What Does General Liability Insurance Cover For Contractors

General liability insurance generally does not protect independent contractors or subcontractors.

What does general liability insurance cover for contractors. Contractors insurance however is a term commonly used to refer to what is arguably the most critical coverage on the list general liability gl insurance. This means your insurance likely does not cover independent contractor mistakes or protect your customers from them. Does general liability insurance cover subcontractors. Most business opt to have general liability insurance.

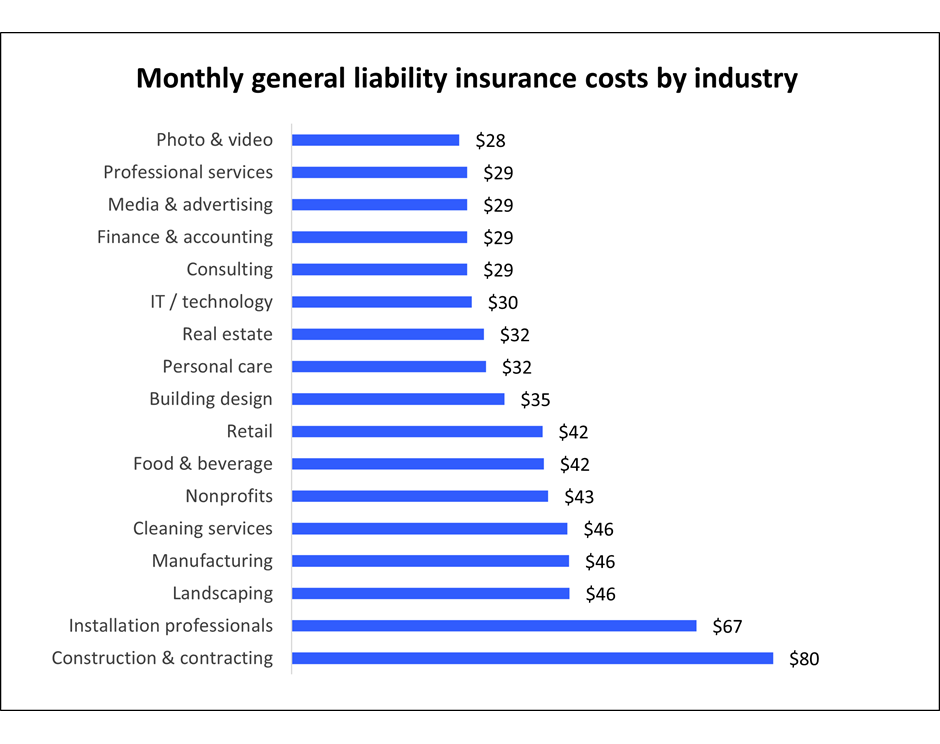

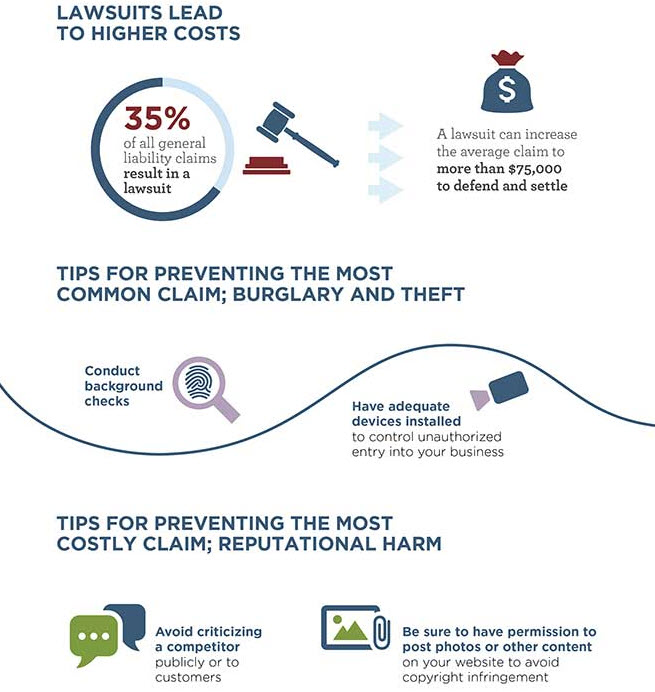

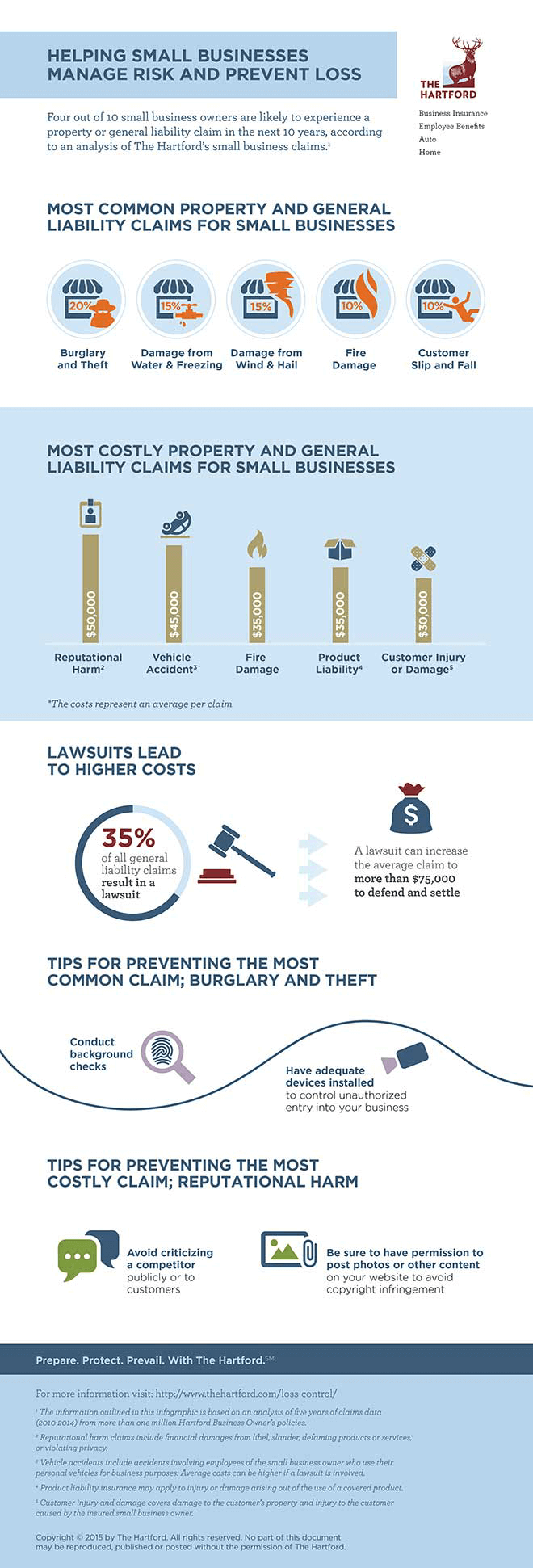

General liability helps protect your business from claims of bodily injury property damage advertising injury and more. Basically gl insurance offers coverage for all sorts of third party claims. If a visitor is injured at your jobsite or property damage occurs during a renovation for instance general liability insurance can cover medical bills or the cost of repairs. Find out how general liability insurance can help protect your small business from a broad range of accidents.

A standard general liability gl commercial policy will protect you against claims made for property damage bodily injury products completed operations advertising and personal injury. It also likely does not cover accidents or other damage they cause. If work done by a subcontractor on your company s behalf beware claims for bodily injury and property damage done by the sub may not be covered. Does general liability insurance cover subcontractors.

Get a quote today. What does general liability insurance cover.