Tax Relief Options

Filing and payment deadlines more for businesses.

Tax relief options. Visit support for tax professionals. The first of a few tax relief options is the irs fresh start initiative originally started in 2008 and has since undergone frequent changes and expansions to accommodate a higher number of taxpayers aiming to make things easier for individuals and businesses struggling to pay their tax debts. Find out about additional support options that can help during this time including information on lodgment and payment varying payg instalments or claiming gst credits. Visit the irs s coronavirus tax relief webpage to learn more about the payments and how individuals can get them.

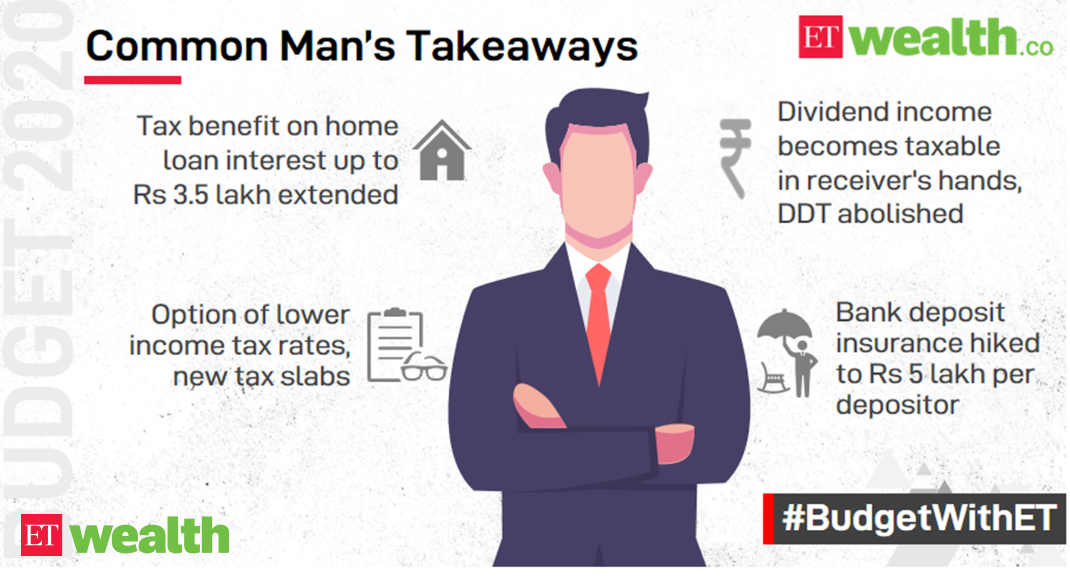

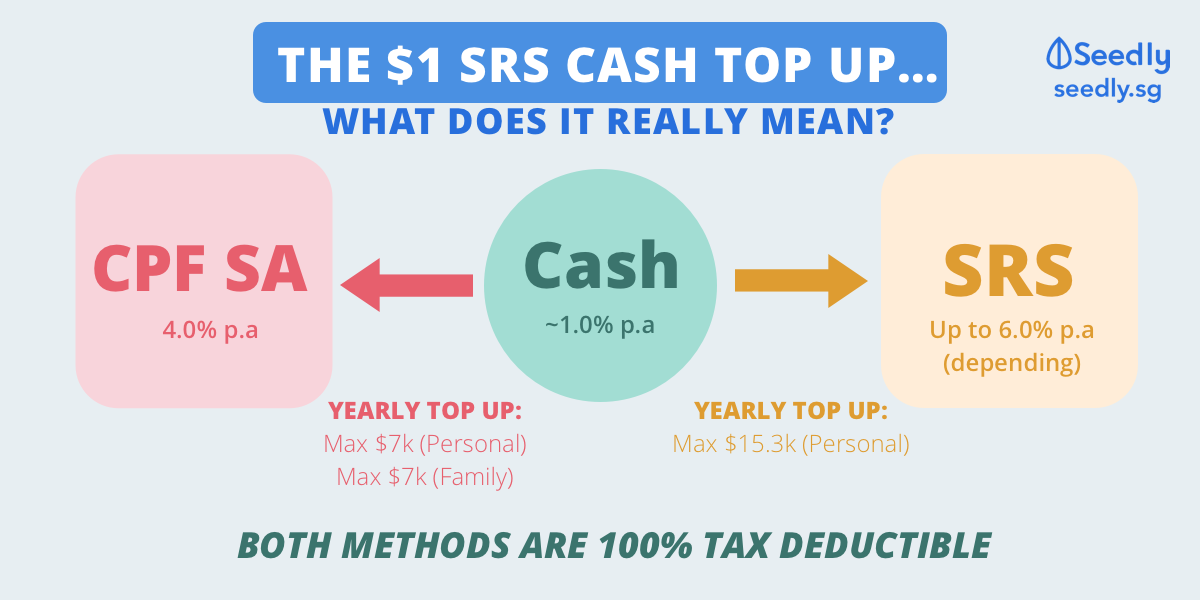

Options for relief from tax debt. Tax relief options under the irs fresh start initiative. Your small or large business or tax exempt organization may be eligible for covid 19 relief. In fact today online reported that raising one child up to the age of 21 years old in singapore can cost anywhere between sgd 200 000 to an eye watering figure of nearly sgd 1 million.

Visit additional support during covid 19. This could be a significant sum. Keeping the system fair. New employer tax credits.

Top money saving tax relief and rebate options for parents in singapore no one ever said raising kids was cheap. Hope william smith 22 july 2020. The options for overhauling pensions tax relief outlined in the government s call for evidence yesterday 21 july may still be too complicated the industry says. Stock options or shares granted from 16 feb 2008 to 15 feb 2013 both dates inclusive.

When the emi options are exercised the company is entitled to corporation tax relief on the difference between the exercise price and the market value at the date of exercise. Applications taken each year january 1 through may 31 and can be obtained at the mcdowell county assessing office 60 east court street marion nc 28752 all applications due back to the assessing office by june 1 listed below are the programs offered by the state to eligible property owners to help reduce their tax. Tax relief options. This standard practice statement sets out the commissioner s practice when considering the options for removing or deferring the obligation to pay tax interest and or penalties under the tax administration act 1994.

Businesses and tax exempt entities.

/GettyImages-1153812676-0ac08ff7c07b4cd2842e24f081ab6d9b.jpg)