Receivable Factoring Companies

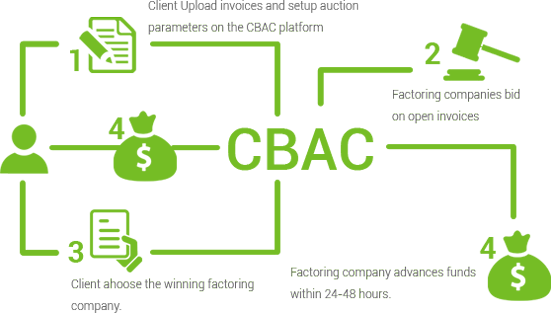

Instead of waiting for weeks or months for customers to pay their invoices accounts receivable financing lets business owners get an advance on those invoices and use the cash for pressing business needs instead of waiting for weeks or months for customers to pay their invoices.

Receivable factoring companies. If you re just starting up or growing quickly and could benefit from some extra capital factoring companies provide a simple and straightforward financing solution. We offer month to month financing programs ranging from 50 000 to 7 million a month. Recourse factoring is a common form of accounts receivable financing in which you must buy back receivables that the factoring company cannot collect. And with so many different companies to choose from finding the best option for your organization can feel a bit overwhelming.

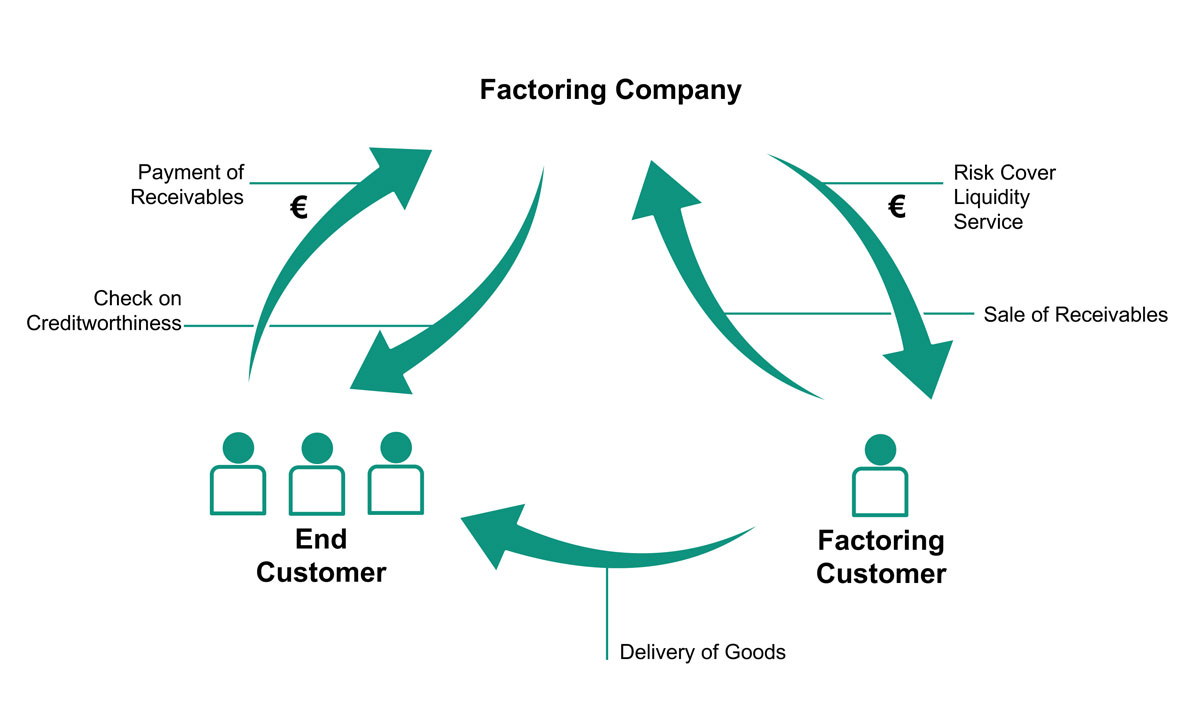

With the cash accounts receivable financing provides companies can meet payroll manage expenses and grow the business. The 7 best invoice factoring companies of 2020. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

Non recourse factoring means the factoring company assumes the majority of the credit risk for collecting on an invoice. Whereas with non recourse factoring the factoring company assumes the credit risk if your customer is unable to pay the invoice due to an insolvency or other financial issues. Accounts receivable factoring is a solution that allows business owners to quickly turn invoices into working capital. Factoring accounts receivable allows you to obtain cash advances from the factoring company which frees up cash from working capital.

Discover accounts receivable factoring companies. What is accounts receivable factoring. Invoice factoring can be a confusing topic to most small business owners. Accounts receivable factoring works for any business.

There are usually stipulations tied to non recourse factoring which typically has a highter factoring rate so make sure you understand exactly what the non recourse terms are before choosing this option. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. Factoring companies will usually focus substantially on the business of accounts receivable financing but factoring in general may be a product of any financier. The factoring company is then responsible for collecting the accounts receivable in return for which it charges you a commission normally based on the value of the invoices factored.

Some factoring companies offer both recourse and non recourse options. Work with the best factoring companies to improve your cash flow today.