Reverse Mortgage Restrictions

However the loan officer will need to collect additional information upfront to determine eligibility.

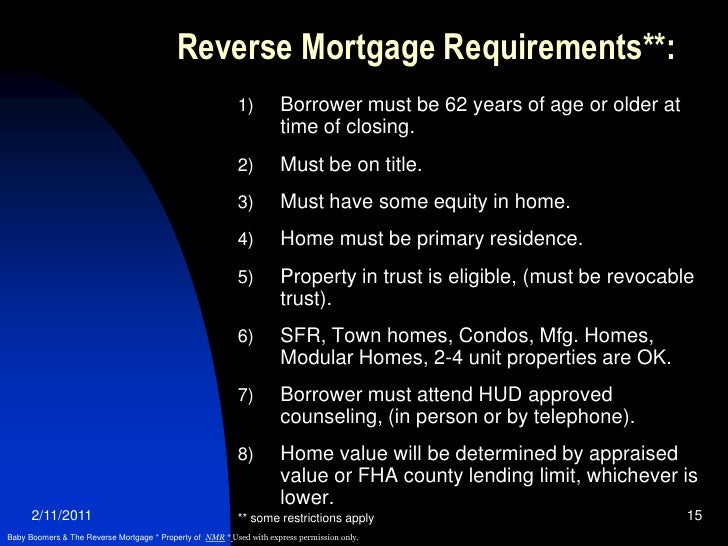

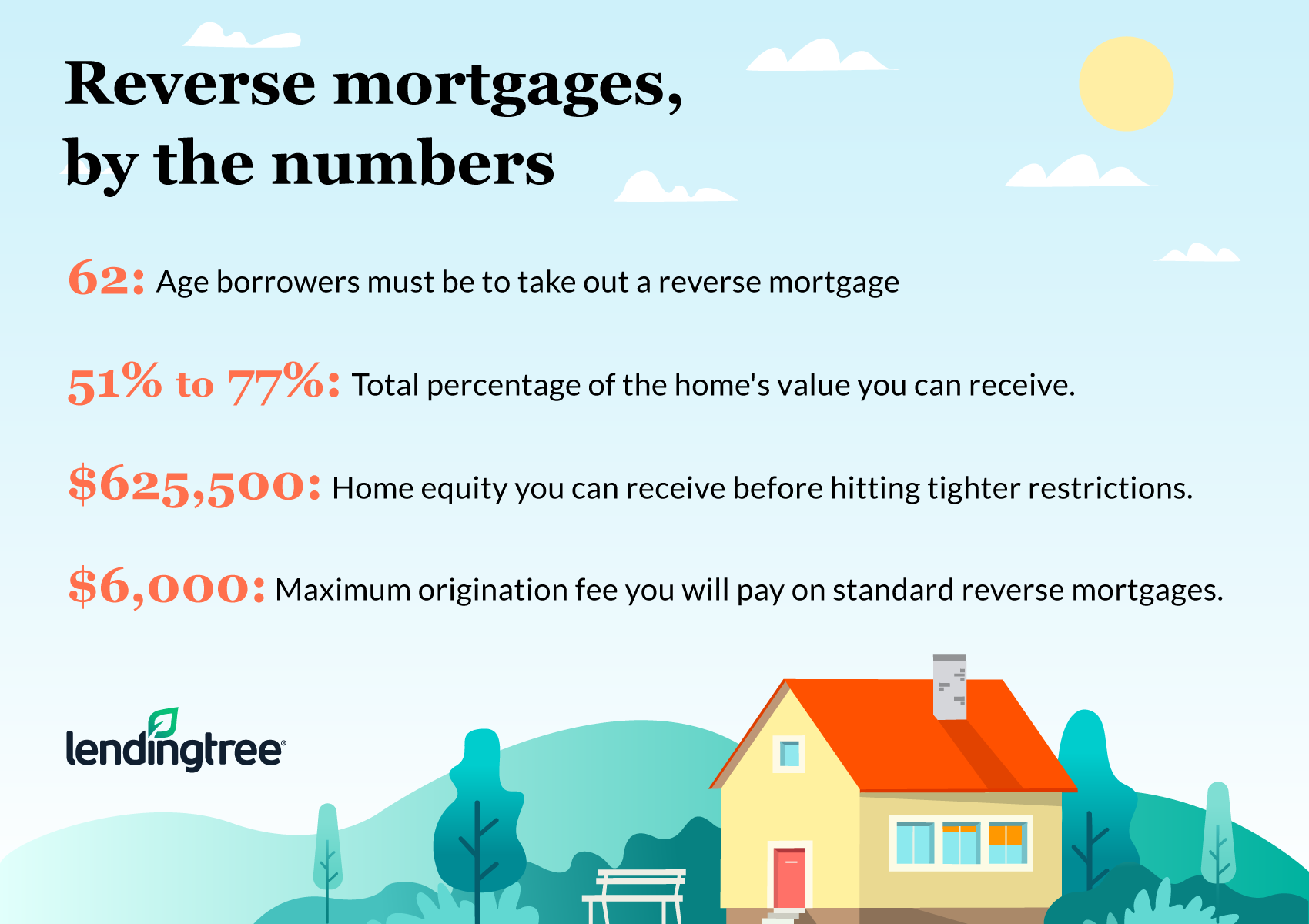

Reverse mortgage restrictions. You also need to watch out for reverse mortgage scams. Here are the 5 rules that apply to reverse mortgages in 2019. The youngest borrower on title must be at least 62 years old live in the home as their primary residence and have sufficient home equity. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

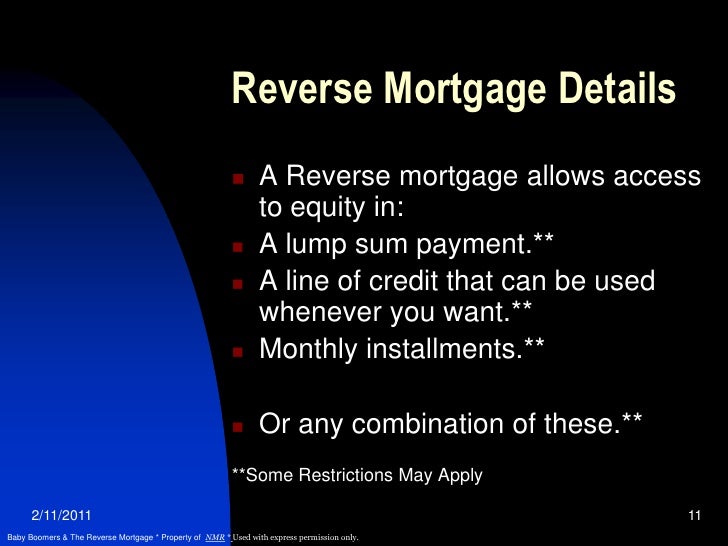

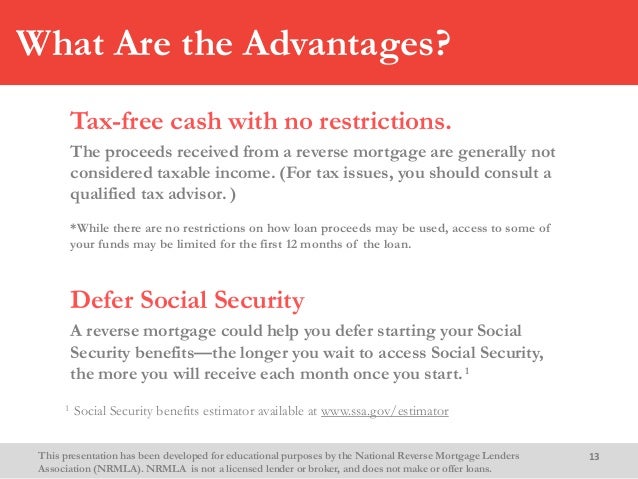

The reverse mortgage loan has continued to evolve since its introduction in 1961 and only grows stronger and safer with each year. There are no restrictions on how you may use the money you receive from a reverse mortgage. Once any mandatory obligations like previous mortgages or liens on the property are paid off the rest of the loan may be used as you see fit. Reverse mortgage restrictions in order to prevent defaults on hecm loans the government includes restrictions within fha reverse mortgage rules.

Reverse mortgages are increasing in popularity with seniors who have equity in their homes and want to supplement their income. The fha continually updates and regulates reverse mortgages with new guidelines to protect you as a borrower. The only reverse mortgage insured by the u s. All borrowers listed on title must be 62 years old.

Federal government is called a home equity conversion mortgage hecm and is only available through an fha approved lender. Click to call america s 1 rated reverse mortgage lender 800 565 1722. Ask your lender what payment options they offer for a reverse mortgage and whether there are any restrictions or fees. Top site menu.

The basic requirements to qualify for a reverse mortgage loan include. If one spouse is under 62 it might be possible to get a reverse mortgage. Home blog. Once you learn more about this kind of loan including the upsides and downsides as well as all of the requirements and restrictions you might think twice about getting one.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. This is primarily due to rules and regulations set by the federal housing administration fha. Reverse mortgage rules requirements. Borrower requirements and responsibilities.

Before getting a reverse mortgage you should understand how they work and learn the risks and requirements associated with them. You must first pay off and close any outstanding loans or lines of credit that are secured by your home such as a mortgage or home equity line of credit.