Set Up A Corporation In California

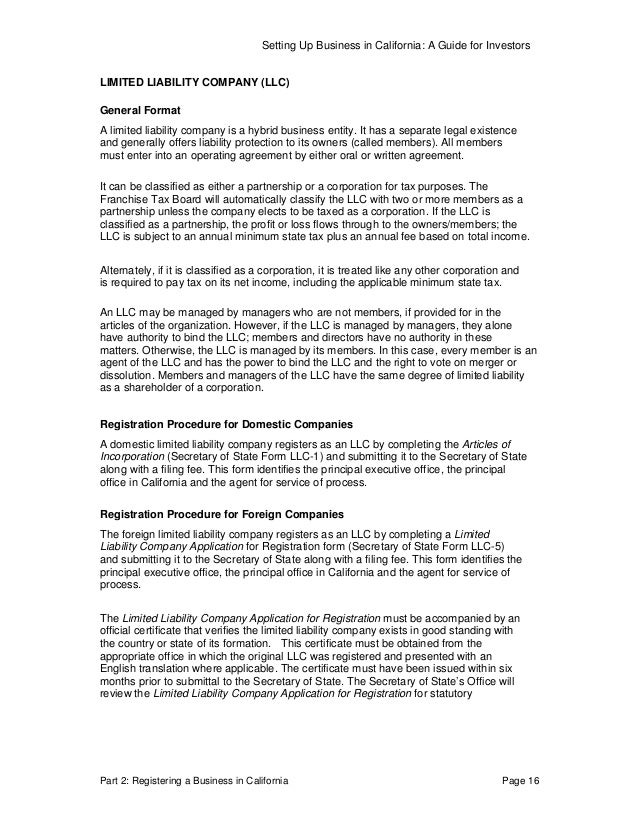

In most cases your llc can be classified as a sole proprietorship a partnership a c corporation or an s corporation for tax purposes.

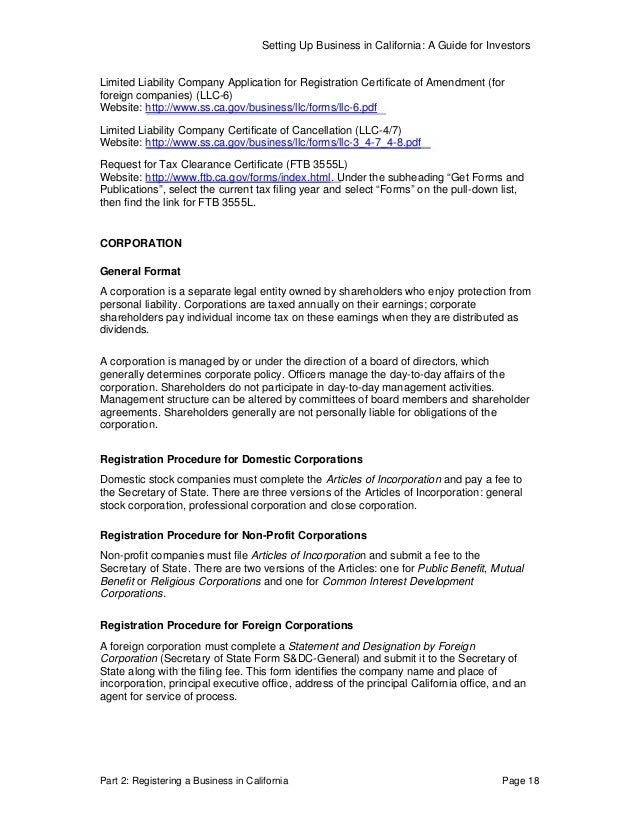

Set up a corporation in california. Choose a business structure. Start your business today with our simple step by step guide and get on the fast track to financial and personal independence. An 800 annual minimum tax must be paid during the first quarter of each accounting period whether the corporation is active operates at a loss or does not do business. When you file your california articles of incorporation you will be asked to give the name of your california service of process agent.

California s corporations are for those who want the limited liability and the more formal structure of a corporation but with pass through taxation of the business profits. A california llc generally offers liability protection similar to that of a corporation but is taxed differently. California while a hotbed for startups and top corporations currently ranks 30 on forbes best states for business list and is known for being more difficult to operate in as well as taxing businesses higher than most other states. A california corporation is required to keep bylaws at its principal place of business in california.

California s corporation formation services how to register an s corporation in ca. The bylaws must either specify the number of directors or set a minimum and maximum number of directors and state that the exact number will be decided by the board or the shareholders. They are not filed with the secretary of state. All california corporations and foreign corporations doing business in california must pay california taxes to the california franchise tax board ftb.

Choose a california registered agent. Setting up a california corporation can offer your company many advantages not available to sole proprietorship or partnerships. In addition to filing the applicable documents with the secretary of state an operating agreement among the members as to the affairs of the llc and the conduct of its business is required. Select a business entity type from the following list for a brief overview of the principal types of legal business structures available in.

A california s corporation is simply a standard corporation that becomes an s corporation when its shareholders elect special tax status. Domestic llcs may be managed by one or more managers or one or more members. However forming your california corporation will require a bit of preparation and some assistance from an experienced and qualified attorney. The california business investment services unit provides tailored site selection services for businesses real estate executives and site selection consultants.

In case you need help we include a list of business resources in your local area. With the best economic climate in the us and better access to venture capital than anywhere else in the nation starting a business in california is a great choice for entrepreneurs.