What Is An Individual Brokerage Account

System availability and response times may be subject to market conditions.

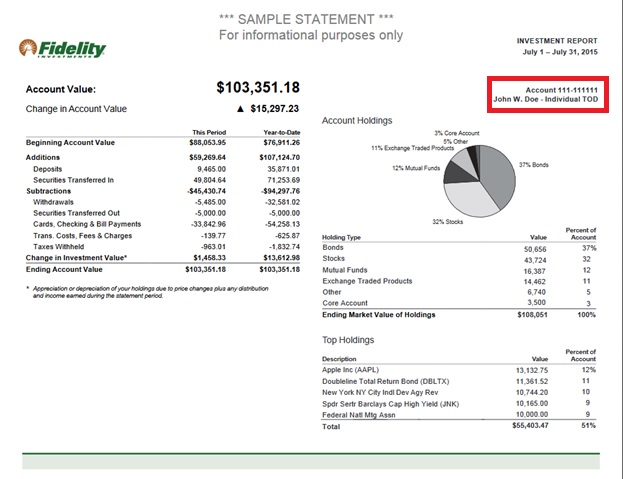

What is an individual brokerage account. If you want to invest beyond your basic 401 k or roth ira you are going to need to open something known as a brokerage account now i want to talk to you about five things you may want to consider before you open a brokerage account so you are ultimately happy with the decision you make about not only the type of account you open but the firm with which you establish a relationship. Fidelity s current base margin rate effective since 03 18 2020 is 7 075. There are three kinds of brokerage accounts. Joint brokerage accounts are beneficial if you re looking to pool your investments with another person such as a spouse or family member and can be a way to simplify investment management and or estate planning.

There must be enough money in the account to cover the trade at the time of its execution including both the price of the security and. A brokerage account is a type of taxable investment account that you open with a brokerage firm. A broker also known as a brokerage is a company that connects buyers and sellers of investment vehicles like stocks and bonds. Once you ve deposited funds you can use the money to buy different types of investment securities.

This account upon approval is eligible for both margin borrowing and options trading. You deposit money into this account by writing a check wiring money or transferring money from your checking or savings account. A brokerage account is often where an investor keeps assets. 4 00 rate available for debit balances over 1 000 000.

Etfs are subject. The investor is able to deposit funds and place investment orders in their account to manage a diversified portfolio. What is a brokerage account. An individual brokerage account is registered in only one name.

Most brokers allow investors to open a brokerage account online in a few quick steps. A brokerage account allows an individual investor who has deposited money with a licensed brokerage firm to make orders to buy and sell assets with the firm serving as their representative for. A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. A fidelity brokerage account is required for access to research reports.

A brokerage account is a taxable investment account used to buy stocks bonds mutual funds and other investments. The most basic kind is a cash management account into which investors place money in order to make trades.

/what-is-a-brokerage-account-356076_FINAL-5e0c3872c0684007b1d5595593c0c9d0.png)