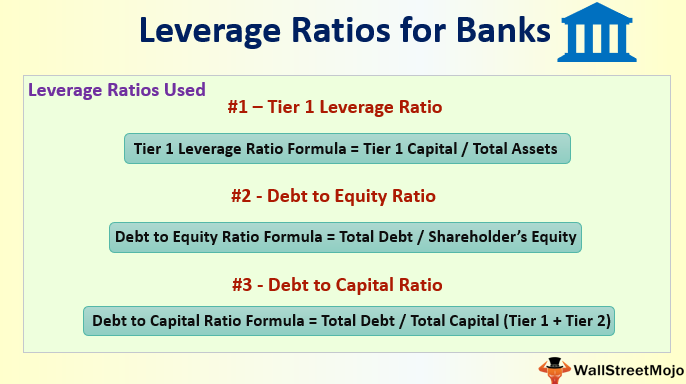

Tier 1 Leverage Ratio

Common equity tier 1 capital.

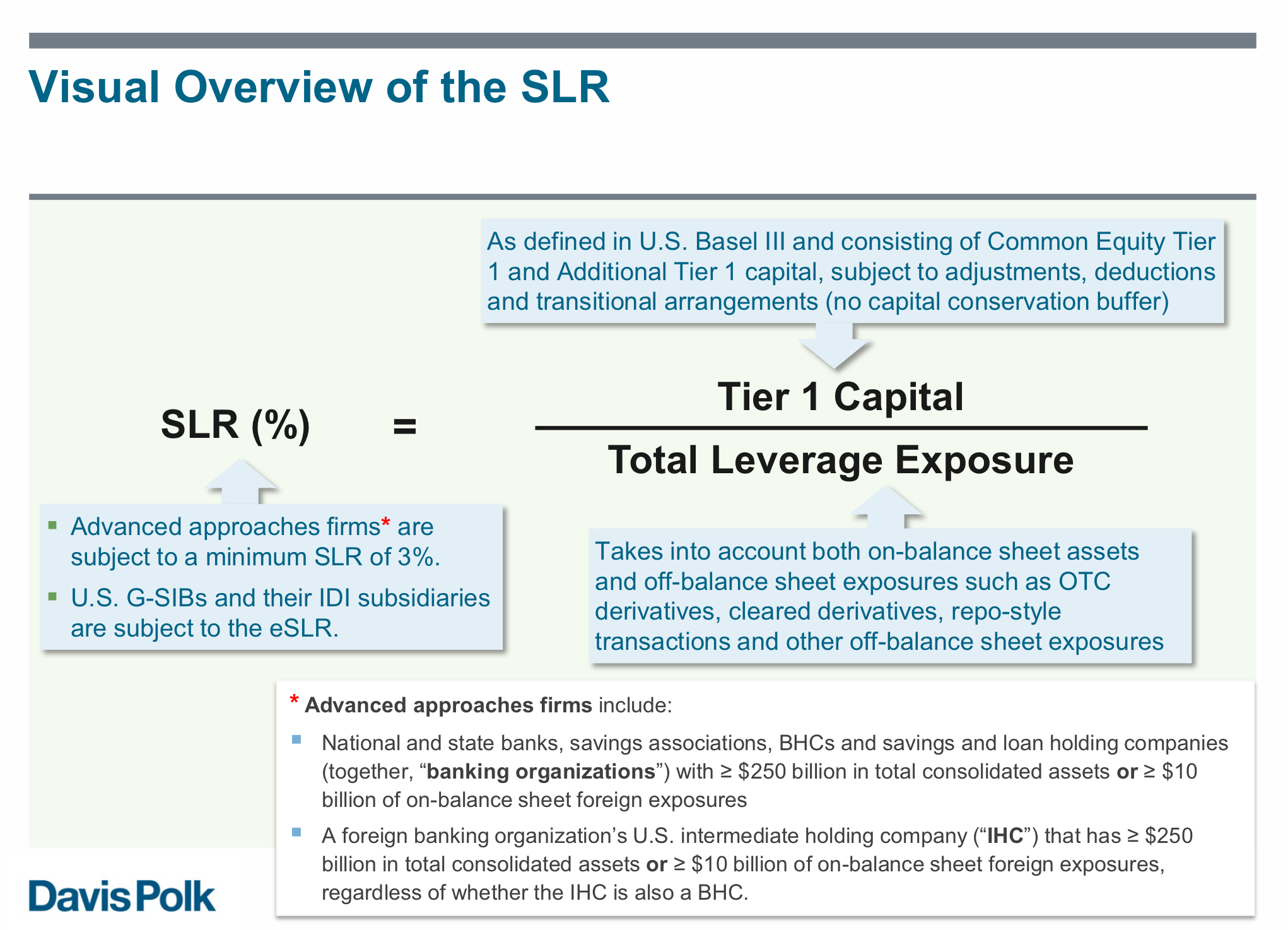

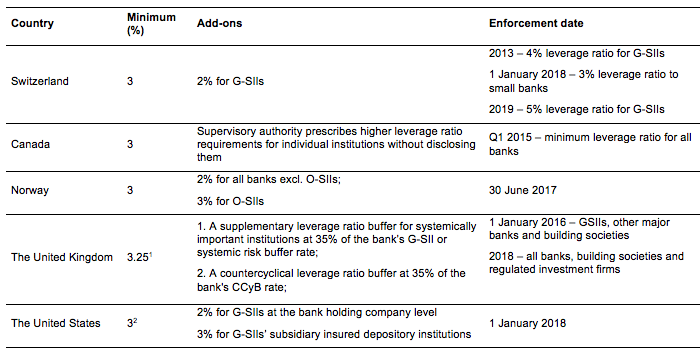

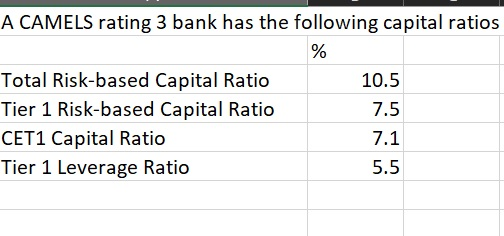

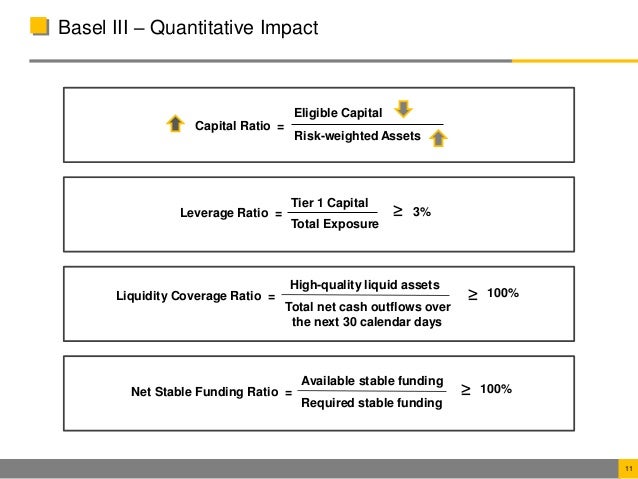

Tier 1 leverage ratio. Avg assets lev tier 1 capital. The banks are expected to maintain a leverage ratio in excess of 3 under basel iii. The leverage ratio is defined as the capital measure divided by the exposure measure expressed as a percentage. Tier 1 core capital as a percent of average total assets minus ineligible intangibles.

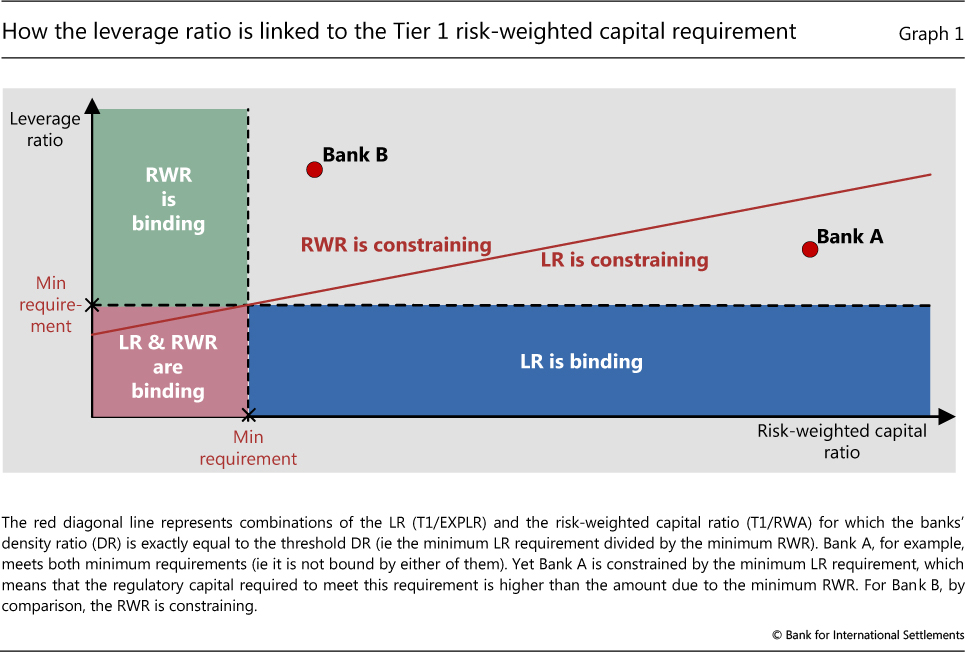

A ratio that calculates the amount of capital a bank should have as a percentage of its total risk adjusted assets. Under the basel accords the bank s minimum capital ratio requirement is set at 8 and 6 must be in the form of tier 1 capital. Common equity tier 1 capital is the most loss absorbing form of capital. Evaluate how leveraged a bank is.

Tier 1 leverage ratio tier 1 leverage ratio fdic definition. Tier 1 leverage ratio. The tier 1 leverage ratio is a direct outcome of the crisis and so far it has worked well amidst all the amendments. However investors are still reliant on banks to calculate this number and it is highly possible that investors will be fed an inaccurate picture.

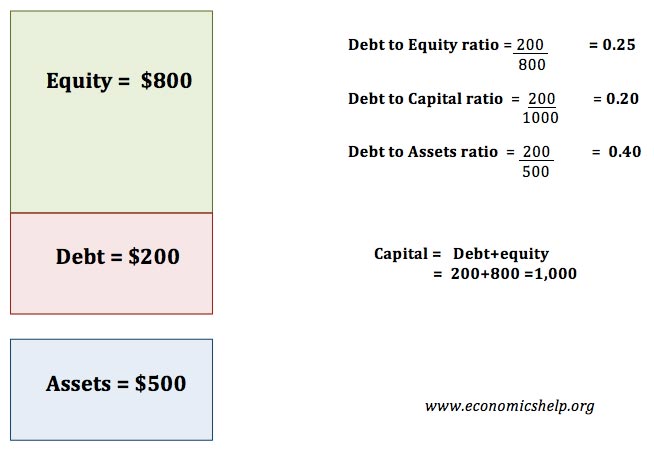

The tier 1 leverage ratio is the ratio that is most strongly associated with the true amount of capital that is being leveraged and therefore is a good way to understand a banks current leverage. Tier 1 capital vs. This is a non risk based leverage ratio and is calculated by dividing tier 1 capital by the bank s average total consolidated assets sum of the exposures of all assets and non balance sheet items. As the denominator for the tier 1 leverage capital ratio.

Tier 1 leverage ratio defines the connection between a banks adjusted total assets average total consolidated assets and it s core capital. Tier 1 capital requirements. It includes qualifying common stock and related surplus net of treasury stock. The capital measure is tier 1 capital and the exposure measure includes both on.

The calculation is used to determine a minimum capital adequacy. Basel iii introduced a minimum leverage ratio.

:max_bytes(150000):strip_icc()/BankofAmericaLeverageratio-5c7830d5c9e77c0001d19cbf.jpg)

/BankofAmericaLeverageratio-5c7830d5c9e77c0001d19cbf.jpg)