What Is Factoring Services

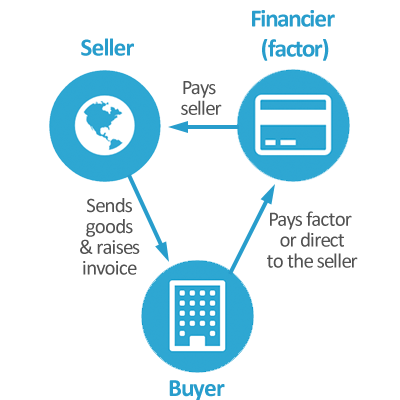

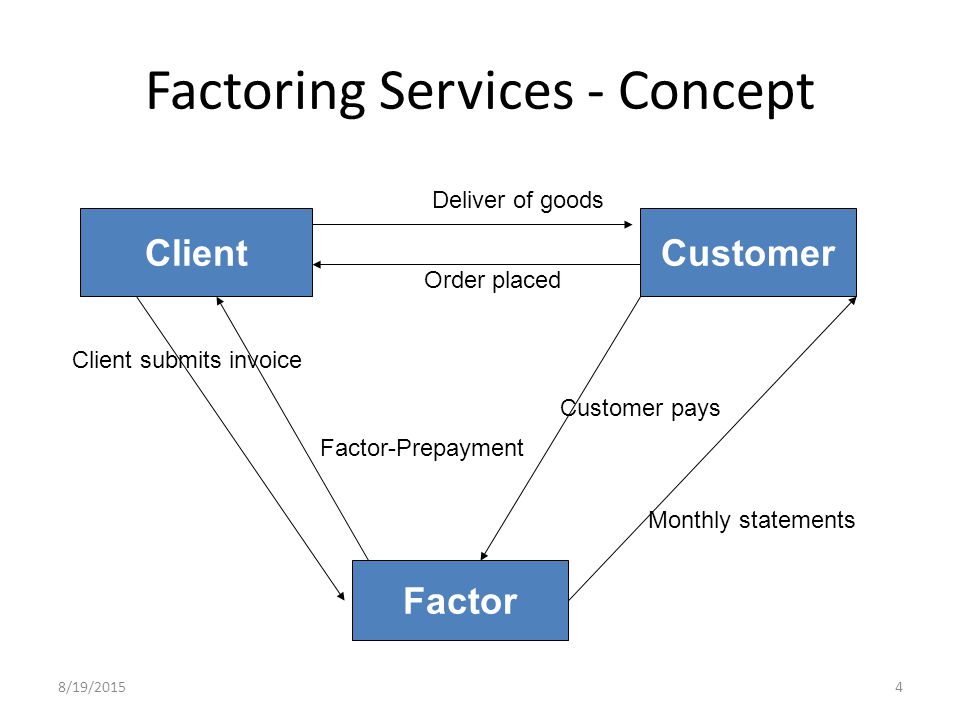

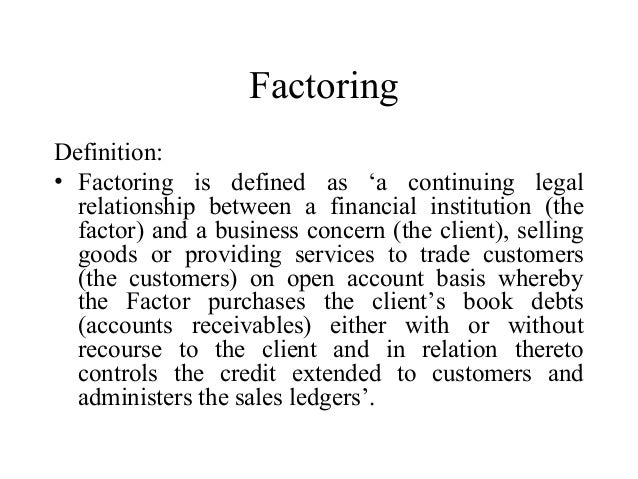

Factoring implies a financial arrangement between the factor and client in which the firm client gets advances in return for receivables from a financial institution factor it is a financing technique in which there is an outright selling of trade debts by a firm to a third party i e.

What is factoring services. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. Factoring generalist because invoice factoring has made its way into several industries companies have divided themselves into either specialists or generalists. A factoring company should be able to meet the cash requirements of your business and offer services that add value to the factoring relationship. Factoring receivables factoring or debtor financing is when a company buys a debt or invoice from another company factoring is also seen as a form of invoice discounting in many markets and is very similar but just within a different context.

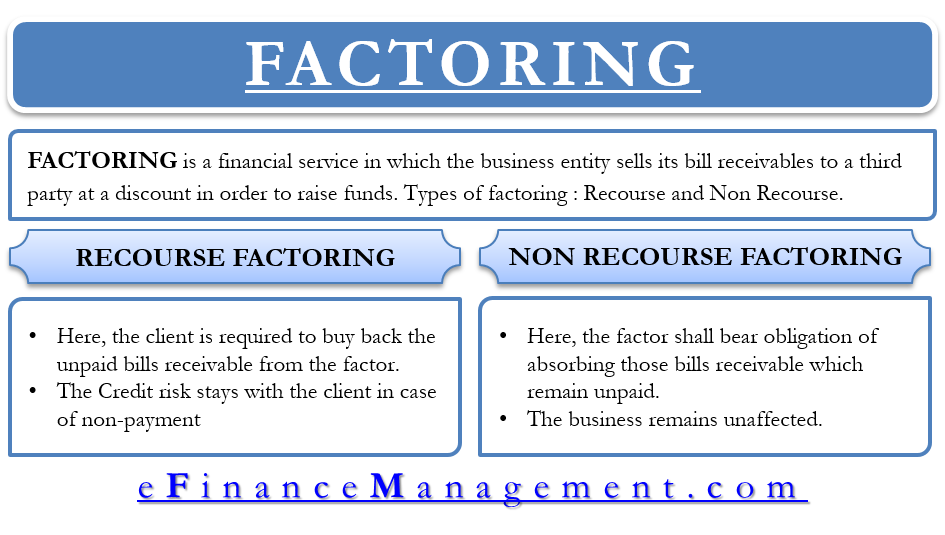

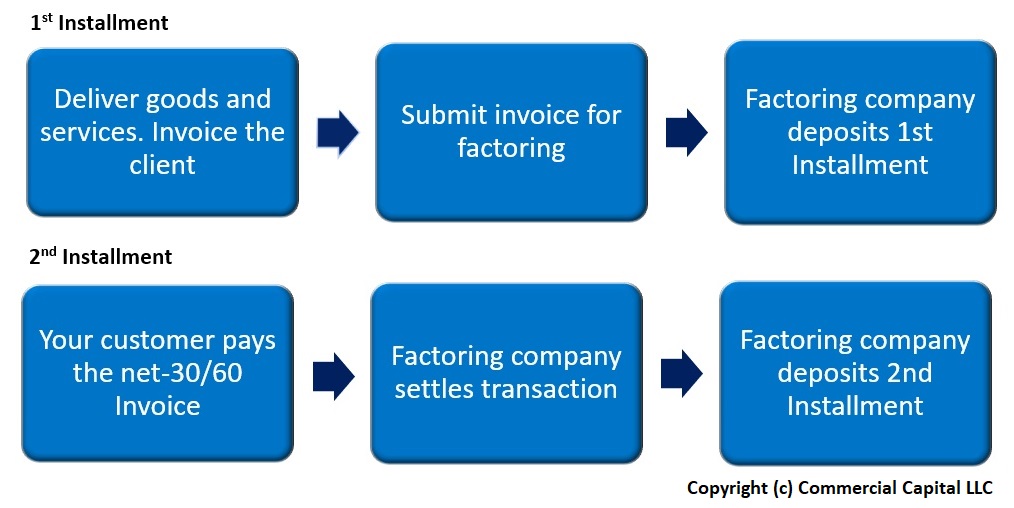

Home factoring services. These are decided depending upon the financial situation of the client. Most companies factor for two years or less. Sometimes referred to as a full service factoring this provides the complete answer to slow paying customers shortage of working capital and if needed protection against bad debt losses if credit protection is part of the factoring agreement it is referred to as non recourse factoring a factoring agreement where the credit risk on the debtor remains with the seller is called with.

In case of non recourse factoring services factor bears the risk of bad debt so in that case factoring commission rate would be comparatively higher. Factoring is a short term solution. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. Trucking factoring services are beneficial as the typical pay term from a customer can be anywhere from 30 60 to 90 days.

Factoring involves the selling of invoices to a third party company at a small discount in order to improve cash flow. In this purchase accounts receivable are discounted in order to allow the buyer to make a profit upon the settlement of the debt. Factoring may provide the cash you need to fund growth or to take advantage of early payment discounts suppliers offer. If the buyer fails to pay for the invoiced goods or services the supplier is required to repurchase the unpaid invoice from the factor.

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. Factor at discounted prices. Factoring is initiated on behalf of the supplier whereas supply chain finance or reverse factoring is a buyer controlled early pay finance program. The rate of factoring commission factor reserve the rate of interest all of them is negotiable.