Safest Way To Get Credit Report

Get your credit report for free.

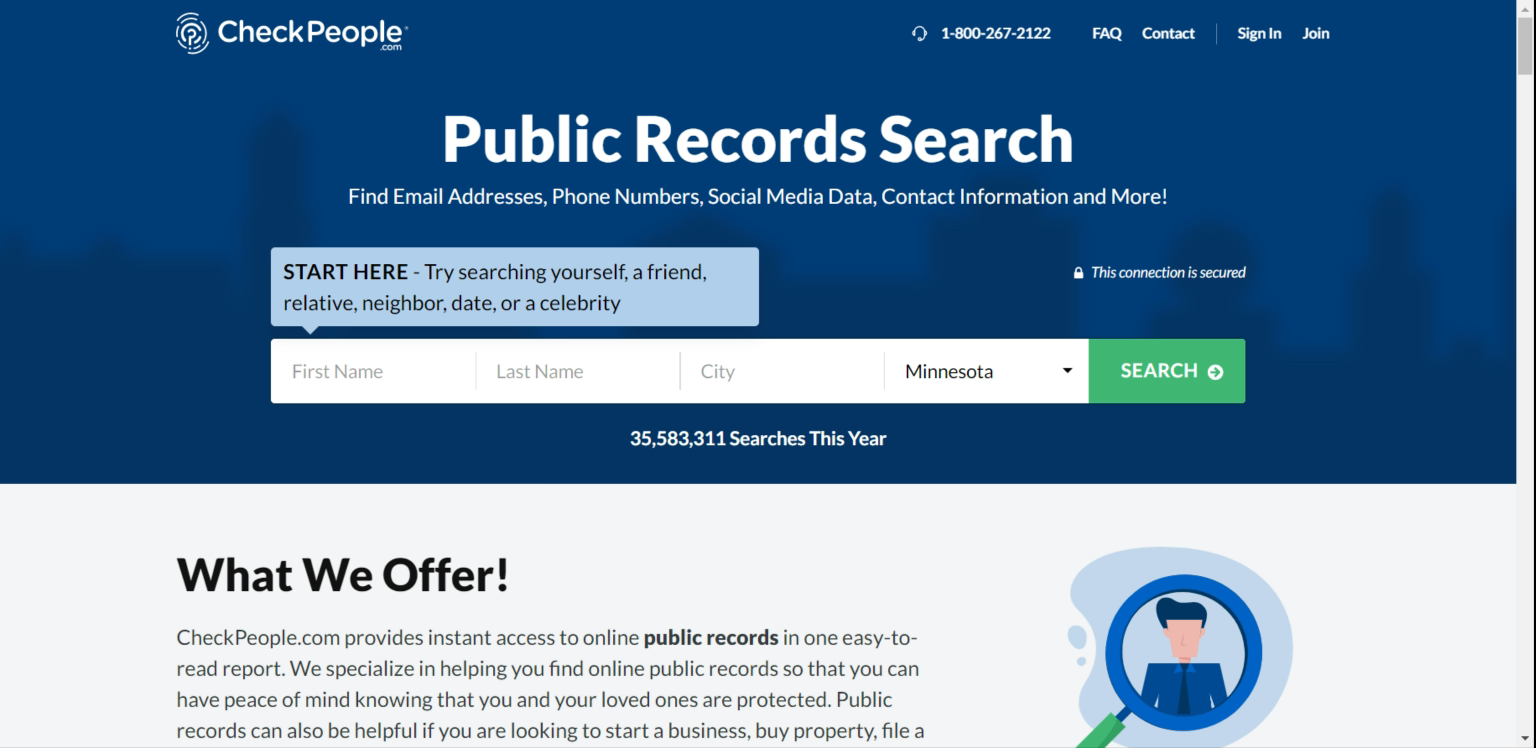

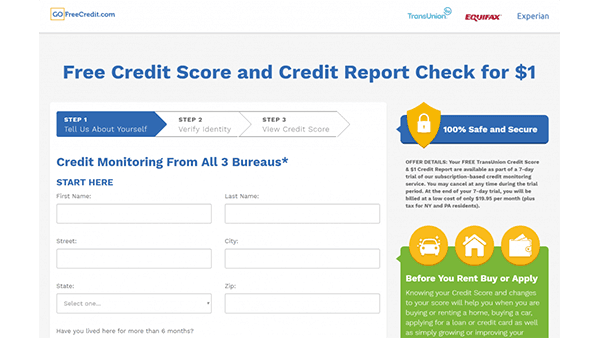

Safest way to get credit report. Checking your credit report regularly can help you spot errors and detect potentially fraudulent activity. Equifax experian and. According to a march 2009 msnbc news report you may get your credit reports for free but if you forget to cancel your trial period it will cost you. It s worth getting a copy of your credit report once a year.

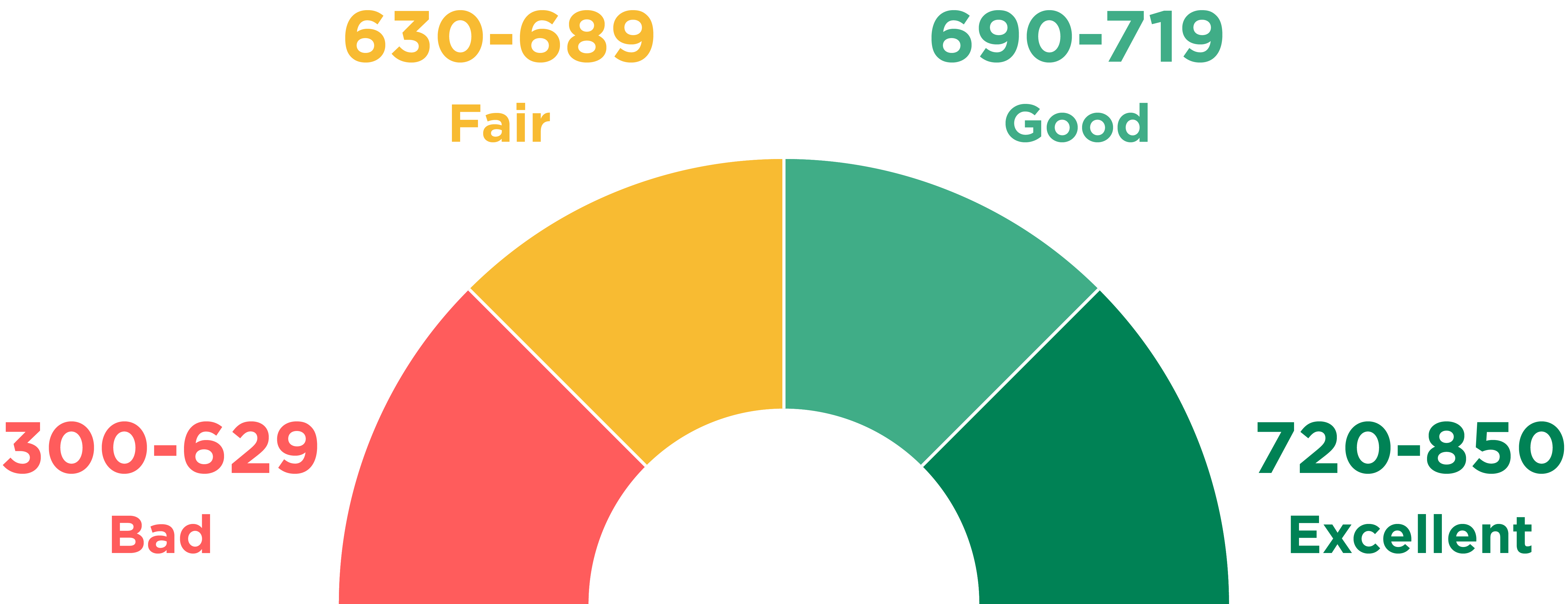

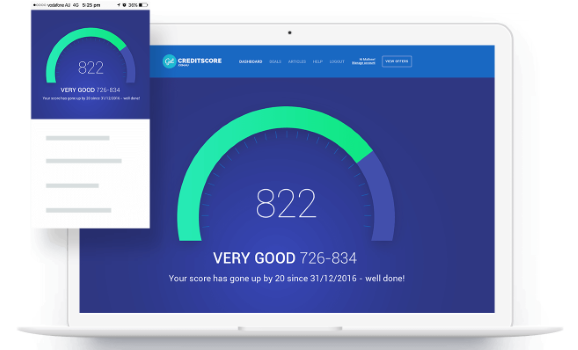

Fortunately there are a number of ways to check your credit report for free. It s easy to get a free credit report but the main credit bureaus don t usually include a credit score. If you ve ever applied for credit or a loan there will be a credit report about you. A lower score will affect your ability to get a loan or credit.

Many such sites charge consumers a monthly fee to see their credit reports in return for credit monitoring services. Every four months you can check to see if anything suspicious has shown up on an account. Many credit card companies provide their cardholders with free credit scores. And under federal law you re entitled to a free credit report from each of the three major credit bureaus equifax experian and transunion once every 12 months.

Three major credit reporting agencies provide credit reports. That s all the credit monitoring you need. For example you can get your experian free credit report sept 1 then on january 1 get your equifax and then on may 1 ask for your transunion free credit report. A credit report shows your bill payment history current debt and other financial info.

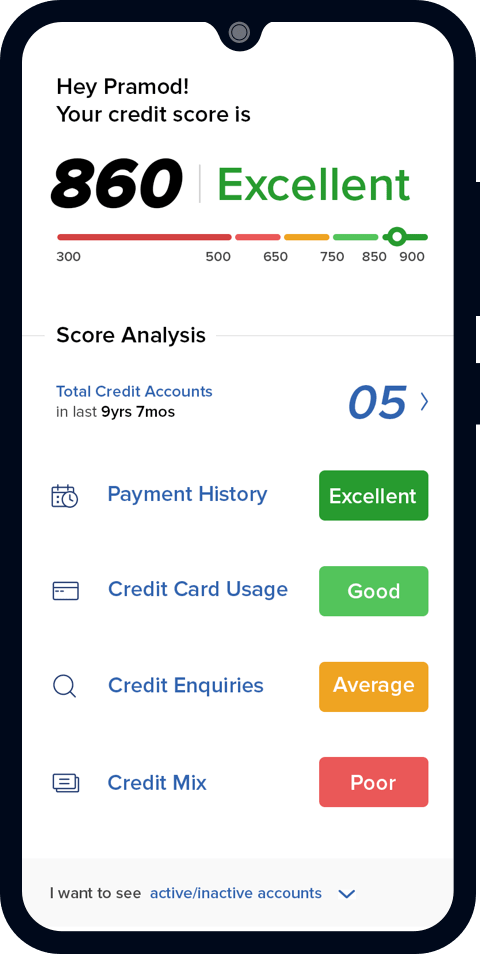

Learn three ways to improve your credit report and score. Getting a free credit report can be safe if you are careful about the particular website from which you get it. See how to improve your credit score. You can do this for free if you can wait 10 days to get it.

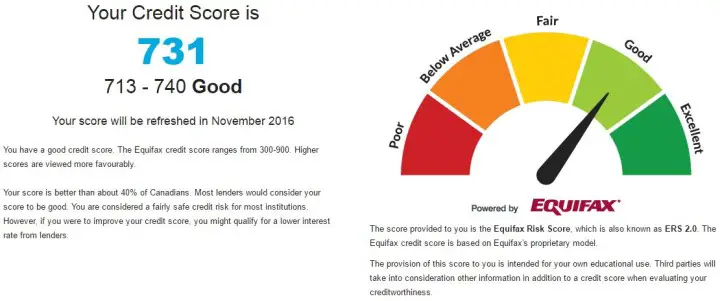

The best free credit reports don t ask for any credit card information for sign up and can easily be accessed online. The higher your score the lower your interest rate may be for a loan or credit card. Companies and lenders use your credit report to calculate your credit score a number usually between 300 and 850. If you find a problem once you work with that.

:max_bytes(150000):strip_icc()/GettyImages-1041512942-69d44b3432c342469fb14e34e370f6bc.jpg)

:max_bytes(150000):strip_icc()/credit.karma.logo.cropped-5bfc2e08c9e77c0026b570fb.png)

/is-paypal-safe-315818-v3-5b477342c9e77c00377efb8f.png)