What Is Points In A Mortgage Loan

Mortgage points come in two varieties.

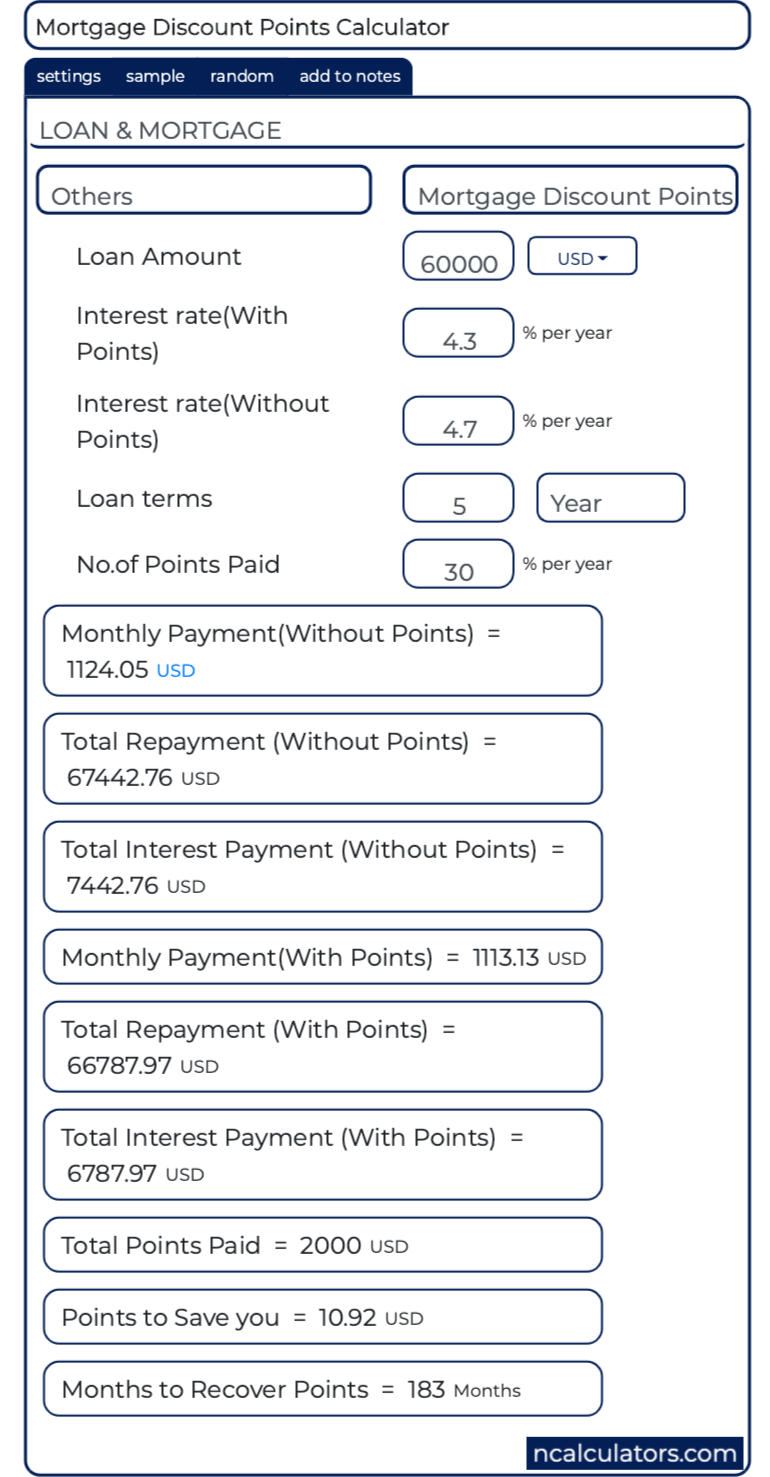

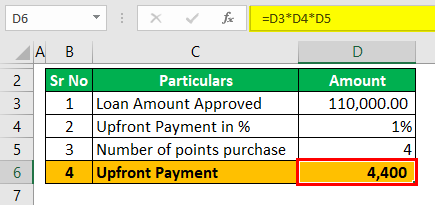

What is points in a mortgage loan. One point costs 1 percent of your mortgage amount or 1 000 for every 100 000. Each point equals 1 of your loan amount. Mortgage lenders and brokers quote points as a percentage of the mortgage amount and require you to pay points on a mortgage at the time that you close on your loan. There are two types of points.

Learn more about what mortgage points are and determine whether buying points is a good option for you. For example 1 point on a 100 000 loan would cost 1 000. Points are one type of fee paid at closing by you to your mortgage lender. Origination points and discount points.

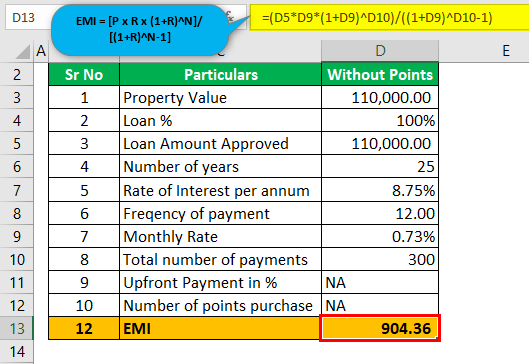

You can choose to pay a percentage of the interest up front to lower your interest rate and monthly payment. This is also called buying down the rate which can lower your monthly mortgage payments. One point is equal to 1 percent of the amount that you re borrowing. When you pay for points on a mortgage you are actually paying interest right now for the loan.

Mortgage points also known as discount points are a form of prepaid interest. On a 300 000 home loan for. In return the homeowner can. In both cases each point is typically equal to 1 of the total amount mortgaged.

A mortgage point is equal to 1 percent of your total loan amount. Origination points and discount points.