Residual Interest Credit Card

We hope you found this helpful.

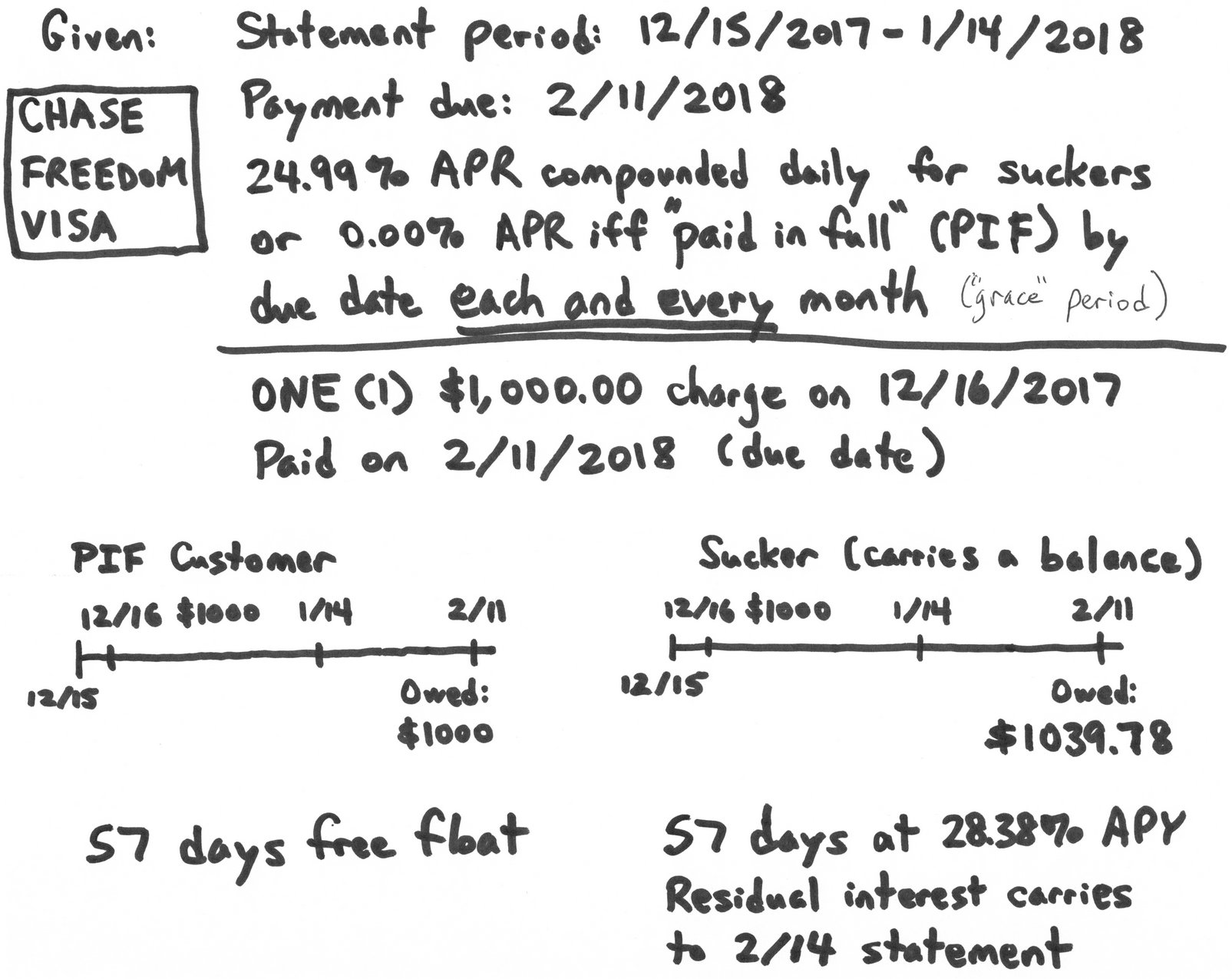

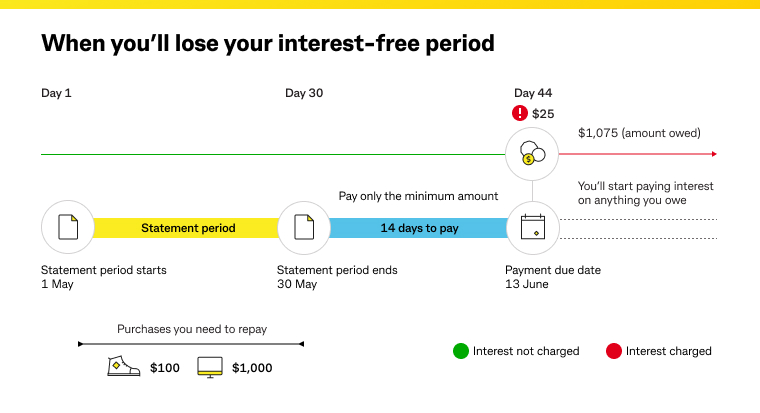

Residual interest credit card. Residual interest is the amount of interest that accrues between when a credit card bill is sent and when payment is received. Even if you think you ve paid your balance off in full and you don t make any other purchases interest might show up on your next statement. Not sure what that means. Residual interest accumulates between the date of your credit card statement and the date you make your payment.

Residual interest is any interest that accrues on an interest bearing account like a credit card loan line of credit or mortgage. Residual interest is the interest charged when you don t pay a credit card in full by the time the grace period is up. However if you re close to paying off your card after previously carrying a balance the best way to avoid residual interest is to call your. Residual interest only applies if you carry a balance on a credit card from month to month.

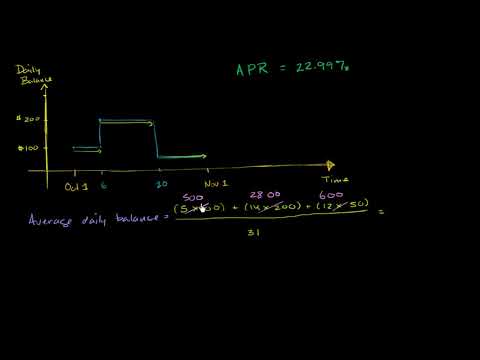

For example if your statement is issued on 10th of each month and you pay your balance in full on the 15th you will still be charged interest for the 5 days prior to making your payment which will show on the next months statement. Since it accrues after your billing period closes you won t see it on your current statement. It is normally charged on balances that are incurred between. I m glad you called them and they took it off your bill this time.

The best way to avoid residual interest is to pay off your credit card balance every month. It builds up daily between the time your new statement is issued and the day your payment posts. Our content is not intended to provide legal investment or financial advice or to indicate that a particular capital one product or service is available or right for you. That s to cover any previous outstanding balance from the period between the credit card bill being sent and when the payment is received.

How to pay off residual interest. Credit card issuers must get a lot of calls about residual interest charges. If you re new to the whole credit card thing check out this guide for how to use a credit card without going into debt. Credit card company contracts are not all exactly the same.

Residual interest aka trailing interest occurs when you carry a credit card balance from one month to the next. Residual interest also known as trailing interest is the interest charged on a credit card balance that accumulates between the billing statement date and the date you pay the bill. Let s start with some definitions.

/how-and-when-is-credit-card-interest-charged-960803_final-a8011c78570a428aaf59f9e39011575b.png)

/business-woman-thinking-account-businesswoman-accounting-office-working-976512548-cb6ae59ee6f543fcac7e4dbe0a3d71f0.jpg)