What Kind Of Taxes Are There

Surtax is an additional tax levied on some other tax.

What kind of taxes are there. If paying taxes is a consistent source of stress for you you may want to change your approach. Ecotax a tax of any kind intended to improve the environment. They describe ways that a tax applies to the person or group being taxed. An ira can be set up at nearly any major financial institution banks insurance companies mutual fund companies brokerages and more though the type of ira you get may dictate where it is set.

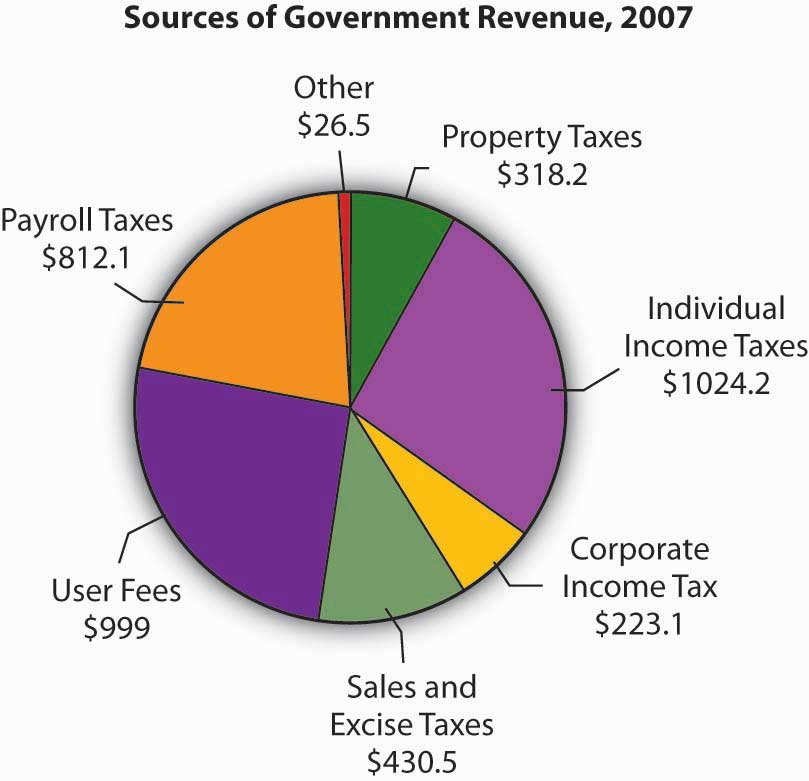

Taxes on income taxes on property and taxes on goods and services. There are many types of taxes in the u s and because taxes are here to stay it s nice to understand exactly the different types work. There are many different kinds of taxes most of which fall into a few basic categories. Franchise tax is a tax levied on the net worth of a corporation.

Scutage was a tax levied in england. Three main types of taxes. While there are many individual taxes following are the three main types of taxation. This is a type of taxation where as you have more income that is subject to tax you pay higher average rates.

Property taxes in texas property taxes are based on the assessed current market value of real estate and income producing tangible personal property. There s no estate tax in texas either although estates valued at more than 11 58 million can be taxed at the federal level as of 2020. Income tax a percentage of individual earnings filed to the federal government corporate tax a percentage of corporate profits taken as tax by. Federal state and local.

Taxes for businesses come in several varieties. You pay some of them directly like the cringed income tax corporate tax and wealth tax etc while you pay some of the taxes indirectly like sales tax service tax and value added tax etc. The implementation of both the taxes differs. There are several very common types of taxes.

The federal government 43 states and many local municipalities levy income taxes on personal and business revenue and interest income. A person could pay scutage instead of serving in the military. There are also different types of taxes depending on various business activities like selling taxable products or services using equipment owning business property being self employed versus having employees and of course making a profit. There are two types of taxes namely direct taxes and indirect taxes.

A lump sum tax is therefore a particular kind of regressive tax since a fixed amount of money is going to be a higher fraction of income for lower income entities and vice versa.