What Is Personal Injury Protection Coverage

What does personal injury coverage protect.

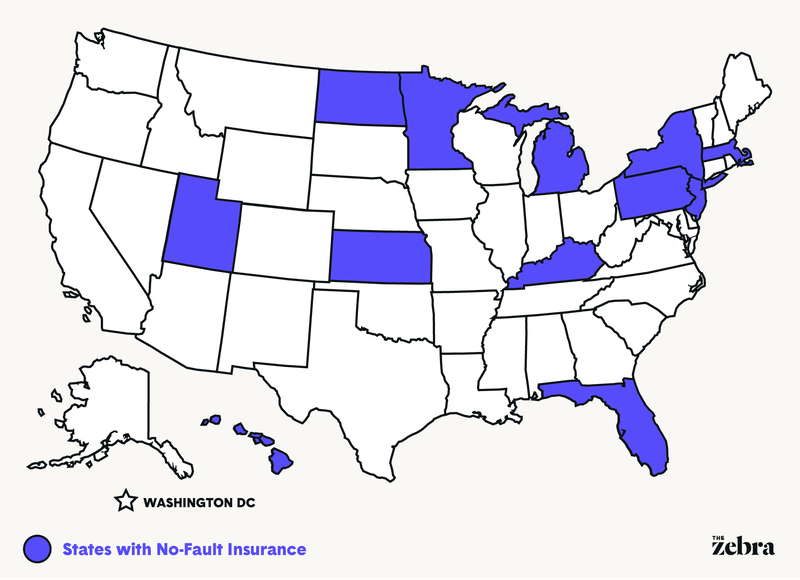

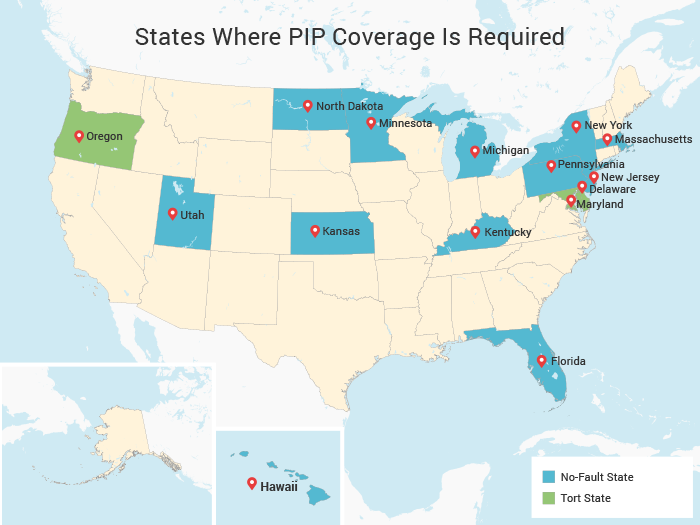

What is personal injury protection coverage. Furthermore it can cover you if you are a passenger in a vehicle other than your own. However 16 states require you to carry a minimum amount of pip coverage. First and foremost your insurance coverage will compensate the injured person for all of the losses associated with his or her injuries up to your policy limits. Pip is a required type of coverage for drivers in 16 states.

Personal injury protection is specifically designed for auto accident injuries. Pip is optional in most states. Pip stands for personal insurance protection personal injury protection and it is an extension of car insurance that covers medical expenses and in many cases lost wages. When you purchase personal injury coverage on your homeowner s insurance policy you can protect yourself against multiple forms of damages that can come from a personal injury case.

Depending on the state where you live pip may be an available insurance coverage or a required policy add on. Most health insurance companies will not cover medical expenses associated with a car accident. Pip will cover you and anyone in your car at the time of the incident. This coverage could help even if you re not in your car.

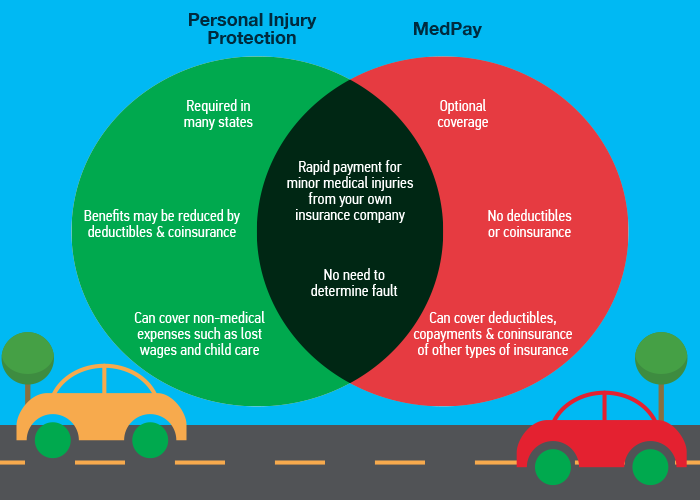

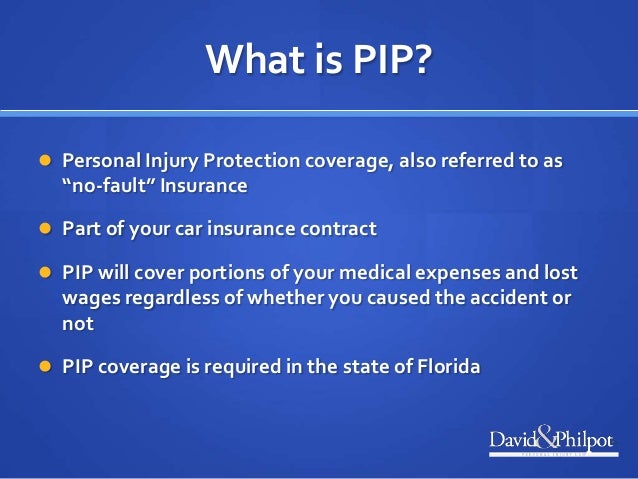

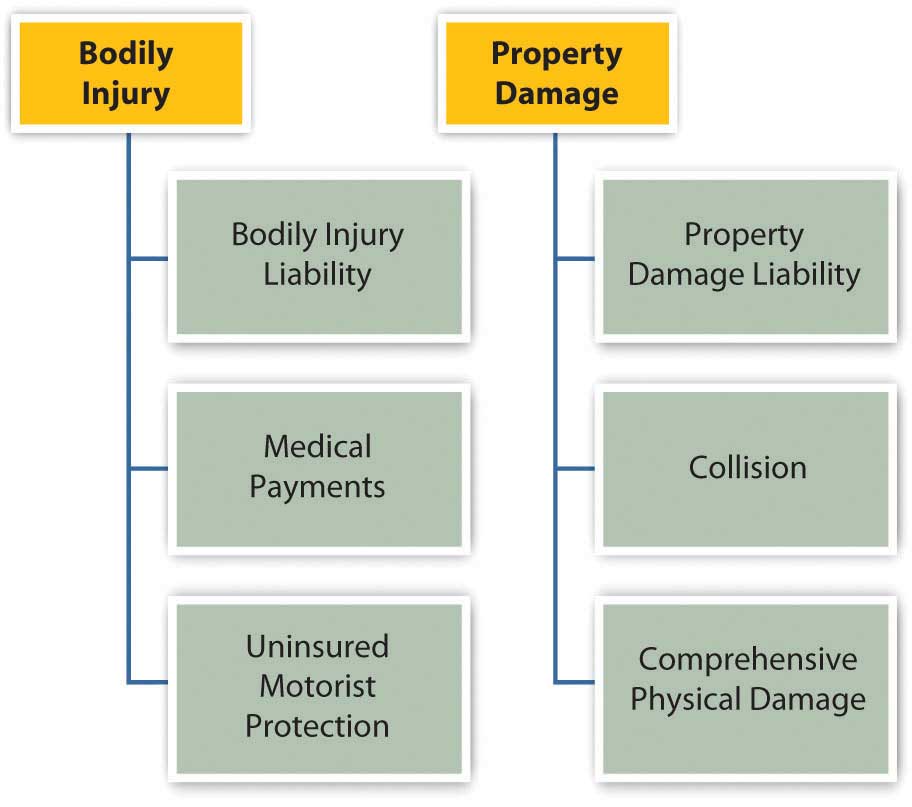

A personal injury certainly sounds like an injury that happens to you or even to another person in fact this type of insurance can often be confused with bodily injury or personal liability insurance. Personal injury protection also known as pip coverage or no fault insurance covers medical expenses regardless of who s at fault. Pip insurance personal injury protection is the auto insurance coverage that pays for accident related injury expenses after a car accident. Personal injury protection or pip is an insurance policy that covers medical bills for you and your passengers in the event of a vehicle accident.

Personal injury protection pip is an extension of car insurance available in some u s. Call toll free 800 777 0028 search for. It can often include lost wages too. States that covers medical expenses and in some cases lost wages and other damages.

It can also cover things like lost wages childcare funeral expenses and long term rehabilitation. It is often called no fault coverage because its inherent comprehensiveness pays out claims agnostic of who is at fault in the accident. Personal injury protection pip insurance covers your medical bills and lost wages when you or your passengers are injured in a car accident.