Young Drivers Insurance Rates

New and teenage drivers.

Young drivers insurance rates. The young adult driver profiles we used in our auto insurance rate study will find representative rates at american family that are a mixed bag. Best car insurance for teens and young drivers in 2020. Car insurance for young drivers can be expensive costing thousands per year. New drivers not only pay more for car insurance than other drivers but a lot more.

We know that insurance can be costly for young drivers so we take the time to compare offers from canada s leading insurance companies. For great value car insurance and access to our exclusive discounted drivefirst program then call today on 01 882 0834 or get an online quote in minutes. But by age 30 this drops down to 552. Looking for cheap car insurance for young drivers.

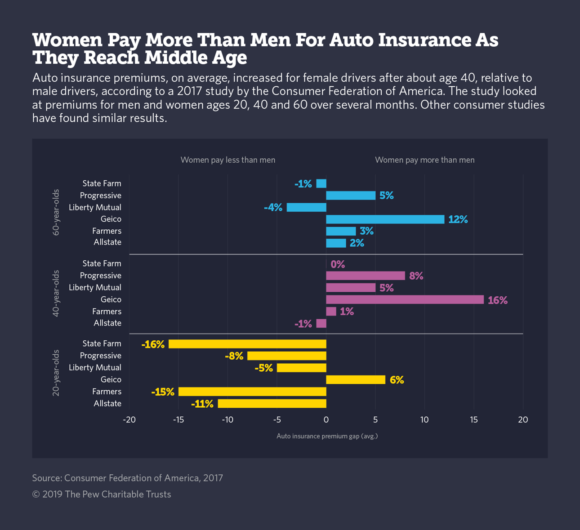

Request a quote today or call us at 1 866 467 4376. Affordable insurance policies are available for good students and. The most common ways to reduce your car insurance rates include good student and driver education discounts. The study premium for the young adult female profile is about 60 below the average for the nine companies in our study.

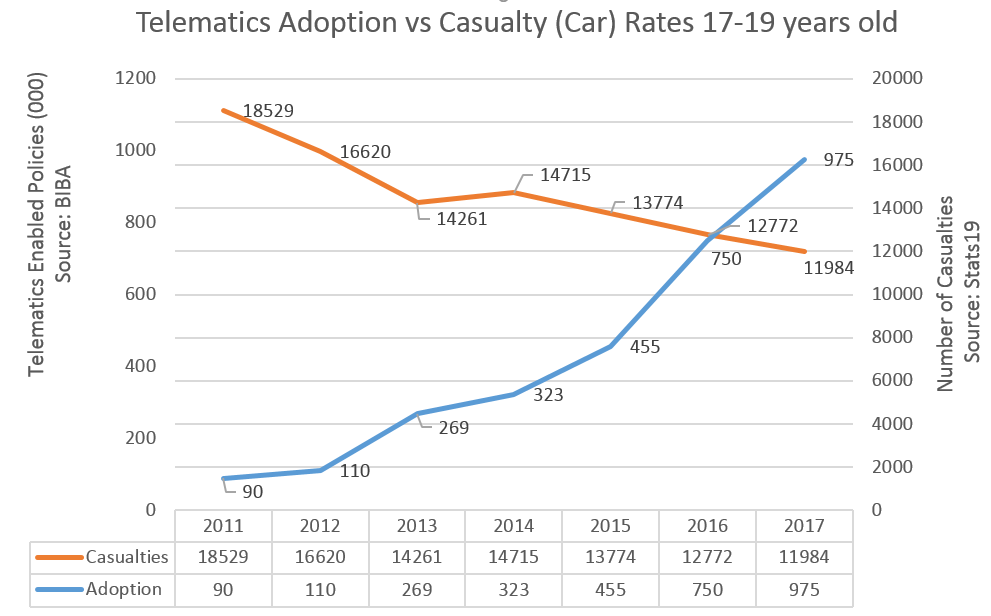

Whether or not you re a young driver insurance premiums the payments made to insurance companies depend on three things. Car insurance rates are set by actuaries whose job is to calculate risk. We have a number of young driver insurance options to suit drivers aged 17 24 with full or provisional licences. The risk is highest with 16 year olds who have a crash rate twice as high as 18 and 19 year olds.

That risk is reflected in the average car insurance rates for teenagers. Adding a young driver to a family car insurance policy is cheaper than purchasing insurance on your own. Find the best car insurance rates and deals for new and young drivers. Young drivers are far more likely to get into car accidents than older drivers.

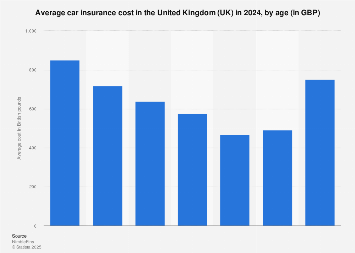

The younger the driver the more expensive the car insurance. Then try first ireland first. If you re in the market for car insurance for new drivers say teens or car insurance for college students that isn t good news as rates are super high for inexperienced motorists. You can make big savings by showing an insurer you re not the typical high risk young driver.

You will likely pay 20 more than the increase to your family s premiums would be by having your own separate plan. If you look at the chart below a 20 year old male driver will pay 1 129 per year for standard minimum liability coverage.