Reverse Mortgage Foreclosure After Death

Heirs and others are not entitled to continue to live in the home after the borrowers are gone under the terms of the loan.

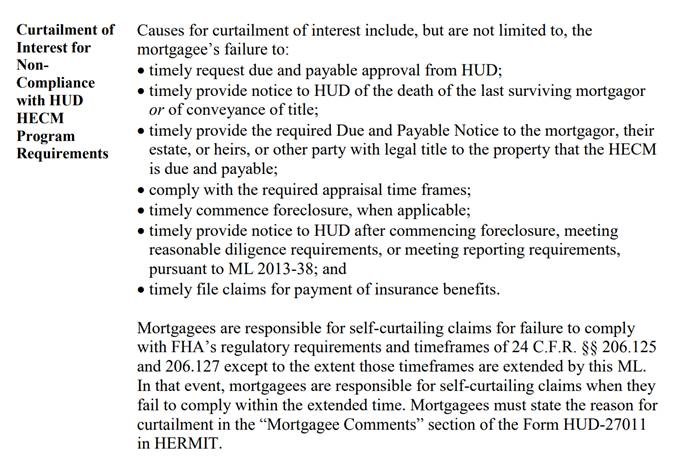

Reverse mortgage foreclosure after death. Pay the loan balance in full this could be done thru refinancing existing assets or selling the property and keeping any remaining home equity walk away from the home which would result in a foreclosure action by the servicer. A reverse mortgage is a federally insured loan that provides homeowners with monthly cash payments based on the amount of equity they ve built up in the property. Reverse mortgage after death of the borrower. While no payments are made by a homeowner with a reverse mortgage the mortgage is due upon death.

The options for the reverse mortgage after death include. Lenders can seek foreclosure on the homes. The mortgage repayment is 235 thousand can we sell the property for 325 000. How heirs should handle a reverse mortgage after death.

The reverse mortgage is a popular method used. Provide lender a deed in lieu of foreclosure. Essentially repaying the owed loan and keeping the rest in the state of florida. Borrowers with jumbo reverse mortgages need to check with their lender to see if they are liable to repay any difference after the home is sold.

Reverse mortgages become due and payable upon the death of the last remaining borrower or when the last borrower permanently leaves the home. The heirs need to be able to do so quickly so that excessive interest and fees do not add up and they do not risk foreclosure. Spouses and tenants whose names are not on the reverse mortgage loan should be notified about their limited rights to remain in the home after the borrower dies or permanently moves out of the home. In the event that one spouse dies the surviving spouse becomes the sole owner of the home with the reverse mortgage.

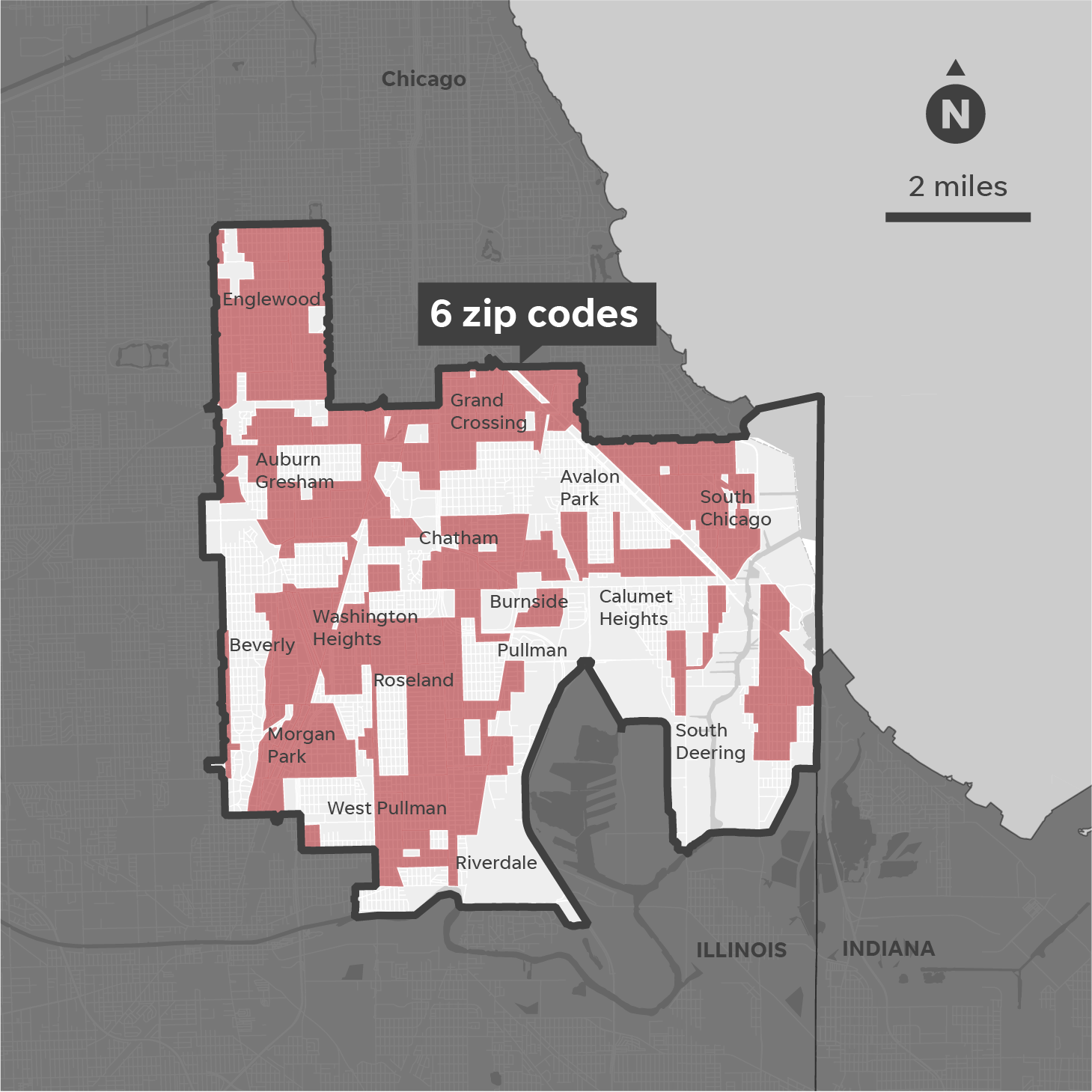

The couple jointly owns the home and completed the reverse mortgage application process together. Many reverse mortgage borrowers die with reverse mortgage balances that are higher than the value of the home. As reverse mortgages end heirs are left with heartache after a death heirs who want to pay off reverse mortgages to hold onto a family home can be stymied by a seemingly endless cycle of problems. Reverse mortgages are not multi generational loans.

:max_bytes(150000):strip_icc()/shutterstock_292433354.reverse.mortgage.cropped-5bfc31484cedfd0026c22351.jpg)