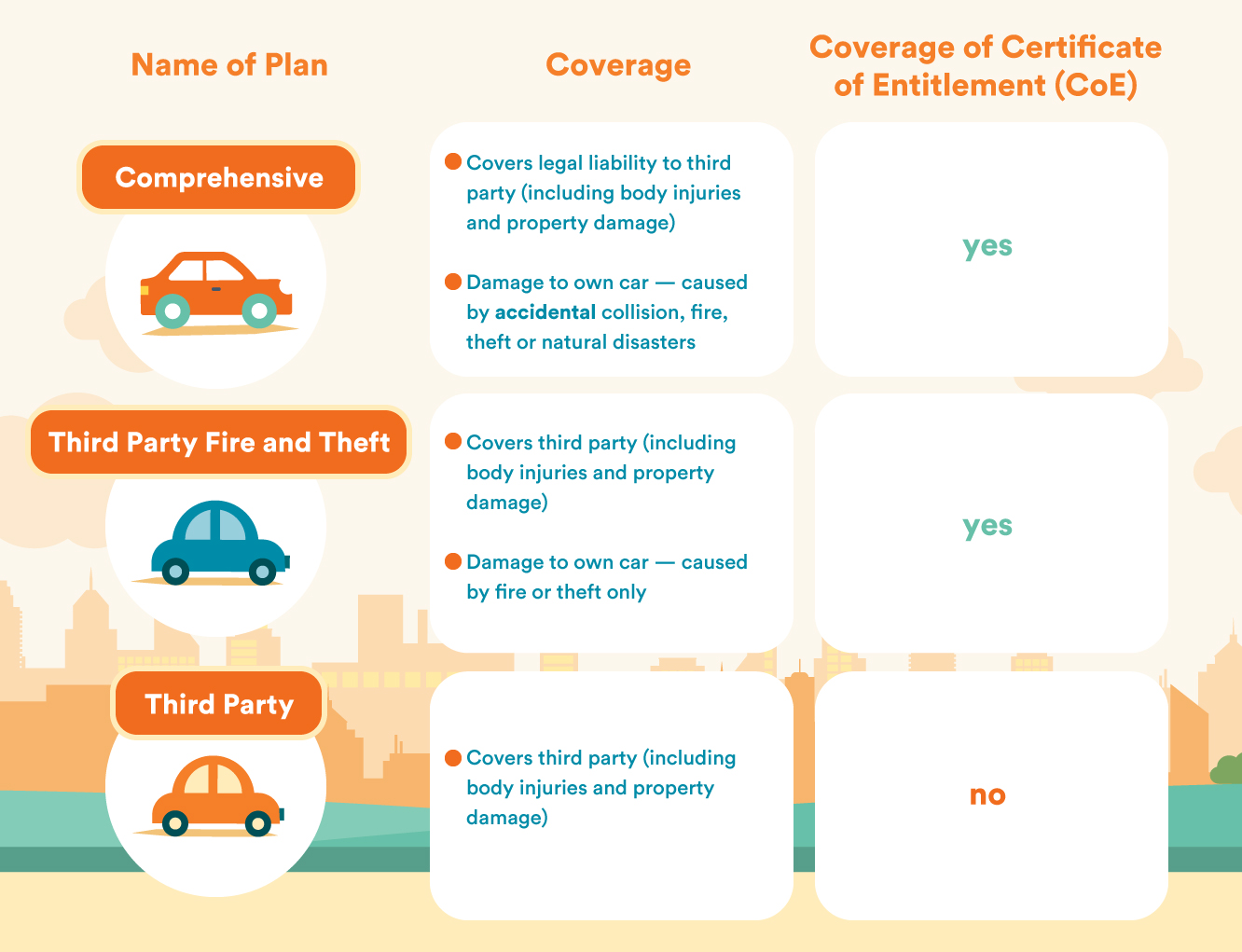

Property damage liability can help protect you if you re found at fault for damaging someone s property in an accident. Repair or replacement of stationary objects. Liability car insurance is the part of a car insurance policy that provides financial protection for a driver who harms someone else or their property while operating a vehicle. Liability insurance also called third party insurance is a part of the general insurance system of risk financing to protect the purchaser the insured from the risks of liabilities imposed by lawsuits and similar claims and protects the insured if the purchaser is sued for claims that come within the coverage of the insurance policy.

Liability car insurance is a safeguard against a driver s personal assets in the event that they cause an accident that results in bodily harm or property damage to another. Both components bodily injury and property damage are third party benefits one that the driver cannot use personally. Minimum and maximum limits on auto liability insurance. A limit is the maximum dollar amount your insurance may pay per event.

Liability auto insurance is an essential part of every car insurance policy. Liability car insurance or liability coverage as it s also known helps pay for the costs of the other driver s property and medical injuries if you are at fault in an accident. Liability car insurance is the coverage that pays to repair the damage you cause to other people and their things. In some states it s possible for drivers to carry no car insurance beyond basic liability coverage to cover the costs of damage or injury to the other car and its passengers.

For example if you have a property damage limit of 10 000 and cause 15 000 in damages in a covered accident you are responsible for the excess 5 000. Vehicle repair or replacement. Auto liability insurance is a type of car insurance coverage that s required by law in most states. Learn about property damage liability insurance.

Your insurer will pay for the property damage and injuries up to the covered limit.