Self Employed Tax Help

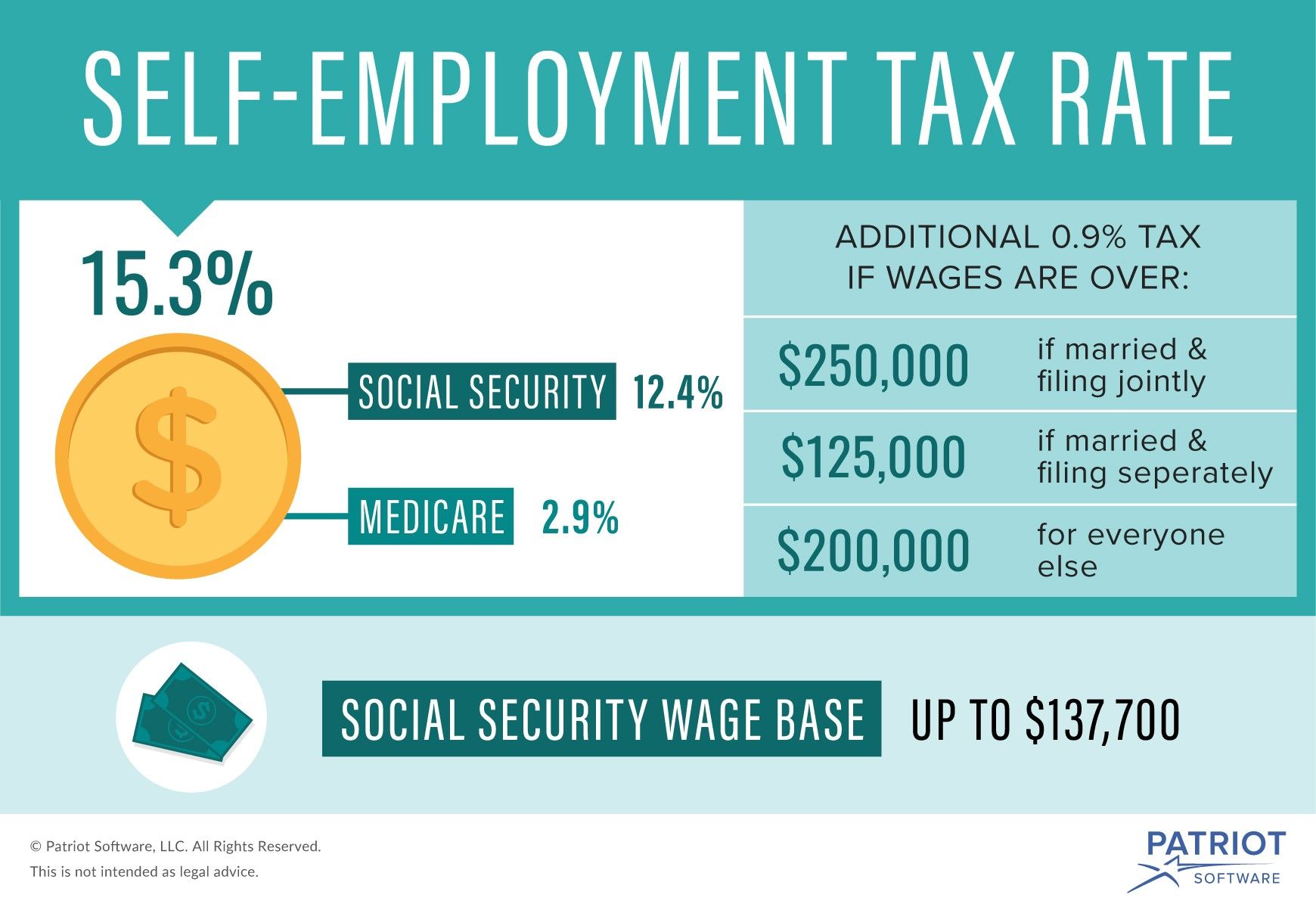

You figure self employment tax se tax yourself using schedule se form 1040 or 1040 sr.

Self employed tax help. It is similar to the social security and medicare taxes withheld from the pay of most wage earners. In general anytime the wording self employment tax. If you re not eligible based on the 2018 to 2019 self assessment tax return we will then look at the tax years 2016 to 2017 2017 to 2018 and 2018 to 2019. Self employment includes contracting working as a sole trader and small business owners.

That rate is the sum of a 12 4 for social security and 2 9 for medicare. You pay tax on net profit by filing an individual income return. Instead go to corporations. If you have received full time or part time income from trade business vocation or profession you are considered a self employed person.

What s new for small businesses and self. It is intended to benefit self employed people who were profitable in 2019 but as a result of the covid 19 pandemic will make a loss in 2020. Quickbooks self employed offer with turbotax self employed and turbotax live self employed for users filing from 4 16 7 15 or extension filers. What is self employment tax.

Income tax loss relief for self employed on 23 july 2020 the government announced the introduction of a new once off income tax relief measure. Self employed individuals including those earning income from commissions. If you are incorporated this information does not apply to you. Usually a self employed person can start in business without following any formal or legal set up tasks.

If you are starting a small business see the checklist for new small businesses. If you re self employed you use your individual ird number to pay tax. Hm revenue customs department for work and pensions department for business energy industrial strategy office of tax simplification companies house. The checklist provides important tax information.

The self employment tax rate is 15 3. Self employment tax is a tax consisting of social security and medicare taxes primarily for individuals who work for themselves. You have to report this income in your tax return. Self employment tax applies to net earnings what.

Find out how we will work out your. What is self employment tax. Se tax is a social security and medicare tax primarily for individuals who work for themselves. This page shows the relevant information to help you prepare and file your tax return.