Renewable Term Life Insurance May Be Described As

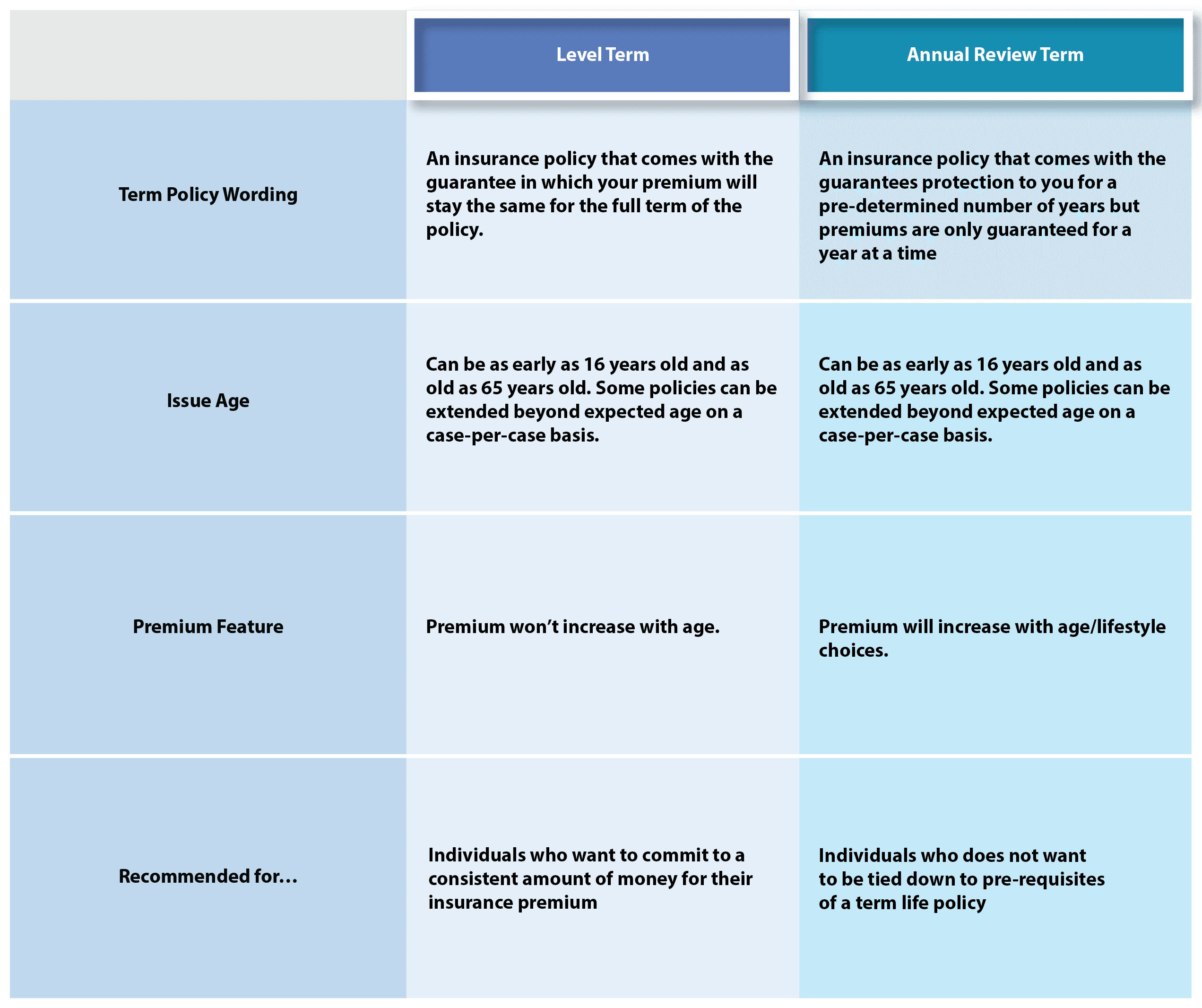

As the name implies annual renewable term life insurance is a term policythat runs in increments of one year.

Renewable term life insurance may be described as. An annual renewable term policy is a one year policy that the insurer guarantees to renew each year for a set number of years. A long term care rider in a life insurance policy may trigger a benefit in the event of which of the following. Annual renewable term insurance art is a form of term life insurance which offers a guarantee of future insurability for a set period of years. What is annual renewable term life insurance.

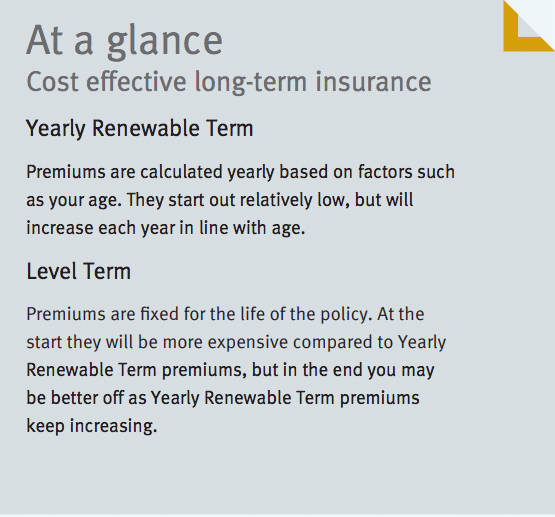

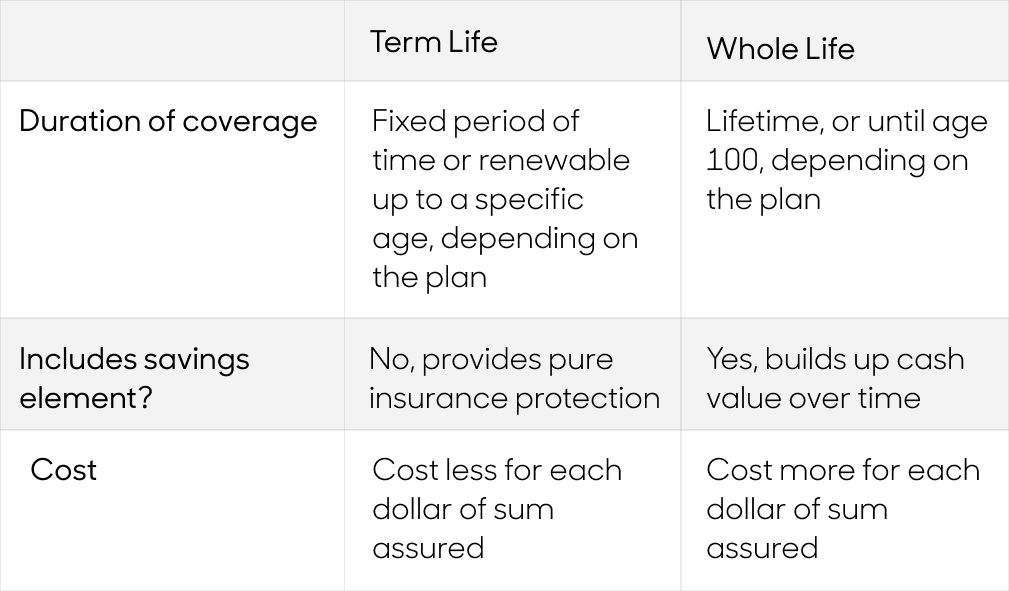

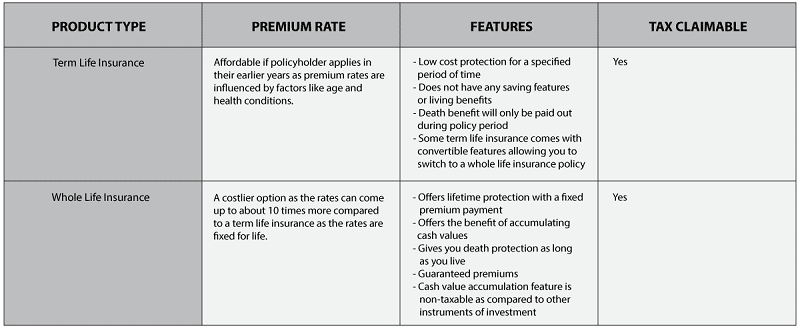

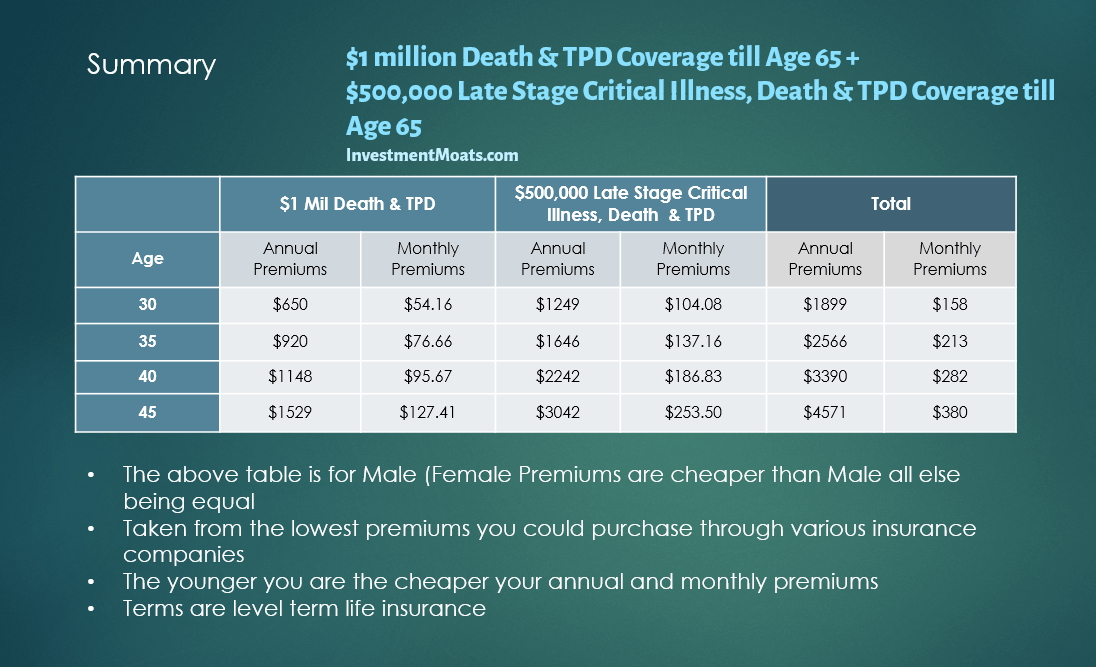

As a person ages risk increases which drives the cost of life insurance higher. After that the policy generally automatically renews but at a slightly higher premium each year since you will be one year older. That means it becomes more expensive to purchase the policy. In nearly all situations the premium will increase.

During the stated period the policyholder will be. A renewable term is a clause in a term insurance policy that allows the beneficiary to extend the coverage term for a set period of time without having to re qualify for new coverage. That is the initial premium will apply for exactly one year. Double the face amount should the insured be confined to a nursing home.

Twitter what makes this type of life insurance unique is that every aspect of the policy can change from one year to the next. A renewable term life insurance policy allows you to simply extend your current coverage at the end of term at an annually increasing rate. Annual renewable life insurance works just like term life policies that have 10 20 and 30 year terms.

/HavenLife-4ae44d7846af46f4b41c8e6331cbaa9e.png)