Rules Of Ira

Early ira withdrawals.

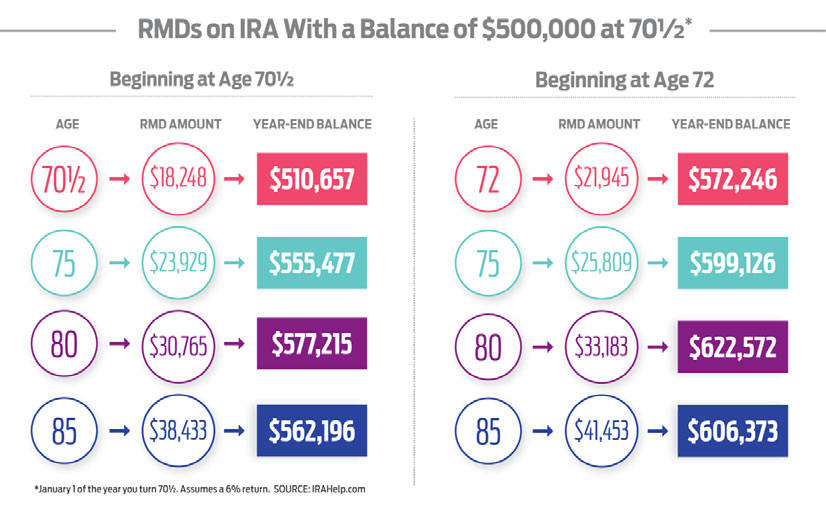

Rules of ira. Assume that louise inherits a traditional ira account worth 100 000 from her uncle harry who died on march 1 2020. An individual retirement account ira is an investing tool individuals use to earn and earmark funds for retirement savings. You may designate your own ira beneficiary. Irs rules say that the money is to be withdrawn during retirement so if you withdraw funds from a traditional ira early before you reach age 59 1 2 the irs will assess a 10 early withdrawal penalty tax.

Sneaking in the backdoor roth ira. But some ira custodians are more versed than others in the complex rules surrounding inherited iras. A simple ira has lower contribution limits than a sep ira and is easier to set up otherwise a simple ira plan follows the same investment distribution and rollover rules as traditional iras. Changes in roth ira rules.

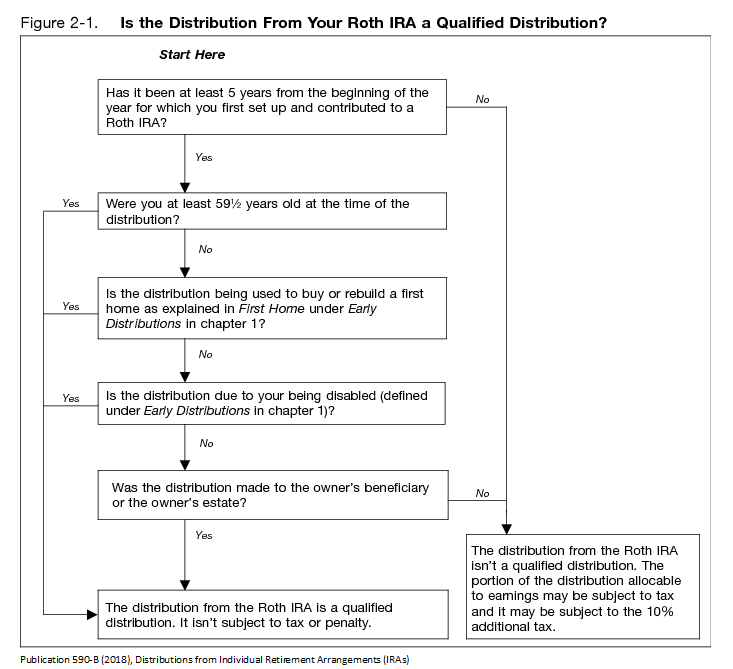

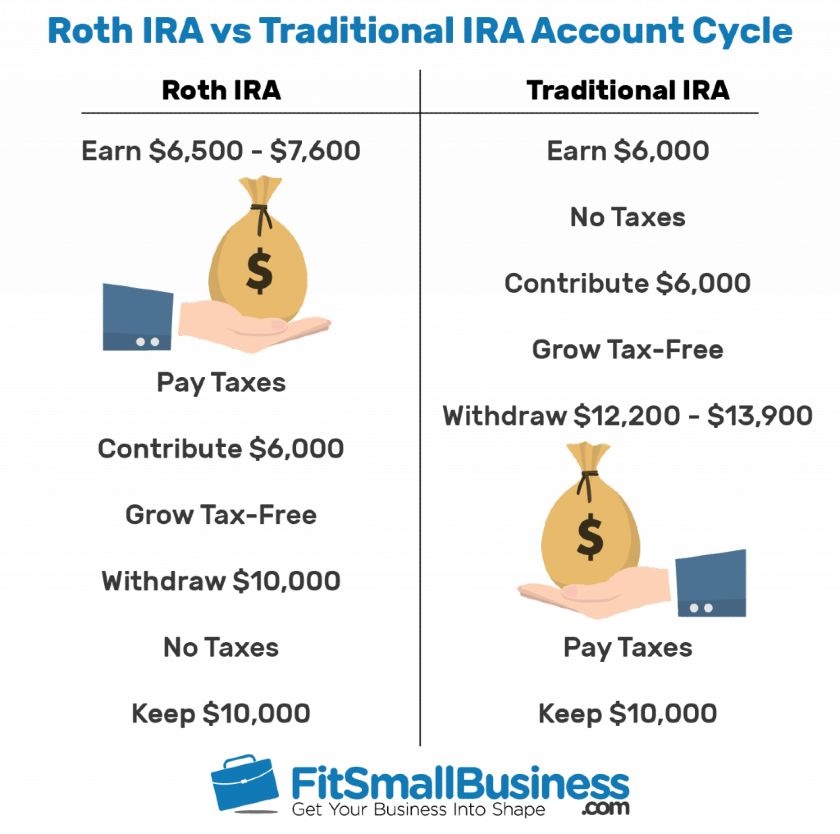

Traditional is the keyword here because different rules apply to roth iras. For more information on these types of plans see the sep simple ira plan and sarsep faqs. More understanding the 5 year rule. Contributions distributions withdrawals loans rollovers and roth conversions.

A simple ira is literally more simple than a 401 k. They are typically less expensive to administer and less time consuming to operate. The 10 year clock begins on january 1 2021 which is the year after the year. Talk about it with the custodian ahead of time says tully.

If you are under 59 you ll be subject to the same distribution rules as if the ira had been yours originally so you cannot take distributions without paying the 10 early withdrawal penalty unless you meet one of the irs penalty exceptions. Sep simple ira plan or. Penalty free and tax free withdrawals of contributions are allowed at any time which is what makes the roth a. Ira rules you should know more in 2019 and 2020 your total contributions to all iras cannot be more than 6 000 if you are age 49 or younger and 7 000 if you are 50 or older.

Iras are specifically designed to hold retirement savings.

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)