Va Home Loan House Requirements

Similarly while there s no acreage limit with va loans properties with a lot of land can sometimes prove problematic in terms of finding good comps.

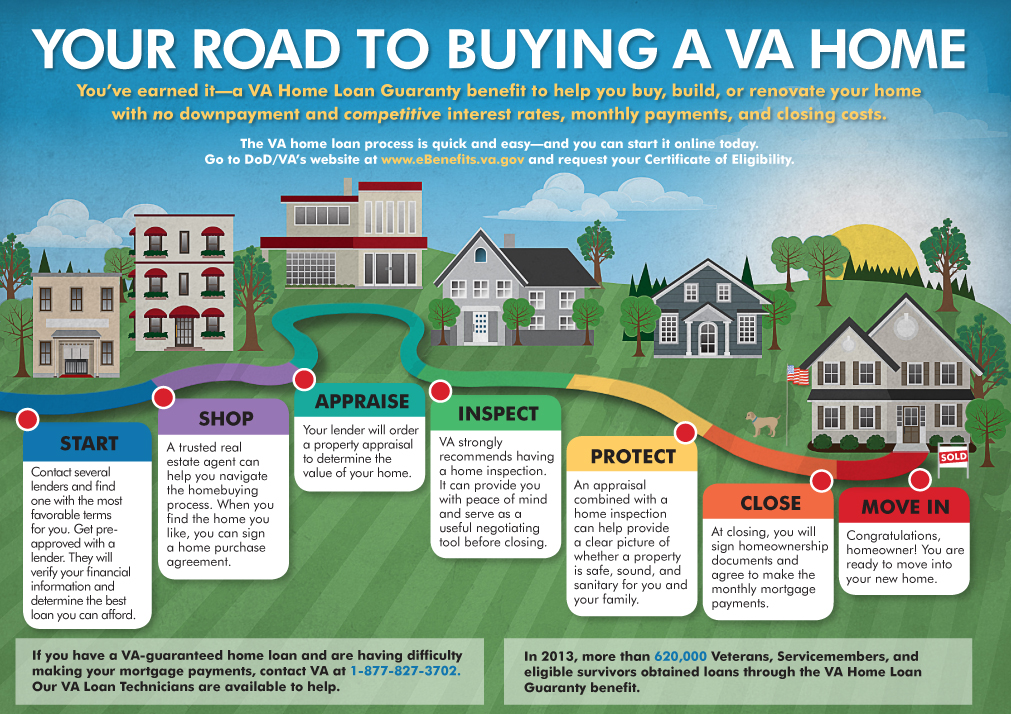

Va home loan house requirements. These home requirements help ensure that veterans and military families have a safe structurally sound and sanitary place to call home. The home you want to buy must meet the va s minimum property requirements. The home must be for your own personal occupancy. You must have satisfactory credit sufficient income and a valid certificate of eligibility coe to be eligible for a va guaranteed home loan.

Va helps servicemembers veterans and eligible surviving spouses become homeowners. If you apply and are eligible for a va backed home loan you ll receive a certificate of eligibility coe this is the document that tells private lenders such as banks credit unions or mortgage companies that you have va home loan eligibility and entitlement. The standards ensure that homes financed by va loans are safe structurally sound and sanitary. The va loan program s success in terms of low foreclosure rate is due in part to these residual income requirements.

For example some lenders may not be willing to lending on. As part of our mission to serve you we provide a home loan guaranty benefit and other housing related programs to help you buy build repair retain or adapt a home for your own personal occupancy. The va minimum property requirements for mortgages backed through the veterans benefits program can help determine whether the property you re considering qualifies for a va loan. Find out how to apply for a certificate of eligibility coe to show your lender that you qualify based on your service history and duty status.

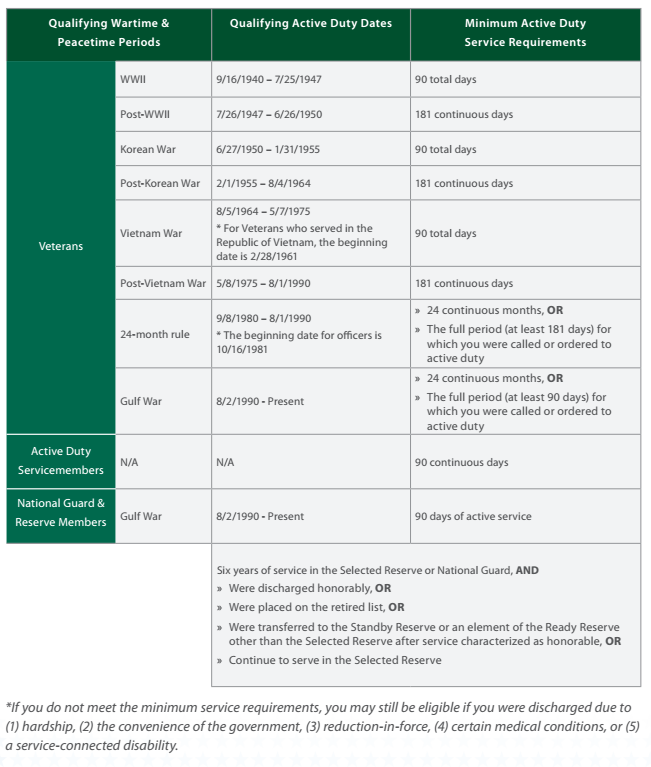

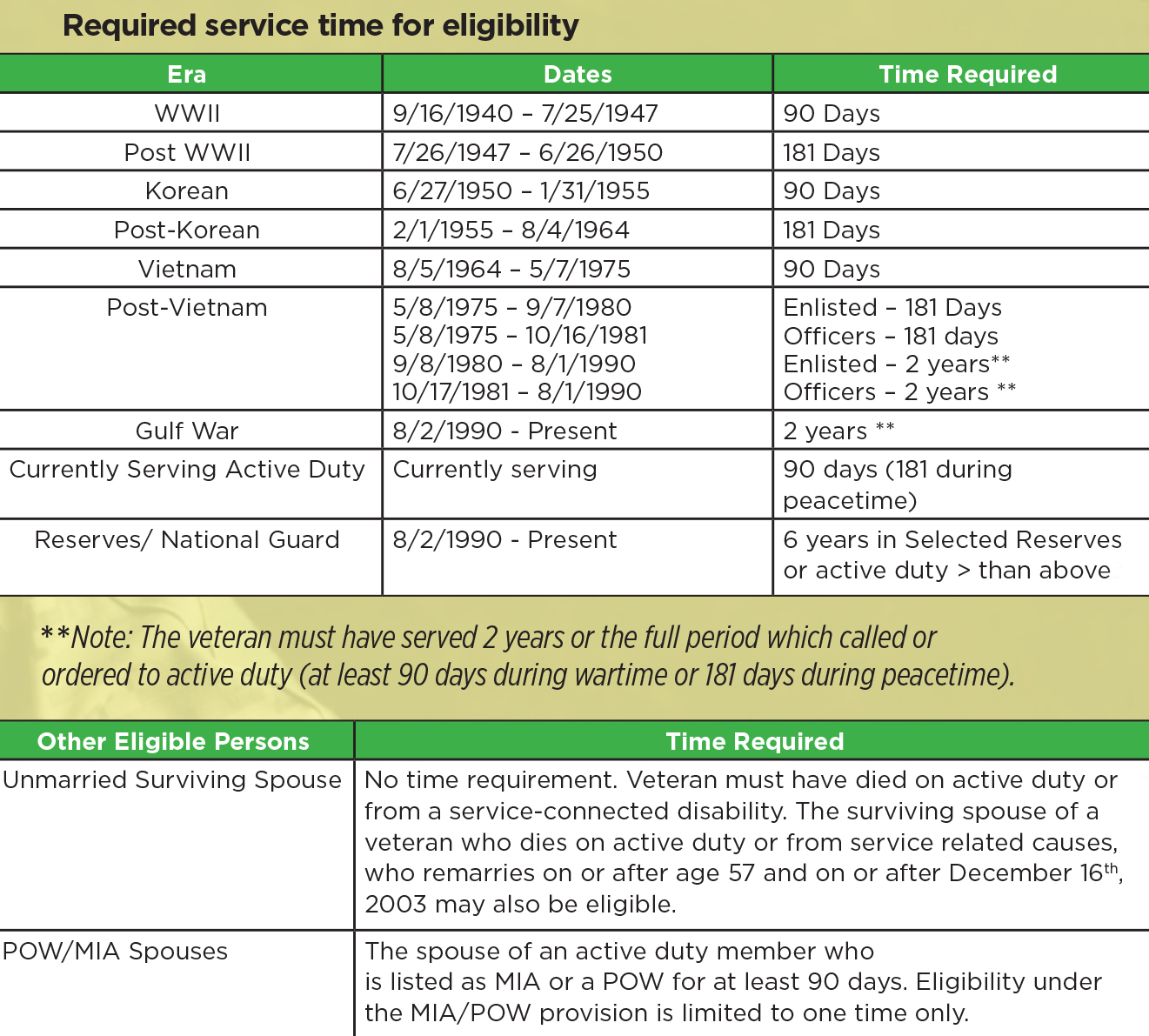

The eligibility requirements to obtain a coe are listed below for servicemembers and veterans spouses and other eligible beneficiaries. In addition lenders may have their own in house guidelines and requirements regarding property types. Va loans seldom get used for nonresidential or business property purchases as the va designed the home loan program to increase homeownership among service members and veterans. Once the buyer gets under contract on a home a va appraisal is conducted to assess the market value and condition of the property.

/va-home-loans-1798389_FINALv2-d42807494ecd4966aed01de64838b89c.png)