What Is A Form 1095a

/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)

If you used them to pay for your health insurance and the amount you paid for coverage.

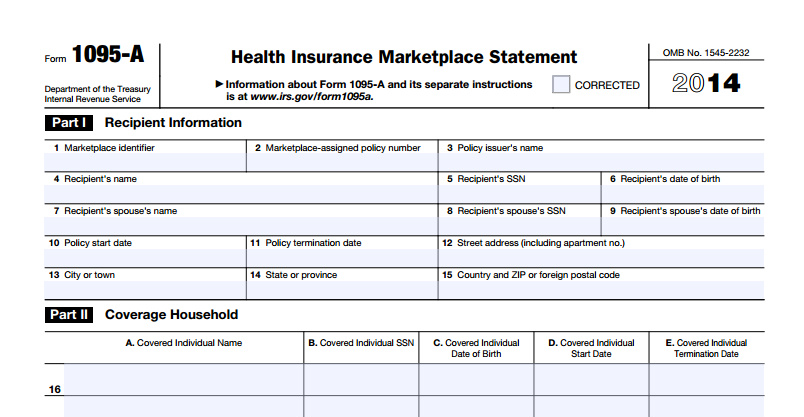

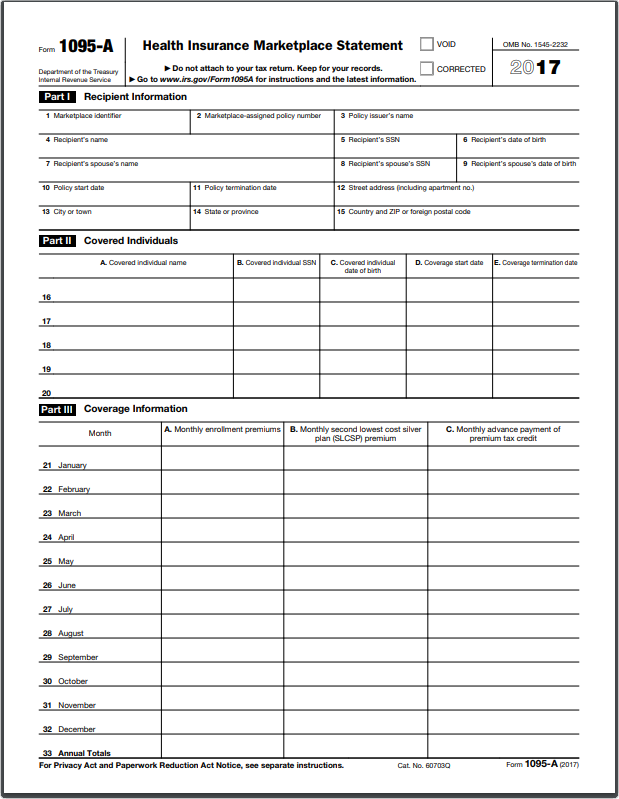

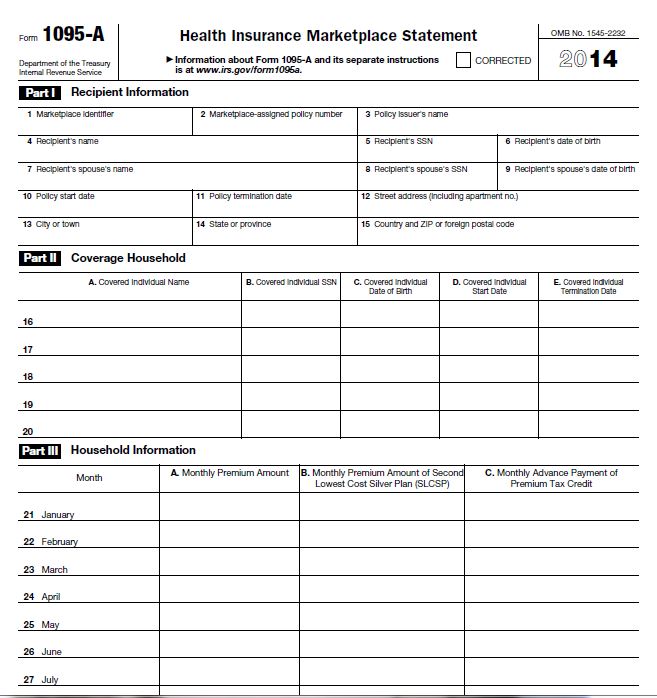

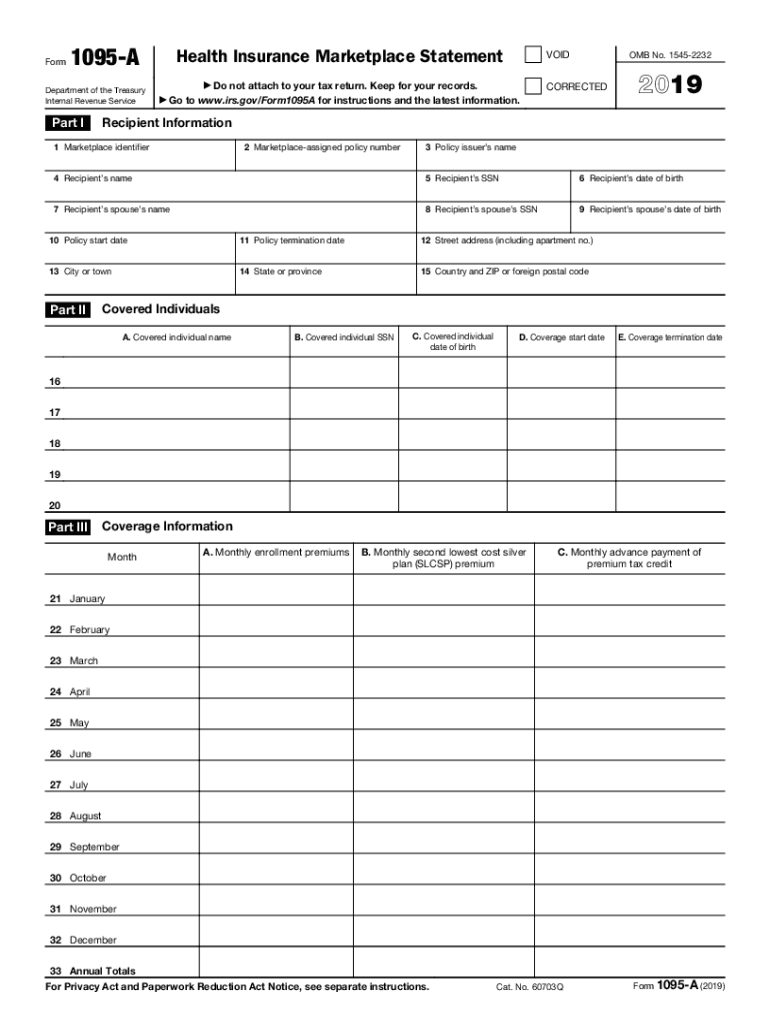

What is a form 1095a. Health insurance marketplaces furnish form 1095 a to. Form 1095 a includes the identifying information about the client and any other individuals covered by the health insurance plan as well as information on the type and duration of coverage. Form 1095 is a collection of internal revenue service irs tax forms in the united states which are used to determine whether an individual is required to pay the individual shared responsibility provision. Your 1095 a contains information about marketplace plans any member of your household had in 2019 including.

Form 1095 a is used to report certain information to the irs about individuals who enroll in a qualified health plan through the marketplace. A figure called second lowest cost silver plan slcsp you ll use information from your 1095 a to fill out form 8962 premium tax credit pdf. Form 1095 a is an irs form for individuals who enroll in a qualified health plan qhp through the health insurance marketplace. Individuals can also use the health insurance information contained in the form forms to help them fill out their tax returns.

Typically it is sent to individuals who had marketplace coverage to allow them to. If you bought health insurance through one of the health care exchanges also known as marketplaces you should receive a form 1095 a which provides information about your insurance policy your premiums the cost you pay for insurance any advance payment of premium tax credit and the people in your household covered by the policy. Form 1095 a is used to report certain information to the irs about individuals who enroll in a qualified health plan through the health insurance marketplace. Any tax credits you were entitled to.

What s on form 1095 a and why you need it. What is 1095 b the 1095 b form health coverage is mailed to individuals by the insurer to report minimum essential coverage. The form does not have. Information about form 1095 a health insurance marketplace statement including recent updates related forms and instructions on how to file.

The 1095 a form health insurance marketplace statement is for people who have health insurance through the health insurance marketplace often called an exchange. Insurance companies participating in health care exchanges should provide you with the 1095 a form a health insurance marketplace statement. Claim premium tax credits reconcile the credit on their returns with advanced premium tax credit payments.

/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png)

/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png)