Working Capital Funding

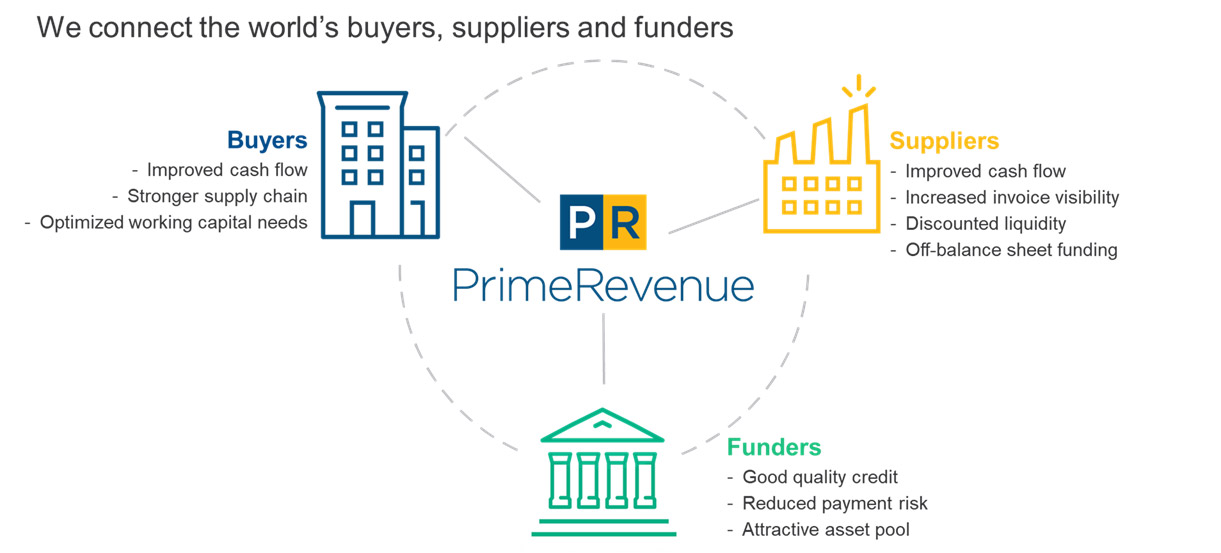

Working capital finance is business finance designed to boost the working capital available to a business.

Working capital funding. Grow your business with dbs and the government. Working capital also known as net working capital is the difference between a company s current assets like cash accounts receivable and inventories of raw materials and finished goods and. Innovative ways to fund your business growth. Working capital is an early stage venture fund that invests in scalable innovations to meet the growing corporate demand for more transparent and ethical supply chains addressing the urgent need to protect vulnerable workers and source responsibly.

The united states navy working capital fund nwcf is a branch of the family of united states department of defense dod working capital funds. Our working capital programs provide the funds a small business needs at terms that make sense for the success of that business. Collateral free funding of up to s 1 000 000. The nwcf is a revolving fund an account or fund that relies on sales revenue rather than direct congressional appropriations to finance its operations.

Healthy cash flow allows you to pursue new opportunities and win more business. Working capital loans tailored to your needs working capital is the lifeblood of any business. Enhanced sme working capital loan. It s often used for specific growth projects such as taking on a bigger contract or investing in a new market.

Capital for business working capital loans are simple fast and affordable and are designed to help with seasonal shortcomings with revenue or need to boost inventory. A working capital loan is a loan that is taken to finance a company s everyday operations. We offer loans up to 500 000 with little or no documentation. Our loans can be funded and the cash in your account in as little as 24 hours.

A working capital fund wcf is a full cost recovery operating model where program expenses are recovered through funds collected from supported customers both internal and external to the organization. Funding circle is accredited by the government owned british business bank to provide loans under the coronavirus business interruption loan scheme cbils. Working capital loans are perfect for business owners who need short term funding to grow.

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)