Refi Rules

Data most often compare the default and loss behaviors of conventional loans and rate refinancing during this time.

Refi rules. Counteract same length loans after five years of homeownership refinancing one 30 year mortgage into another 30 year mortgage isn t always the right move even if you save money on a rate. Only refinance if you ll save x dollars each month. In terms of refinancing reverse mortgages the motivation for doing so can come from a number of places that tend to be a bit more specialized. If your home is valued at 200 000 and you owe 150 000 you have 50 000 in equity.

The faster accrual of home equity and things like a shorter loan term. If you refinance to a thirty year loan you will lower your monthly payment but greatly increase the length of your loan and pay more interest in the long run. Refinancing conventional forward mortgages is a very common practice that some borrowers utilize in order to try and create more favorable terms as they work to pay off their home loan. You have to prove your creditworthiness to initially qualify for a mortgage loan approval.

To make a refi worthwhile you must keep your house long enough for the savings in monthly payments to cover the closing costs closing costs average 2 of the loan amount according to. The longer the term of the loan the more you will pay in interest on the loan. If possible refinance to a ten or fifteen year mortgage. A va streamline refinance requires you to have a va loan already and the popular fha streamline has a.

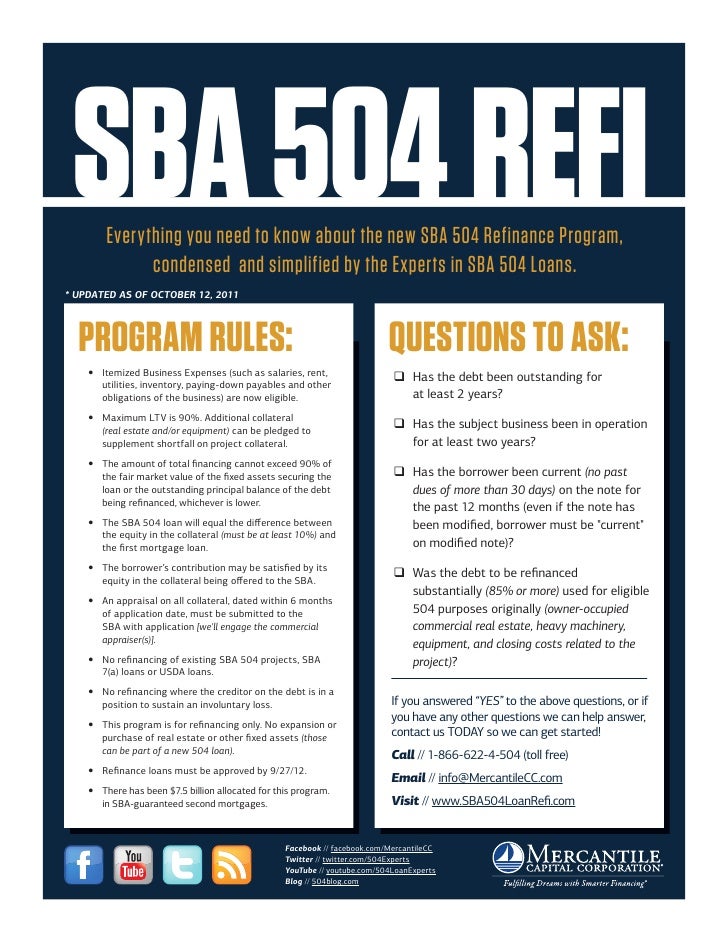

Many streamline refinance types require you to have a certain type of loan to use the program. With a cash out refinance you can access your equity in cash and use it on whatever you like from home renovations to paying off debt. And you have to do the same for mortgage refinancing. Cash out refinance equity rules requirements more than a decade removed from the financial and housing crisis of 2008 there remains a good deal of debate on its cause.

With a cash out refinance the homeowner can withdraw equity from their home. Can make a refinance totally worth your while regardless of payment. The tcja rules regarding refinancing don t apply unless the initial mortgage went into effect on or before that date and the new loan can t exceed the amount of the original mortgage. The 2018 2025 deduction rules apply to the refinancing of an initial mortgage that was completed after december 15 2017.

This blanket refinance rule fails to consider the interest savings. Typically mortgage refinancing options are reserved for qualified borrowers.

/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)