Roth Ira Providers Comparison

How they compare however the roth 401 k has a number of key differences from the roth ira.

Roth ira providers comparison. Roth ira setup fee. Designated roth 401 k roth ira. Here are the seven best roth iras to open. These accounts also grow over time due to compounding interest.

Another option is to open a roth ira which doesn t offer any immediate deduction but does provide tax free withdrawals in retirement. Charles schwab is another provider of roth ira accounts with no recurring fees and no minimum balance requirement. 0 roth ira termination fee. Up to 6 000 can be contributed to an ira in 2020 and those.

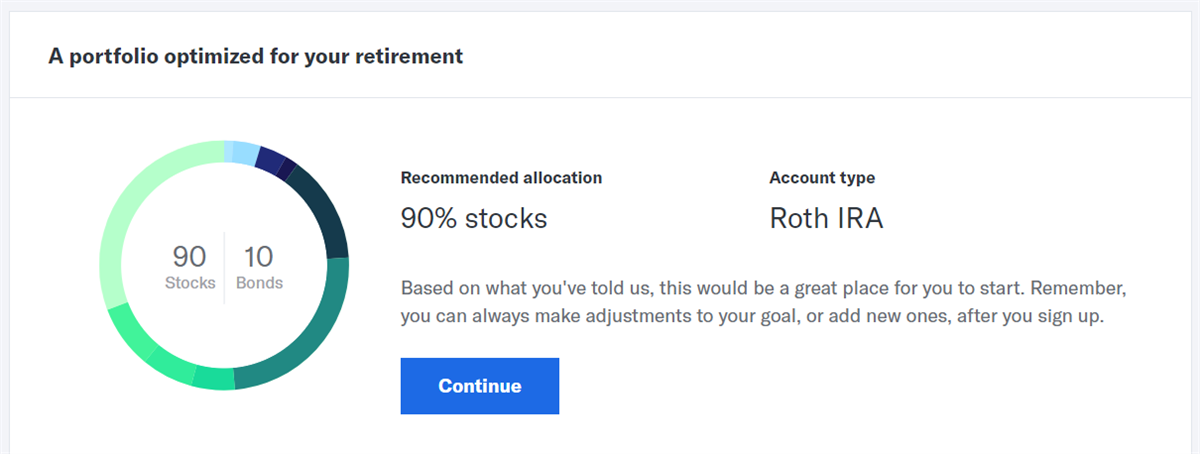

Once you have this money in your roth ira account you will select investments to make your money grow think of stocks bonds mutual funds etfs etc. A roth ira is one of the best accounts for growing tax free retirement savings and it takes just 15 minutes to open one. 0 last in the best roth ira providers list is vanguard which is known for its excellent selection of mutual and exchange traded funds. Here s what to know before deciding which account is right for you.

Roth 401 k roth ira and pre tax 401 k retirement accounts. A roth ira allows you to put money you ve already been taxed on into the account. A retirement account whether it is a traditional ira roth ira or 401 k builds up as you contribute to the account. A roth ira is a tax advantaged retirement investment account.

The broker is keeping funds expense ratios at around 0 50 and many are below that. Traditional pre tax employee elective contributions are made with before tax dollars. Designated roth employee elective contributions are made with after tax dollars. See which rank as the best.

Whether you re opening a new ira transferring one to a new broker or rolling over a 401 k nerdwallet has selected the best ira providers by category. 0 roth ira annual fee.

/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)