What Information Is Needed To Get Preapproved For A Mortgage

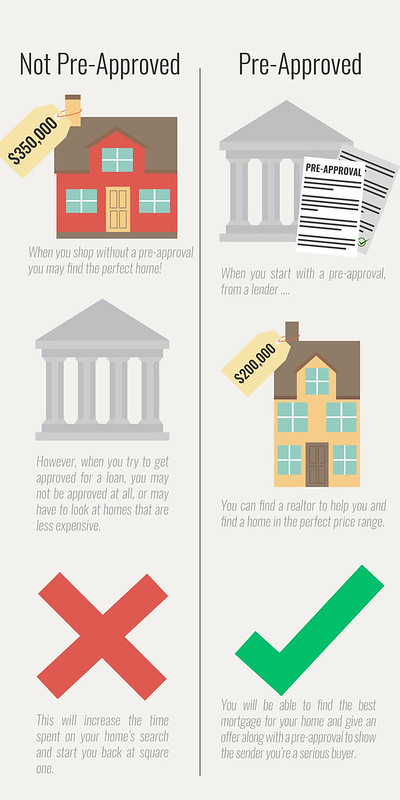

A mortgage pre approval is a written statement from a lender that signifies a home buyers qualification for a specific home loan.

What information is needed to get preapproved for a mortgage. A seller often wants to see a mortgage preapproval letter and in some. Income credit score and debt are just some of the factors that go into the pre approval process. Pre approval means that a lender has stated in writing that you qualify for a mortgage loan based on your current income and credit history. Approval approved with conditions suspended or denied suspended means that the underwriting process requires more information or documentation from you.

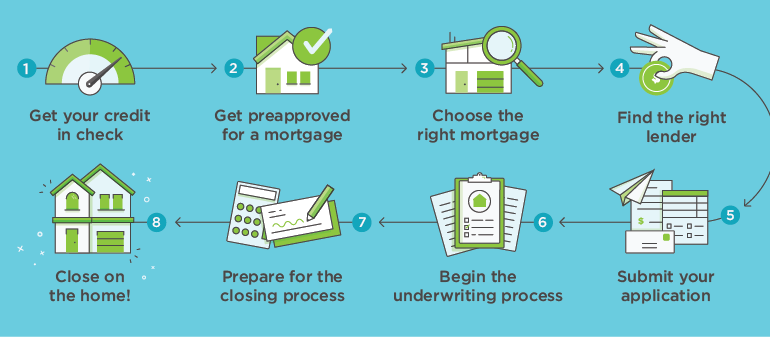

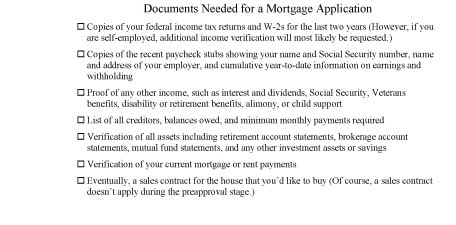

9 things you need to be preapproved for a mortgage 1. Know the maximum amount of a mortgage you could qualify for. The underwriter returns one of four decisions. To get pre approved for a mortgage you ll need five things proof of assets and income good credit employment verification and other types of documentation your lender may require.

A pre approval usually specifies a term interest rate and mortgage amount. Going through the preapproval process with several lenders allows a home buyer to shop interest rates and find the best deal. Borrowers need to have a good credit history in order to quality for mortgage pre approval. Getting preapproved for a mortgage before you go home shopping isn t required but it is a good idea especially in a seller s market where competition among buyers is intense.

What you ll need to get a pre approved mortgage. Have an official form of identification on hand like a driver s license or passport. With a pre approval you can. A lender will issue a loan commitment after approving both you and the property you intend to purchase.

Estimate your mortgage payments. Besides considering the information contained in the application lenders run a credit check on the.

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

.png)

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg)